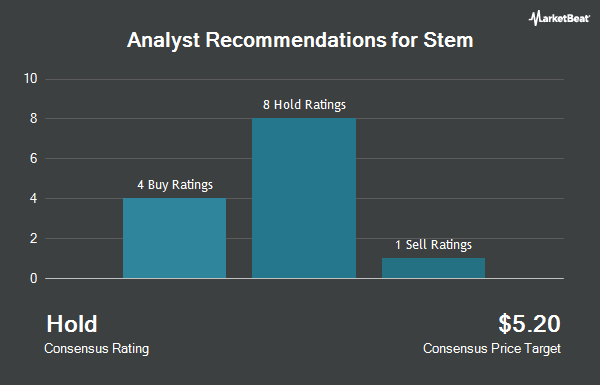

Shares of Stem, Inc. (NYSE:STEM - Get Free Report) have earned an average recommendation of "Hold" from the nine brokerages that are covering the company, MarketBeat.com reports. Eight analysts have rated the stock with a hold recommendation and one has given a buy recommendation to the company. The average 1 year price objective among brokers that have covered the stock in the last year is $1.11.

A number of analysts recently weighed in on the stock. Susquehanna increased their price target on shares of Stem from $0.40 to $0.60 and gave the company a "neutral" rating in a research report on Thursday, May 1st. BMO Capital Markets cut their price target on shares of Stem from $0.50 to $0.40 and set a "market perform" rating on the stock in a research report on Wednesday, March 5th. UBS Group reiterated a "neutral" rating on shares of Stem in a research report on Monday, April 14th. Finally, Roth Mkm raised their target price on shares of Stem from $0.35 to $0.40 and gave the stock a "neutral" rating in a report on Wednesday, March 5th.

Read Our Latest Analysis on STEM

Stem Stock Performance

Shares of NYSE STEM traded down $0.00 during trading hours on Friday, hitting $0.46. The stock had a trading volume of 1,551,602 shares, compared to its average volume of 7,334,350. The company has a market capitalization of $76.00 million, a P/E ratio of -0.09 and a beta of 1.42. The firm's 50-day moving average price is $0.43 and its two-hundred day moving average price is $0.49. Stem has a 52 week low of $0.29 and a 52 week high of $1.68.

Stem (NYSE:STEM - Get Free Report) last issued its quarterly earnings results on Tuesday, April 29th. The company reported ($0.15) EPS for the quarter, topping analysts' consensus estimates of ($0.20) by $0.05. Stem had a negative return on equity of 275.79% and a negative net margin of 328.11%. The company had revenue of $32.51 million during the quarter, compared to analyst estimates of $28.59 million. As a group, analysts expect that Stem will post -0.52 EPS for the current fiscal year.

Institutional Trading of Stem

A number of large investors have recently modified their holdings of the business. AQR Capital Management LLC lifted its position in Stem by 505.8% in the 1st quarter. AQR Capital Management LLC now owns 1,482,790 shares of the company's stock worth $519,000 after buying an additional 1,238,012 shares during the last quarter. BNP Paribas Financial Markets bought a new stake in Stem in the 4th quarter worth approximately $480,000. Collar Capital Management LLC bought a new stake in Stem in the 4th quarter worth approximately $223,000. Canada Pension Plan Investment Board bought a new stake in Stem in the 4th quarter worth approximately $203,000. Finally, Deutsche Bank AG lifted its position in Stem by 102.9% in the 4th quarter. Deutsche Bank AG now owns 622,731 shares of the company's stock worth $374,000 after buying an additional 315,823 shares during the last quarter. Institutional investors own 61.63% of the company's stock.

About Stem

(

Get Free ReportStem, Inc operates as a digitally connected, intelligent, and renewable energy storage network provider worldwide. The company offers energy storage hardware sourced from original equipment manufacturers (OEMs); edge hardware to aid in the collection of site data and real-time operation and control of the site and other optional equipment; and Athena, a software platform, which offers battery hardware and software-enabled services to operate the energy storage systems.

Featured Stories

Before you consider Stem, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stem wasn't on the list.

While Stem currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.