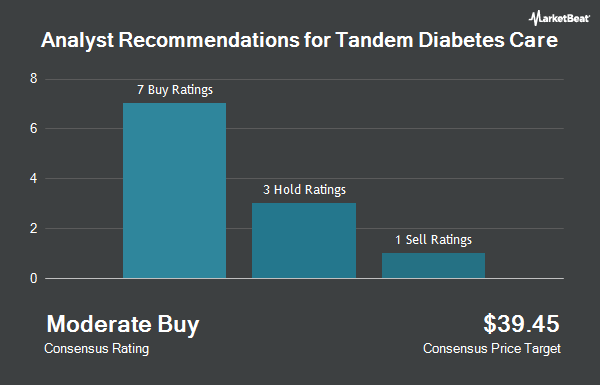

Tandem Diabetes Care, Inc. (NASDAQ:TNDM - Get Free Report) has earned a consensus recommendation of "Hold" from the fifteen research firms that are presently covering the firm, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, ten have issued a hold rating and four have assigned a buy rating to the company. The average 1 year price target among brokers that have updated their coverage on the stock in the last year is $22.6667.

Several research firms recently issued reports on TNDM. Stifel Nicolaus cut their price objective on Tandem Diabetes Care from $60.00 to $31.00 and set a "buy" rating on the stock in a report on Thursday, May 1st. Robert W. Baird dropped their price objective on shares of Tandem Diabetes Care from $33.00 to $24.00 and set a "neutral" rating for the company in a report on Thursday, May 1st. UBS Group dropped their price objective on shares of Tandem Diabetes Care from $20.00 to $17.00 and set a "neutral" rating for the company in a report on Thursday, August 7th. Piper Sandler cut shares of Tandem Diabetes Care from an "overweight" rating to a "neutral" rating and dropped their price objective for the company from $30.00 to $14.00 in a report on Thursday, August 7th. Finally, Lake Street Capital cut shares of Tandem Diabetes Care from a "buy" rating to a "hold" rating and dropped their price objective for the company from $75.00 to $12.00 in a report on Monday, August 11th.

Get Our Latest Stock Analysis on TNDM

Tandem Diabetes Care Trading Up 1.8%

Shares of Tandem Diabetes Care stock traded up $0.19 during trading hours on Thursday, hitting $11.01. The company's stock had a trading volume of 529,164 shares, compared to its average volume of 1,709,615. Tandem Diabetes Care has a twelve month low of $9.98 and a twelve month high of $47.60. The firm has a fifty day moving average of $16.59 and a 200-day moving average of $20.46. The stock has a market cap of $744.22 million, a price-to-earnings ratio of -3.58 and a beta of 1.46. The company has a debt-to-equity ratio of 2.32, a quick ratio of 1.88 and a current ratio of 2.44.

Tandem Diabetes Care (NASDAQ:TNDM - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The medical device company reported ($0.48) EPS for the quarter, missing the consensus estimate of ($0.40) by ($0.08). The business had revenue of $240.68 million during the quarter, compared to analyst estimates of $238.39 million. Tandem Diabetes Care had a negative net margin of 20.51% and a negative return on equity of 65.40%. The business's revenue for the quarter was up 8.5% on a year-over-year basis. During the same period last year, the company earned ($0.47) EPS. Research analysts forecast that Tandem Diabetes Care will post -1.68 EPS for the current year.

Insider Transactions at Tandem Diabetes Care

In related news, CEO John F. Sheridan acquired 10,000 shares of Tandem Diabetes Care stock in a transaction dated Monday, August 11th. The stock was acquired at an average price of $10.23 per share, for a total transaction of $102,300.00. Following the transaction, the chief executive officer owned 106,327 shares of the company's stock, valued at $1,087,725.21. This represents a 10.38% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Leigh Vosseller purchased 13,720 shares of Tandem Diabetes Care stock in a transaction that occurred on Friday, August 8th. The stock was bought at an average cost of $10.89 per share, with a total value of $149,410.80. Following the completion of the transaction, the chief financial officer owned 25,580 shares of the company's stock, valued at $278,566.20. The trade was a 115.68% increase in their ownership of the stock. The disclosure for this purchase can be found here. Corporate insiders own 1.90% of the company's stock.

Institutional Investors Weigh In On Tandem Diabetes Care

Institutional investors and hedge funds have recently bought and sold shares of the stock. Sessa Capital IM L.P. purchased a new position in Tandem Diabetes Care during the 1st quarter worth approximately $85,574,000. Ophir Asset Management Pty Ltd purchased a new position in Tandem Diabetes Care during the 2nd quarter worth approximately $27,307,000. Hood River Capital Management LLC purchased a new position in Tandem Diabetes Care during the 4th quarter worth approximately $46,035,000. Jacobs Levy Equity Management Inc. grew its stake in Tandem Diabetes Care by 189.0% during the 4th quarter. Jacobs Levy Equity Management Inc. now owns 1,661,013 shares of the medical device company's stock worth $59,830,000 after buying an additional 1,086,337 shares during the last quarter. Finally, Brown Advisory Inc. purchased a new position in Tandem Diabetes Care during the 4th quarter worth approximately $32,889,000.

About Tandem Diabetes Care

(

Get Free Report)

Tandem Diabetes Care, Inc, a medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally. The company's flagship product is the t:slim X2 insulin delivery system, a pump platform for managing insulin delivery and display continuous glucose monitoring sensor information directly on the pump home screen; and Tandem Mobi insulin pump, an automated insulin delivery system.

Read More

Before you consider Tandem Diabetes Care, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tandem Diabetes Care wasn't on the list.

While Tandem Diabetes Care currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.