ServiceTitan (NASDAQ:TTAN - Get Free Report) had its price target upped by equities research analysts at TD Securities from $120.00 to $140.00 in a report issued on Wednesday,Benzinga reports. The brokerage currently has a "buy" rating on the stock. TD Securities' target price would suggest a potential upside of 10.49% from the stock's previous close.

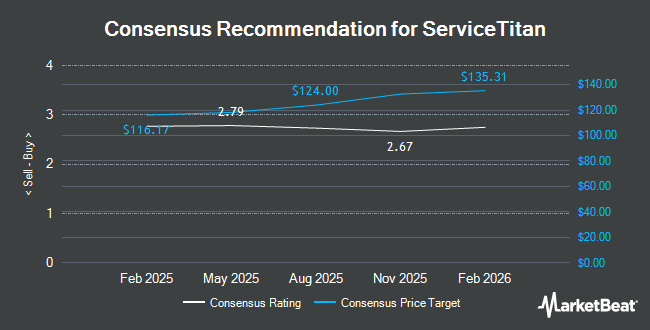

TTAN has been the topic of a number of other research reports. KeyCorp upped their target price on shares of ServiceTitan from $120.00 to $140.00 and gave the company an "overweight" rating in a research note on Friday, April 25th. Loop Capital reduced their target price on ServiceTitan from $105.00 to $90.00 and set a "hold" rating on the stock in a report on Friday, March 14th. TD Cowen began coverage on ServiceTitan in a report on Tuesday, April 8th. They issued a "buy" rating and a $120.00 price target for the company. Morgan Stanley upped their price target on ServiceTitan from $104.00 to $107.00 and gave the company an "equal weight" rating in a research report on Friday, March 14th. Finally, Stifel Nicolaus reduced their price objective on ServiceTitan from $120.00 to $110.00 and set a "buy" rating on the stock in a research note on Friday, March 14th. Four equities research analysts have rated the stock with a hold rating, eleven have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, ServiceTitan has an average rating of "Moderate Buy" and a consensus price target of $119.79.

Read Our Latest Analysis on TTAN

ServiceTitan Stock Performance

NASDAQ:TTAN opened at $126.71 on Wednesday. The company's 50-day simple moving average is $108.40. ServiceTitan has a 52 week low of $79.81 and a 52 week high of $131.33.

Insider Activity

In related news, CFO David Sherry sold 10,175 shares of the business's stock in a transaction dated Thursday, March 20th. The stock was sold at an average price of $94.65, for a total transaction of $963,063.75. Following the completion of the transaction, the chief financial officer now owns 325,409 shares of the company's stock, valued at approximately $30,799,961.85. The trade was a 3.03% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, CAO Michele O'connor sold 5,494 shares of the firm's stock in a transaction that occurred on Thursday, March 20th. The shares were sold at an average price of $94.65, for a total value of $520,007.10. Following the completion of the sale, the chief accounting officer now directly owns 89,302 shares in the company, valued at $8,452,434.30. This trade represents a 5.80% decrease in their position. The disclosure for this sale can be found here. 51.72% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

A number of large investors have recently modified their holdings of TTAN. Deer Management Co. LLC bought a new position in shares of ServiceTitan during the 4th quarter worth about $925,943,000. TPG GP A LLC bought a new stake in shares of ServiceTitan in the 4th quarter worth approximately $525,405,000. Battery Management Corp. acquired a new stake in shares of ServiceTitan during the 4th quarter worth approximately $496,599,000. Price T Rowe Associates Inc. MD increased its position in shares of ServiceTitan by 1.4% during the first quarter. Price T Rowe Associates Inc. MD now owns 2,306,168 shares of the company's stock valued at $219,341,000 after purchasing an additional 32,066 shares during the period. Finally, Kayne Anderson Rudnick Investment Management LLC lifted its position in ServiceTitan by 1,545.2% in the first quarter. Kayne Anderson Rudnick Investment Management LLC now owns 2,055,736 shares of the company's stock worth $195,521,000 after purchasing an additional 1,930,779 shares during the period.

About ServiceTitan

(

Get Free Report)

ServiceTitan, Inc engages in the collection of field service activities required to install, maintain, and service the infrastructure and systems of residences and commercial buildings. The company was founded by Ara Mahdessian and Vahe Kuzoyan on June 8, 2008 and is headquartered in Glendale, CA.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ServiceTitan, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ServiceTitan wasn't on the list.

While ServiceTitan currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.