Susquehanna Fundamental Investments LLC purchased a new stake in Playtika Holding Corp. (NASDAQ:PLTK - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund purchased 346,098 shares of the company's stock, valued at approximately $2,402,000. Susquehanna Fundamental Investments LLC owned 0.09% of Playtika as of its most recent filing with the Securities & Exchange Commission.

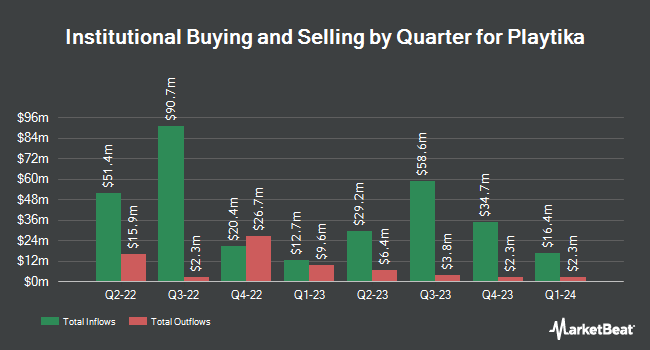

Other institutional investors and hedge funds have also recently modified their holdings of the company. Covestor Ltd grew its holdings in Playtika by 11.4% in the fourth quarter. Covestor Ltd now owns 14,103 shares of the company's stock worth $98,000 after purchasing an additional 1,447 shares during the period. Sterling Capital Management LLC boosted its position in shares of Playtika by 57.2% during the 4th quarter. Sterling Capital Management LLC now owns 4,216 shares of the company's stock worth $29,000 after purchasing an additional 1,534 shares in the last quarter. Choreo LLC grew its stake in shares of Playtika by 14.9% in the 4th quarter. Choreo LLC now owns 12,485 shares of the company's stock valued at $90,000 after buying an additional 1,619 shares during the period. Dimensional Fund Advisors LP increased its position in Playtika by 0.3% in the 4th quarter. Dimensional Fund Advisors LP now owns 536,945 shares of the company's stock valued at $3,726,000 after buying an additional 1,639 shares in the last quarter. Finally, Invesco Ltd. raised its stake in Playtika by 3.0% during the 4th quarter. Invesco Ltd. now owns 78,390 shares of the company's stock worth $544,000 after buying an additional 2,304 shares during the period. 11.94% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities research analysts have commented on PLTK shares. Wedbush reissued an "outperform" rating and issued a $11.50 price objective on shares of Playtika in a research note on Friday. Robert W. Baird reissued a "neutral" rating and issued a $6.00 price target (down previously from $9.00) on shares of Playtika in a research report on Friday, February 28th. Morgan Stanley lowered their price objective on shares of Playtika from $7.25 to $5.75 and set an "equal weight" rating on the stock in a report on Thursday, April 17th. Macquarie decreased their target price on shares of Playtika from $7.00 to $6.00 and set a "neutral" rating for the company in a research report on Friday, February 28th. Finally, Citigroup dropped their price target on shares of Playtika from $10.00 to $9.00 and set a "buy" rating on the stock in a research report on Friday, March 7th. Six equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. According to MarketBeat, Playtika presently has a consensus rating of "Hold" and a consensus price target of $7.78.

View Our Latest Stock Report on Playtika

Playtika Stock Up 0.0 %

PLTK stock traded up $0.00 during trading on Monday, reaching $5.44. The stock had a trading volume of 257,229 shares, compared to its average volume of 1,122,649. Playtika Holding Corp. has a one year low of $3.97 and a one year high of $9.16. The company's 50 day moving average is $4.99 and its two-hundred day moving average is $6.68. The company has a market capitalization of $2.04 billion, a price-to-earnings ratio of 9.39, a P/E/G ratio of 1.69 and a beta of 0.91.

Playtika Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, April 4th. Investors of record on Friday, March 21st were given a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 7.35%. The ex-dividend date of this dividend was Friday, March 21st. Playtika's payout ratio is 90.91%.

About Playtika

(

Free Report)

Playtika Holding Corp., together with its subsidiaries, develops mobile games in the United States, Europe, Middle East, Africa, Asia pacific, and internationally. The company owns a portfolio of casual and social casino-themed games. It distributes its games to the end customer through various web and mobile platforms and direct-to-consumer platforms.

Featured Articles

Before you consider Playtika, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Playtika wasn't on the list.

While Playtika currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.