Brixmor Property Group (NYSE:BRX - Get Free Report) had its price target decreased by analysts at Stifel Nicolaus from $29.50 to $29.00 in a research note issued to investors on Tuesday,Benzinga reports. The brokerage presently has a "hold" rating on the real estate investment trust's stock. Stifel Nicolaus' price target would suggest a potential upside of 13.95% from the company's previous close.

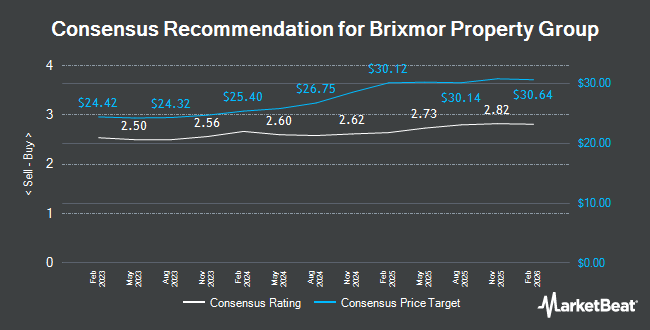

A number of other brokerages have also commented on BRX. The Goldman Sachs Group dropped their price target on Brixmor Property Group from $33.00 to $29.00 and set a "buy" rating on the stock in a report on Thursday, May 1st. Scotiabank dropped their price target on Brixmor Property Group from $30.00 to $29.00 and set a "sector outperform" rating on the stock in a report on Monday, May 12th. Mizuho upgraded Brixmor Property Group from a "neutral" rating to an "outperform" rating and set a $29.00 price target on the stock in a report on Thursday, July 17th. Finally, UBS Group began coverage on Brixmor Property Group in a report on Friday, May 30th. They set a "buy" rating and a $29.00 price target on the stock. Three investment analysts have rated the stock with a hold rating and ten have assigned a buy rating to the company. According to data from MarketBeat.com, Brixmor Property Group currently has an average rating of "Moderate Buy" and an average target price of $30.08.

Check Out Our Latest Stock Analysis on BRX

Brixmor Property Group Stock Down 2.6%

Shares of BRX stock traded down $0.68 during trading hours on Tuesday, reaching $25.45. The company had a trading volume of 2,148,979 shares, compared to its average volume of 2,440,914. Brixmor Property Group has a 12 month low of $22.28 and a 12 month high of $30.67. The company has a debt-to-equity ratio of 1.73, a current ratio of 0.74 and a quick ratio of 0.75. The business has a fifty day simple moving average of $25.69 and a 200-day simple moving average of $25.90. The company has a market cap of $7.79 billion, a price-to-earnings ratio of 23.14, a price-to-earnings-growth ratio of 2.70 and a beta of 1.29.

Brixmor Property Group (NYSE:BRX - Get Free Report) last posted its earnings results on Monday, July 28th. The real estate investment trust reported $0.56 earnings per share for the quarter, beating analysts' consensus estimates of $0.55 by $0.01. The company had revenue of $339.40 million for the quarter, compared to analyst estimates of $332.59 million. Brixmor Property Group had a return on equity of 11.39% and a net margin of 25.27%. The company's revenue for the quarter was up 7.5% on a year-over-year basis. During the same quarter last year, the company earned $0.54 earnings per share. On average, research analysts expect that Brixmor Property Group will post 2.22 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Brixmor Property Group

Hedge funds have recently made changes to their positions in the stock. Headlands Technologies LLC purchased a new position in Brixmor Property Group during the fourth quarter worth about $26,000. Smartleaf Asset Management LLC grew its position in Brixmor Property Group by 53.1% during the first quarter. Smartleaf Asset Management LLC now owns 1,436 shares of the real estate investment trust's stock worth $37,000 after buying an additional 498 shares in the last quarter. Brooklyn Investment Group grew its position in Brixmor Property Group by 146.4% during the first quarter. Brooklyn Investment Group now owns 1,604 shares of the real estate investment trust's stock worth $43,000 after buying an additional 953 shares in the last quarter. SVB Wealth LLC purchased a new position in Brixmor Property Group during the first quarter worth about $44,000. Finally, Quarry LP grew its position in Brixmor Property Group by 39.0% during the fourth quarter. Quarry LP now owns 1,901 shares of the real estate investment trust's stock worth $53,000 after buying an additional 533 shares in the last quarter. 98.43% of the stock is currently owned by hedge funds and other institutional investors.

Brixmor Property Group Company Profile

(

Get Free Report)

Brixmor Property Group, Inc operates as a real estate investment trust, which engages in owning and operating a portfolio of grocery anchored community and neighborhood shopping centers. The company was founded in 1985 and is headquartered in New York, NY.

Further Reading

Before you consider Brixmor Property Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Brixmor Property Group wasn't on the list.

While Brixmor Property Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.