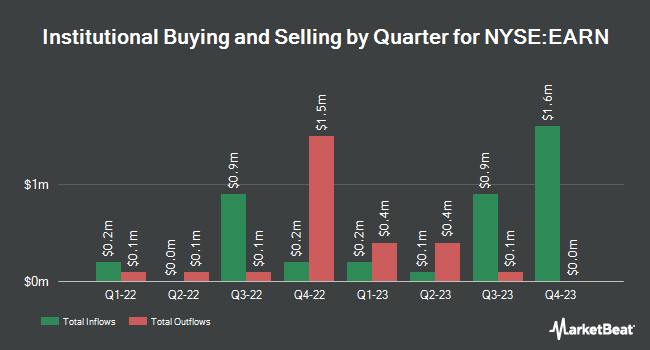

Susquehanna International Group LLP increased its holdings in shares of Ellington Credit (NYSE:EARN - Free Report) by 570.4% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 481,669 shares of the real estate investment trust's stock after buying an additional 409,817 shares during the period. Susquehanna International Group LLP owned about 1.65% of Ellington Credit worth $3,189,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other institutional investors have also recently added to or reduced their stakes in the stock. Geode Capital Management LLC raised its holdings in shares of Ellington Credit by 21.6% during the third quarter. Geode Capital Management LLC now owns 269,850 shares of the real estate investment trust's stock valued at $1,885,000 after acquiring an additional 47,998 shares during the last quarter. Barclays PLC purchased a new stake in shares of Ellington Credit during the third quarter worth approximately $334,000. Clear Harbor Asset Management LLC raised its stake in Ellington Credit by 16.3% in the 4th quarter. Clear Harbor Asset Management LLC now owns 235,395 shares of the real estate investment trust's stock valued at $1,558,000 after purchasing an additional 33,040 shares during the last quarter. Mount Yale Investment Advisors LLC purchased a new position in Ellington Credit in the 4th quarter valued at $152,000. Finally, Global Retirement Partners LLC acquired a new stake in Ellington Credit during the 4th quarter worth $114,000. Institutional investors and hedge funds own 20.40% of the company's stock.

Ellington Credit Stock Performance

Shares of EARN stock traded up $0.07 on Monday, hitting $5.44. 95,788 shares of the stock traded hands, compared to its average volume of 526,750. Ellington Credit has a twelve month low of $4.33 and a twelve month high of $7.26. The firm's 50-day moving average price is $5.48 and its two-hundred day moving average price is $6.21. The stock has a market capitalization of $204.13 million, a PE ratio of 4.85 and a beta of 1.31.

Ellington Credit (NYSE:EARN - Get Free Report) last posted its quarterly earnings results on Wednesday, March 12th. The real estate investment trust reported $0.27 earnings per share for the quarter, beating the consensus estimate of $0.26 by $0.01. The business had revenue of $6.14 million during the quarter, compared to analysts' expectations of $9.65 million. Ellington Credit had a net margin of 226.01% and a return on equity of 15.81%. On average, equities research analysts anticipate that Ellington Credit will post 1.17 EPS for the current fiscal year.

Ellington Credit Announces Dividend

The firm also recently announced a monthly dividend, which will be paid on Monday, June 30th. Shareholders of record on Friday, May 30th will be given a $0.08 dividend. The ex-dividend date is Friday, May 30th. This represents a $0.96 dividend on an annualized basis and a yield of 17.66%. Ellington Credit's dividend payout ratio is currently 320.00%.

Wall Street Analyst Weigh In

Several equities analysts have recently weighed in on the stock. StockNews.com downgraded shares of Ellington Credit from a "hold" rating to a "sell" rating in a research note on Thursday. Piper Sandler decreased their target price on shares of Ellington Credit from $8.00 to $6.50 and set an "overweight" rating on the stock in a research note on Tuesday, April 8th. Finally, UBS Group dropped their price target on Ellington Credit from $6.50 to $5.25 and set a "neutral" rating for the company in a research report on Thursday, April 17th.

Get Our Latest Report on EARN

Insider Activity

In related news, Portfolio Manager Gregory Morris Borenstein bought 8,000 shares of the company's stock in a transaction that occurred on Wednesday, April 9th. The stock was purchased at an average price of $4.73 per share, for a total transaction of $37,840.00. Following the acquisition, the portfolio manager now owns 18,000 shares of the company's stock, valued at approximately $85,140. This trade represents a 80.00% increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is available at this hyperlink. Corporate insiders own 1.60% of the company's stock.

About Ellington Credit

(

Free Report)

Ellington Credit Company, a real estate investment trust, acquires, invests in, and manages residential mortgage-and real estate-related assets. It acquires and manages residential mortgage-backed securities (RMBS), including agency pools and agency collateralized mortgage obligations (CMOs); and non-agency RMBS, such as non-agency CMOs, such as investment grade and non-investment grade.

Featured Articles

Before you consider Ellington Credit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ellington Credit wasn't on the list.

While Ellington Credit currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.