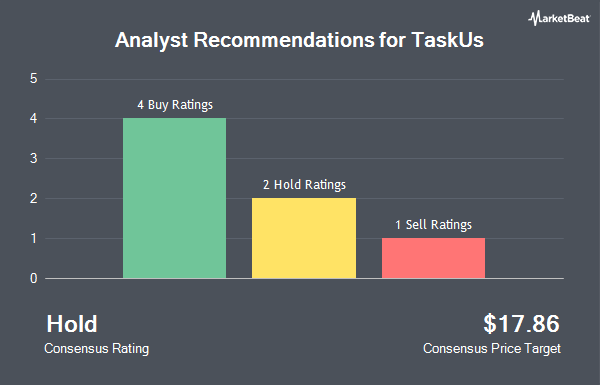

TaskUs, Inc. (NASDAQ:TASK - Get Free Report) has been given a consensus recommendation of "Moderate Buy" by the eight brokerages that are covering the firm, Marketbeat reports. Five research analysts have rated the stock with a hold rating, two have assigned a buy rating and one has assigned a strong buy rating to the company. The average 1-year target price among analysts that have updated their coverage on the stock in the last year is $17.40.

A number of equities research analysts have commented on the stock. William Blair downgraded shares of TaskUs from a "strong-buy" rating to a "hold" rating in a research report on Friday, May 9th. Royal Bank Of Canada dropped their target price on shares of TaskUs from $20.00 to $16.50 and set a "sector perform" rating on the stock in a research report on Monday, May 12th. Zacks Research raised shares of TaskUs from a "hold" rating to a "strong-buy" rating in a research report on Wednesday. Baird R W downgraded shares of TaskUs from a "strong-buy" rating to a "hold" rating in a research report on Monday, May 12th. Finally, Robert W. Baird downgraded shares of TaskUs from an "outperform" rating to a "neutral" rating and set a $16.50 target price on the stock. in a research report on Monday, May 12th.

Get Our Latest Stock Analysis on TASK

Institutional Trading of TaskUs

A number of large investors have recently bought and sold shares of the business. Think Investments LP boosted its stake in TaskUs by 14.8% during the 2nd quarter. Think Investments LP now owns 3,734,665 shares of the company's stock worth $62,593,000 after purchasing an additional 481,307 shares during the period. Qube Research & Technologies Ltd acquired a new stake in TaskUs during the 2nd quarter worth $16,325,000. Ameriprise Financial Inc. boosted its stake in TaskUs by 7.9% during the 4th quarter. Ameriprise Financial Inc. now owns 957,653 shares of the company's stock worth $16,223,000 after purchasing an additional 69,704 shares during the period. Royce & Associates LP boosted its stake in TaskUs by 6.4% during the 1st quarter. Royce & Associates LP now owns 790,289 shares of the company's stock worth $10,772,000 after purchasing an additional 47,610 shares during the period. Finally, Dalton Investments Inc. lifted its stake in shares of TaskUs by 10.3% in the 1st quarter. Dalton Investments Inc. now owns 750,146 shares of the company's stock worth $10,224,000 after acquiring an additional 69,900 shares during the period. Institutional investors and hedge funds own 44.64% of the company's stock.

TaskUs Trading Down 0.0%

NASDAQ:TASK opened at $17.3650 on Friday. The firm has a market cap of $1.56 billion, a PE ratio of 25.17 and a beta of 2.16. The stock has a fifty day moving average price of $16.98 and a 200 day moving average price of $15.43. TaskUs has a 12-month low of $10.57 and a 12-month high of $19.60. The company has a current ratio of 2.84, a quick ratio of 2.84 and a debt-to-equity ratio of 0.42.

TaskUs Company Profile

(

Get Free Report)

TaskUs, Inc provides digital outsourcing services for companies in Philippines, the United States, India, and internationally. It offers digital customer experience that consists of omni-channel customer care services primarily delivered through non-voice digital channels; and other solutions, including experience and customer care services for new product or market launches, and customer acquisition solutions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TaskUs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TaskUs wasn't on the list.

While TaskUs currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.