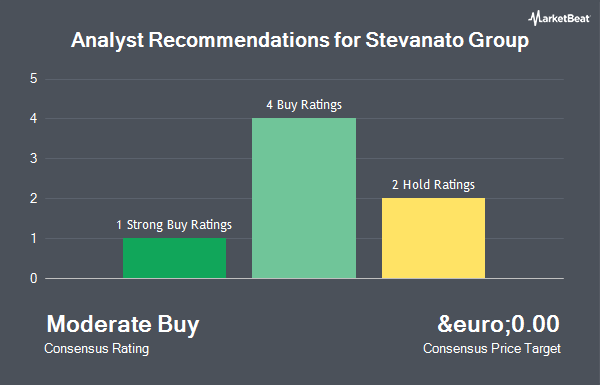

Shares of Stevanato Group S.p.A. (NYSE:STVN - Get Free Report) have been given an average rating of "Moderate Buy" by the seven ratings firms that are currently covering the company, Marketbeat Ratings reports. Three investment analysts have rated the stock with a hold recommendation, three have given a buy recommendation and one has given a strong buy recommendation to the company.

Several brokerages have weighed in on STVN. Weiss Ratings reissued a "hold (c)" rating on shares of Stevanato Group in a report on Wednesday. William Blair reiterated an "outperform" rating on shares of Stevanato Group in a report on Monday, June 30th.

Read Our Latest Report on STVN

Institutional Trading of Stevanato Group

Institutional investors and hedge funds have recently modified their holdings of the stock. Bessemer Group Inc. increased its stake in shares of Stevanato Group by 14,623.3% in the 1st quarter. Bessemer Group Inc. now owns 13,251 shares of the company's stock valued at $270,000 after acquiring an additional 13,161 shares during the last quarter. Palisade Capital Management LP increased its position in shares of Stevanato Group by 52.0% in the 1st quarter. Palisade Capital Management LP now owns 91,431 shares of the company's stock valued at $1,867,000 after buying an additional 31,283 shares in the last quarter. Envestnet Asset Management Inc. increased its position in shares of Stevanato Group by 16.9% in the 1st quarter. Envestnet Asset Management Inc. now owns 162,770 shares of the company's stock valued at $3,324,000 after buying an additional 23,545 shares in the last quarter. Raymond James Financial Inc. increased its position in shares of Stevanato Group by 77.4% in the 1st quarter. Raymond James Financial Inc. now owns 468,475 shares of the company's stock valued at $9,566,000 after buying an additional 204,391 shares in the last quarter. Finally, Cooper Investors PTY Ltd. increased its position in shares of Stevanato Group by 22.4% in the 1st quarter. Cooper Investors PTY Ltd. now owns 137,605 shares of the company's stock valued at $2,810,000 after buying an additional 25,221 shares in the last quarter.

Stevanato Group Stock Performance

Shares of NYSE:STVN opened at €24.58 on Thursday. The stock has a market capitalization of $7.44 billion, a P/E ratio of 45.52, a P/E/G ratio of 2.27 and a beta of 0.57. Stevanato Group has a 1-year low of €17.12 and a 1-year high of €28.00. The company has a current ratio of 1.79, a quick ratio of 1.22 and a debt-to-equity ratio of 0.25. The business has a 50-day moving average price of €24.49 and a two-hundred day moving average price of €23.54.

About Stevanato Group

(

Get Free Report)

Stevanato Group S.p.A. engages in the design, production, and distribution of products and processes to provide integrated solutions for bio-pharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific. The company operates in two segments, Biopharmaceutical and Diagnostic Solutions; and Engineering.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Stevanato Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stevanato Group wasn't on the list.

While Stevanato Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.