Sun Life Financial (NYSE:SLF - Free Report) TSE: SLF had its price objective lifted by Royal Bank of Canada from $82.00 to $88.00 in a research report released on Monday morning, Marketbeat Ratings reports. The brokerage currently has an outperform rating on the financial services provider's stock.

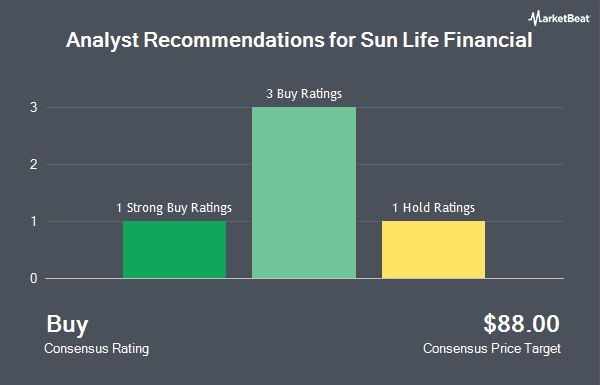

Other research analysts have also issued reports about the company. Scotiabank reissued an "outperform" rating on shares of Sun Life Financial in a research report on Thursday, May 1st. National Bank Financial upgraded shares of Sun Life Financial from a "sector perform" rating to an "outperform" rating in a report on Wednesday, January 15th. Cormark upgraded shares of Sun Life Financial from a "hold" rating to a "moderate buy" rating in a research note on Thursday, February 13th. Finally, StockNews.com lowered shares of Sun Life Financial from a "buy" rating to a "hold" rating in a research note on Wednesday, February 5th. Two equities research analysts have rated the stock with a hold rating, four have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $88.00.

Read Our Latest Analysis on Sun Life Financial

Sun Life Financial Stock Performance

Shares of SLF stock traded down $0.25 during midday trading on Monday, reaching $62.87. 3,796,173 shares of the company were exchanged, compared to its average volume of 669,462. The company's 50 day moving average price is $57.70 and its two-hundred day moving average price is $58.23. The company has a market cap of $35.50 billion, a P/E ratio of 16.37, a PEG ratio of 1.52 and a beta of 0.90. Sun Life Financial has a 12 month low of $46.41 and a 12 month high of $63.39.

Sun Life Financial (NYSE:SLF - Get Free Report) TSE: SLF last announced its earnings results on Thursday, May 8th. The financial services provider reported $1.27 EPS for the quarter, topping the consensus estimate of $1.22 by $0.05. The firm had revenue of $7.91 billion for the quarter, compared to analysts' expectations of $6.44 billion. Sun Life Financial had a return on equity of 16.86% and a net margin of 8.08%. During the same quarter in the previous year, the company earned $1.40 earnings per share. As a group, sell-side analysts predict that Sun Life Financial will post 5.19 earnings per share for the current year.

Sun Life Financial Increases Dividend

The firm also recently declared a quarterly dividend, which will be paid on Monday, June 30th. Investors of record on Wednesday, May 28th will be issued a dividend of $0.6332 per share. This represents a $2.53 dividend on an annualized basis and a yield of 4.03%. This is a boost from Sun Life Financial's previous quarterly dividend of $0.59. The ex-dividend date of this dividend is Wednesday, May 28th. Sun Life Financial's dividend payout ratio (DPR) is currently 62.09%.

Institutional Trading of Sun Life Financial

Hedge funds and other institutional investors have recently modified their holdings of the stock. Vanguard Group Inc. grew its holdings in Sun Life Financial by 1.5% during the 1st quarter. Vanguard Group Inc. now owns 24,595,092 shares of the financial services provider's stock worth $1,407,626,000 after acquiring an additional 361,596 shares during the period. TD Asset Management Inc grew its stake in shares of Sun Life Financial by 2.4% during the first quarter. TD Asset Management Inc now owns 16,100,340 shares of the financial services provider's stock worth $921,330,000 after purchasing an additional 374,682 shares during the period. 1832 Asset Management L.P. increased its holdings in Sun Life Financial by 8.9% in the first quarter. 1832 Asset Management L.P. now owns 10,338,250 shares of the financial services provider's stock valued at $591,968,000 after purchasing an additional 846,735 shares during the last quarter. The Manufacturers Life Insurance Company lifted its stake in Sun Life Financial by 2.1% in the fourth quarter. The Manufacturers Life Insurance Company now owns 9,454,589 shares of the financial services provider's stock valued at $562,121,000 after buying an additional 198,205 shares during the period. Finally, CIBC Asset Management Inc boosted its holdings in Sun Life Financial by 10.8% during the fourth quarter. CIBC Asset Management Inc now owns 7,192,059 shares of the financial services provider's stock worth $427,712,000 after buying an additional 703,391 shares during the last quarter. Institutional investors and hedge funds own 52.26% of the company's stock.

About Sun Life Financial

(

Get Free Report)

Sun Life Financial Inc, a financial services company, provides savings, retirement, and pension products worldwide. The company operates in five segments: Asset Management, Canada, U.S., Asia, and Corporate. It offers various insurance products, such as term and permanent life; personal health, which includes prescription drugs, dental, and vision care; critical illness; long-term care; and disability, as well as reinsurance.

Featured Stories

Before you consider Sun Life Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Life Financial wasn't on the list.

While Sun Life Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.