Synchronoss Technologies (NASDAQ:SNCR - Get Free Report) will likely be announcing its Q1 2025 earnings results before the market opens on Tuesday, May 6th. Analysts expect Synchronoss Technologies to post earnings of $0.29 per share and revenue of $42.15 million for the quarter. Synchronoss Technologies has set its FY 2025 guidance at EPS.

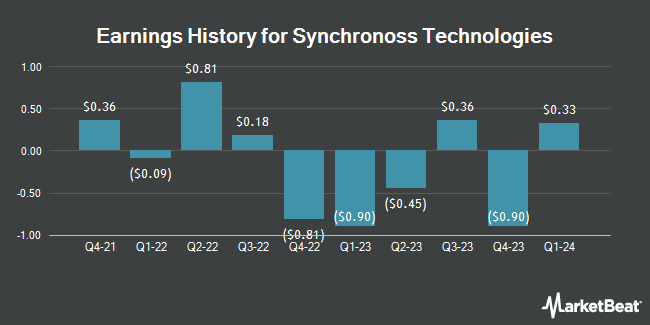

Synchronoss Technologies (NASDAQ:SNCR - Get Free Report) last posted its earnings results on Tuesday, March 11th. The software maker reported $0.85 EPS for the quarter, topping the consensus estimate of $0.10 by $0.75. The firm had revenue of $44.21 million for the quarter, compared to the consensus estimate of $43.76 million. Synchronoss Technologies had a negative net margin of 20.00% and a negative return on equity of 10.99%. On average, analysts expect Synchronoss Technologies to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Synchronoss Technologies Stock Performance

Synchronoss Technologies stock traded up $0.65 during trading hours on Friday, reaching $10.66. 88,685 shares of the company were exchanged, compared to its average volume of 78,081. The firm has a market cap of $122.49 million, a price-to-earnings ratio of -2.75 and a beta of 1.78. Synchronoss Technologies has a 12 month low of $6.44 and a 12 month high of $15.46. The company has a current ratio of 1.88, a quick ratio of 1.88 and a debt-to-equity ratio of 5.75. The stock has a 50-day moving average of $10.32 and a 200 day moving average of $10.04.

Analyst Upgrades and Downgrades

Separately, StockNews.com raised Synchronoss Technologies from a "hold" rating to a "buy" rating in a research report on Friday, March 14th.

Read Our Latest Research Report on Synchronoss Technologies

Insiders Place Their Bets

In related news, CEO Jeffrey George Miller sold 6,979 shares of the firm's stock in a transaction on Wednesday, April 23rd. The stock was sold at an average price of $10.50, for a total value of $73,279.50. Following the completion of the transaction, the chief executive officer now directly owns 451,853 shares of the company's stock, valued at $4,744,456.50. This trade represents a 1.52 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. Insiders have sold 33,193 shares of company stock worth $344,220 in the last ninety days. Insiders own 17.90% of the company's stock.

Synchronoss Technologies Company Profile

(

Get Free Report)

Synchronoss Technologies, Inc provides cloud, messaging, digital, and network management solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific. The company offers Synchronoss Personal Cloud platform that allows customers' subscribers to backup and protect, engage with, and manage their personal content.

Recommended Stories

Before you consider Synchronoss Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchronoss Technologies wasn't on the list.

While Synchronoss Technologies currently has a Strong Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.