Transcontinental (TSE:TCL.A - Get Free Report) had its target price boosted by stock analysts at TD Securities from C$26.00 to C$27.00 in a research report issued on Monday,BayStreet.CA reports. The firm presently has a "buy" rating on the stock. TD Securities' target price suggests a potential upside of 35.75% from the company's previous close.

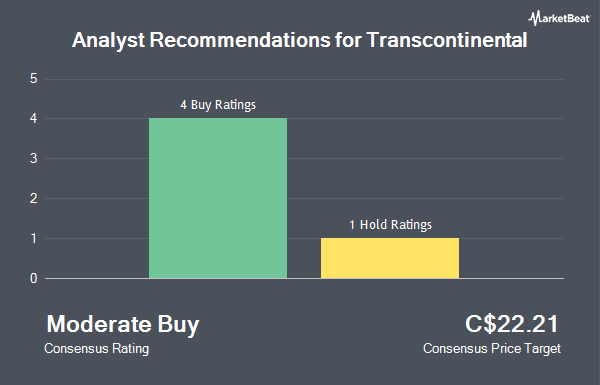

Other research analysts also recently issued research reports about the stock. Royal Bank Of Canada set a C$25.00 target price on shares of Transcontinental and gave the stock an "outperform" rating in a report on Wednesday, September 3rd. National Bankshares upped their target price on shares of Transcontinental from C$23.00 to C$24.00 and gave the stock an "outperform" rating in a report on Friday, June 6th. Cormark dropped their target price on shares of Transcontinental from C$27.00 to C$26.00 in a report on Monday, September 8th. Scotiabank lowered Transcontinental from an "outperform" rating to a "sector perform" rating and raised their price objective for the company from C$22.00 to C$23.25 in a research report on Friday, June 6th. Finally, BMO Capital Markets raised their price objective on Transcontinental from C$20.00 to C$23.00 in a research report on Friday, June 6th. Four investment analysts have rated the stock with a Buy rating and one has assigned a Hold rating to the company. Based on data from MarketBeat.com, Transcontinental presently has an average rating of "Moderate Buy" and an average target price of C$24.18.

Get Our Latest Stock Report on TCL.A

Transcontinental Price Performance

Transcontinental stock traded down C$0.13 during mid-day trading on Monday, hitting C$19.89. The stock had a trading volume of 75,211 shares, compared to its average volume of 224,984. The firm has a market capitalization of C$1.66 billion, a P/E ratio of 9.52, a P/E/G ratio of 6.05 and a beta of 0.79. The company has a current ratio of 1.49, a quick ratio of 1.09 and a debt-to-equity ratio of 54.12. The firm's 50 day moving average is C$19.99 and its 200 day moving average is C$19.48. Transcontinental has a one year low of C$15.97 and a one year high of C$22.33.

About Transcontinental

(

Get Free Report)

Transcontinental, or TC Transcontinental, is a Canadian printer and flexible packaging provider that operates in three segments: packaging, printing, and other. Its packaging segment features the production of different plastic products geared toward consumer goods. Production plants specialize in extrusion, lamination, printing, and converting.

Featured Articles

Before you consider Transcontinental, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transcontinental wasn't on the list.

While Transcontinental currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.