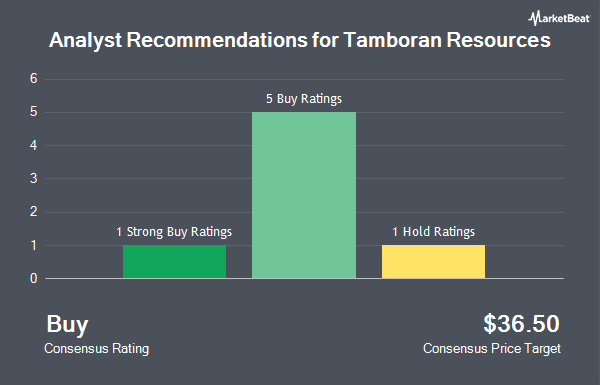

Shares of Tamboran Resources Corporation (NYSE:TBN - Get Free Report) have received an average rating of "Moderate Buy" from the six ratings firms that are currently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the company. The average 12-month price objective among brokers that have issued ratings on the stock in the last year is $34.75.

A number of equities analysts have recently commented on the stock. Weiss Ratings restated a "sell (d)" rating on shares of Tamboran Resources in a research note on Tuesday, October 14th. Royal Bank Of Canada decreased their price target on Tamboran Resources from $31.00 to $30.00 and set a "sector perform" rating for the company in a research note on Wednesday, July 9th.

View Our Latest Report on TBN

Tamboran Resources Stock Performance

Shares of TBN opened at $25.06 on Tuesday. The stock has a market capitalization of $446.57 million, a price-to-earnings ratio of -9.94 and a beta of 0.32. Tamboran Resources has a 12 month low of $15.75 and a 12 month high of $34.50. The firm has a fifty day simple moving average of $23.17 and a 200 day simple moving average of $21.70. The company has a current ratio of 1.55, a quick ratio of 1.55 and a debt-to-equity ratio of 0.02.

Institutional Trading of Tamboran Resources

Several institutional investors and hedge funds have recently added to or reduced their stakes in the company. HITE Hedge Asset Management LLC grew its position in shares of Tamboran Resources by 58.3% in the 1st quarter. HITE Hedge Asset Management LLC now owns 809,505 shares of the company's stock valued at $19,420,000 after acquiring an additional 298,084 shares during the period. Alberta Investment Management Corp lifted its stake in Tamboran Resources by 116.8% in the 2nd quarter. Alberta Investment Management Corp now owns 758,680 shares of the company's stock valued at $16,175,000 after purchasing an additional 408,680 shares during the last quarter. Ingalls & Snyder LLC grew its holdings in Tamboran Resources by 36.2% during the second quarter. Ingalls & Snyder LLC now owns 115,340 shares of the company's stock worth $2,459,000 after purchasing an additional 30,650 shares during the period. Whitebox Advisors LLC acquired a new position in Tamboran Resources during the second quarter worth approximately $1,194,000. Finally, Bank of America Corp DE increased its position in Tamboran Resources by 1,471.7% during the second quarter. Bank of America Corp DE now owns 11,788 shares of the company's stock worth $251,000 after buying an additional 11,038 shares during the last quarter.

About Tamboran Resources

(

Get Free Report)

Tamboran Resources Corporation, a natural gas company, focuses on developing unconventional gas resources in the northern territory of Australia. Its assets include a 25% non-operated working interest in EP 161; a 38.75% working interest in EPs 76, 98, and 117; and a 100% working interest in EPs 136 and 143, as well as EP (A) 197, located in the Betaloo Basin.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Tamboran Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tamboran Resources wasn't on the list.

While Tamboran Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.