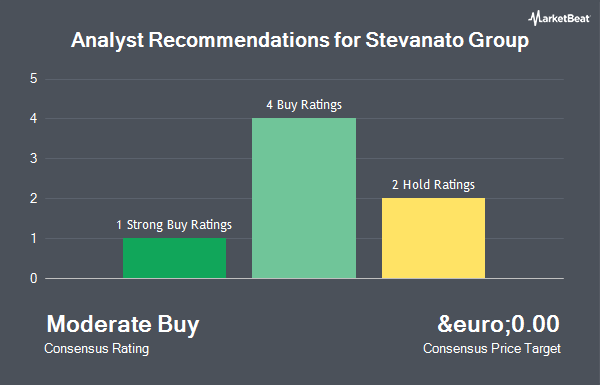

Shares of Stevanato Group S.p.A. (NYSE:STVN - Get Free Report) have earned a consensus recommendation of "Moderate Buy" from the six research firms that are presently covering the company, MarketBeat.com reports. Two investment analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the company.

Separately, William Blair reiterated an "outperform" rating on shares of Stevanato Group in a research report on Monday, June 30th.

Get Our Latest Stock Report on Stevanato Group

Institutional Trading of Stevanato Group

Several institutional investors have recently bought and sold shares of STVN. Invesco Ltd. acquired a new stake in Stevanato Group in the first quarter valued at approximately $19,072,000. Champlain Investment Partners LLC acquired a new stake in Stevanato Group in the first quarter valued at approximately $15,741,000. Ranger Investment Management L.P. grew its holdings in Stevanato Group by 125.6% in the second quarter. Ranger Investment Management L.P. now owns 1,321,030 shares of the company's stock valued at $32,273,000 after purchasing an additional 735,417 shares during the period. MetLife Investment Management LLC acquired a new stake in Stevanato Group in the first quarter valued at approximately $12,944,000. Finally, Loomis Sayles & Co. L P acquired a new stake in Stevanato Group in the second quarter valued at approximately $13,729,000.

Stevanato Group Stock Performance

STVN stock traded up €0.35 during trading on Friday, hitting €27.28. 246,400 shares of the company traded hands, compared to its average volume of 349,682. The stock's 50-day simple moving average is €24.39 and its 200 day simple moving average is €23.03. The company has a debt-to-equity ratio of 0.25, a current ratio of 1.79 and a quick ratio of 1.22. The company has a market cap of $8.26 billion, a PE ratio of 50.52, a P/E/G ratio of 2.54 and a beta of 0.55. Stevanato Group has a 1 year low of €17.12 and a 1 year high of €28.00.

Stevanato Group Company Profile

(

Get Free Report)

Stevanato Group S.p.A. engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific. The company operates in two segments, Biopharmaceutical and Diagnostic Solutions; and Engineering.

Further Reading

Before you consider Stevanato Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stevanato Group wasn't on the list.

While Stevanato Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.