T. Rowe Price Investment Management Inc. lessened its stake in shares of EyePoint Pharmaceuticals, Inc. (NASDAQ:EYPT - Free Report) by 83.7% in the fourth quarter, according to the company in its most recent filing with the SEC. The fund owned 206,939 shares of the company's stock after selling 1,061,815 shares during the quarter. T. Rowe Price Investment Management Inc. owned about 0.30% of EyePoint Pharmaceuticals worth $1,542,000 as of its most recent SEC filing.

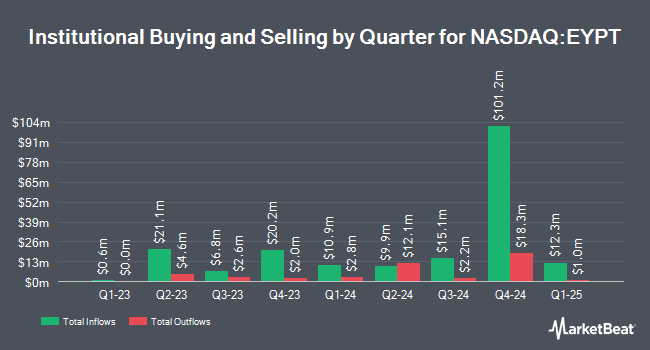

Several other large investors have also recently added to or reduced their stakes in EYPT. Geode Capital Management LLC grew its position in EyePoint Pharmaceuticals by 16.1% during the 3rd quarter. Geode Capital Management LLC now owns 1,199,056 shares of the company's stock worth $9,583,000 after acquiring an additional 166,699 shares during the last quarter. Barclays PLC increased its position in shares of EyePoint Pharmaceuticals by 410.4% during the third quarter. Barclays PLC now owns 245,045 shares of the company's stock valued at $1,959,000 after acquiring an additional 197,033 shares during the last quarter. JPMorgan Chase & Co. boosted its stake in EyePoint Pharmaceuticals by 1,171.3% in the third quarter. JPMorgan Chase & Co. now owns 371,758 shares of the company's stock valued at $2,970,000 after acquiring an additional 342,516 shares during the last quarter. Franklin Resources Inc. grew its stake in shares of EyePoint Pharmaceuticals by 9.9% during the 3rd quarter. Franklin Resources Inc. now owns 4,012,048 shares of the company's stock worth $32,056,000 after acquiring an additional 362,399 shares during the period. Finally, abrdn plc purchased a new position in EyePoint Pharmaceuticals in the 4th quarter valued at approximately $1,719,000. Institutional investors own 99.41% of the company's stock.

Analyst Ratings Changes

Several equities analysts have recently commented on the company. Chardan Capital reiterated a "buy" rating and set a $33.00 price objective on shares of EyePoint Pharmaceuticals in a research report on Thursday, March 6th. HC Wainwright restated a "buy" rating and issued a $22.00 price target on shares of EyePoint Pharmaceuticals in a research note on Thursday, March 6th. StockNews.com upgraded EyePoint Pharmaceuticals to a "sell" rating in a research note on Friday, March 14th. Finally, Citigroup initiated coverage on EyePoint Pharmaceuticals in a research report on Tuesday, January 7th. They issued a "buy" rating and a $33.00 target price on the stock. One investment analyst has rated the stock with a sell rating and nine have issued a buy rating to the company. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $26.63.

Check Out Our Latest Stock Report on EyePoint Pharmaceuticals

EyePoint Pharmaceuticals Stock Up 2.4 %

NASDAQ EYPT traded up $0.17 during trading on Friday, hitting $7.30. The stock had a trading volume of 690,968 shares, compared to its average volume of 879,558. EyePoint Pharmaceuticals, Inc. has a twelve month low of $3.91 and a twelve month high of $14.00. The firm has a 50 day moving average price of $6.00 and a 200 day moving average price of $7.66. The company has a market capitalization of $502.32 million, a PE ratio of -3.65 and a beta of 1.39.

EyePoint Pharmaceuticals (NASDAQ:EYPT - Get Free Report) last issued its quarterly earnings data on Wednesday, March 5th. The company reported ($0.64) earnings per share for the quarter, missing analysts' consensus estimates of ($0.54) by ($0.10). EyePoint Pharmaceuticals had a negative net margin of 226.57% and a negative return on equity of 43.01%. The firm had revenue of $11.60 million during the quarter, compared to analysts' expectations of $11.02 million. On average, sell-side analysts anticipate that EyePoint Pharmaceuticals, Inc. will post -2.13 earnings per share for the current year.

About EyePoint Pharmaceuticals

(

Free Report)

EyePoint Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, engages in developing and commercializing therapeutics to improve the lives of patients with serious retinal diseases. The company's pipeline leverages its proprietary bioerodible Durasert E technology for sustained intraocular drug delivery.

Further Reading

Before you consider EyePoint Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EyePoint Pharmaceuticals wasn't on the list.

While EyePoint Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.