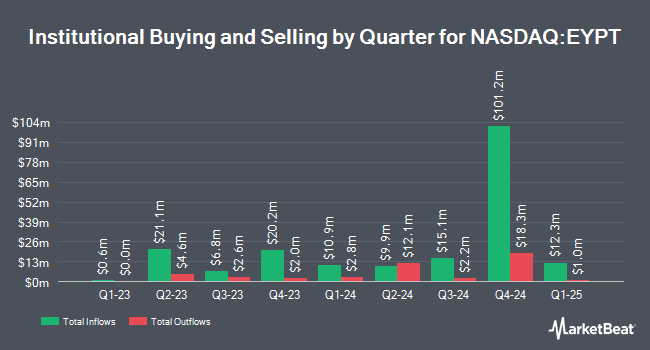

Susquehanna Fundamental Investments LLC bought a new stake in shares of EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT - Free Report) during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm bought 123,769 shares of the company's stock, valued at approximately $922,000. Susquehanna Fundamental Investments LLC owned 0.18% of EyePoint Pharmaceuticals as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also made changes to their positions in EYPT. Virtus ETF Advisers LLC acquired a new stake in shares of EyePoint Pharmaceuticals during the fourth quarter valued at $67,000. Voya Investment Management LLC raised its position in shares of EyePoint Pharmaceuticals by 342.4% during the fourth quarter. Voya Investment Management LLC now owns 73,914 shares of the company's stock worth $551,000 after acquiring an additional 57,205 shares during the last quarter. Blue Owl Capital Holdings LP acquired a new position in shares of EyePoint Pharmaceuticals during the fourth quarter worth about $4,974,000. Adage Capital Partners GP L.L.C. boosted its holdings in shares of EyePoint Pharmaceuticals by 51.7% during the fourth quarter. Adage Capital Partners GP L.L.C. now owns 5,750,000 shares of the company's stock worth $42,838,000 after acquiring an additional 1,958,580 shares during the period. Finally, Silverarc Capital Management LLC grew its holdings in shares of EyePoint Pharmaceuticals by 21.3% during the 4th quarter. Silverarc Capital Management LLC now owns 121,274 shares of the company's stock valued at $903,000 after purchasing an additional 21,274 shares during the last quarter. Institutional investors and hedge funds own 99.41% of the company's stock.

EyePoint Pharmaceuticals Trading Down 0.7 %

NASDAQ:EYPT traded down $0.04 during trading hours on Thursday, hitting $6.05. 100,844 shares of the stock were exchanged, compared to its average volume of 832,482. The company has a market cap of $416.31 million, a P/E ratio of -3.03 and a beta of 1.58. The firm's fifty day moving average price is $6.02 and its 200 day moving average price is $7.58. EyePoint Pharmaceuticals, Inc. has a 52-week low of $3.91 and a 52-week high of $13.99.

EyePoint Pharmaceuticals (NASDAQ:EYPT - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The company reported ($0.65) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.65). EyePoint Pharmaceuticals had a negative return on equity of 43.01% and a negative net margin of 226.57%. The business had revenue of $24.50 million during the quarter, compared to the consensus estimate of $8.84 million. Equities analysts expect that EyePoint Pharmaceuticals, Inc. will post -2.13 EPS for the current fiscal year.

Analyst Upgrades and Downgrades

Several analysts have recently weighed in on the stock. StockNews.com upgraded shares of EyePoint Pharmaceuticals to a "sell" rating in a research report on Friday, March 14th. Chardan Capital reduced their target price on EyePoint Pharmaceuticals from $33.00 to $27.00 and set a "buy" rating for the company in a report on Thursday. Finally, HC Wainwright reiterated a "buy" rating and set a $22.00 target price on shares of EyePoint Pharmaceuticals in a research report on Thursday, March 6th. One research analyst has rated the stock with a sell rating and eight have assigned a buy rating to the company. Based on data from MarketBeat.com, EyePoint Pharmaceuticals has an average rating of "Moderate Buy" and an average price target of $25.29.

View Our Latest Analysis on EyePoint Pharmaceuticals

EyePoint Pharmaceuticals Profile

(

Free Report)

EyePoint Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases. The company's pipeline leverages its proprietary bioerodible Durasert E technology for sustained intraocular drug delivery.

Read More

Before you consider EyePoint Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EyePoint Pharmaceuticals wasn't on the list.

While EyePoint Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.