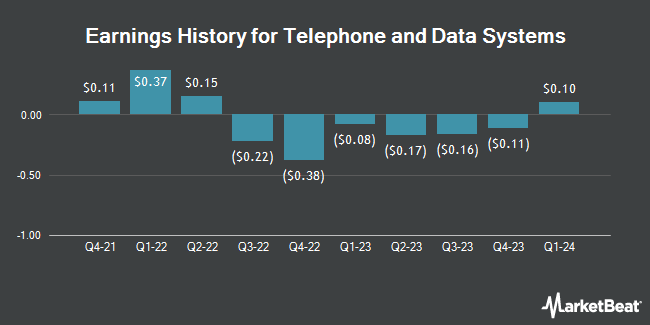

Telephone and Data Systems (NYSE:TDS - Get Free Report) announced its quarterly earnings results on Friday, May 2nd. The Wireless communications provider reported ($0.09) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.02) by ($0.07), Zacks reports. The firm had revenue of $1.15 billion during the quarter, compared to analysts' expectations of $1.18 billion. Telephone and Data Systems had a negative net margin of 10.72% and a positive return on equity of 1.12%. The firm's revenue for the quarter was down 8.6% on a year-over-year basis. During the same quarter in the previous year, the firm posted $0.10 EPS.

Telephone and Data Systems Stock Performance

Telephone and Data Systems stock traded up $0.56 during trading hours on Friday, hitting $34.52. 413,527 shares of the stock traded hands, compared to its average volume of 1,096,355. Telephone and Data Systems has a 1 year low of $15.10 and a 1 year high of $41.21. The stock has a market capitalization of $3.94 billion, a price-to-earnings ratio of -6.39 and a beta of 0.57. The company has a debt-to-equity ratio of 0.85, a current ratio of 1.59 and a quick ratio of 1.44. The firm's 50 day moving average price is $36.01 and its 200-day moving average price is $34.74.

Telephone and Data Systems Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, March 31st. Investors of record on Monday, March 17th were given a $0.04 dividend. This represents a $0.16 annualized dividend and a dividend yield of 0.46%. The ex-dividend date was Monday, March 17th. Telephone and Data Systems's payout ratio is -15.24%.

Wall Street Analysts Forecast Growth

Several analysts recently weighed in on TDS shares. JPMorgan Chase & Co. lifted their price objective on Telephone and Data Systems from $53.00 to $56.00 and gave the company an "overweight" rating in a report on Monday, February 24th. Raymond James reaffirmed an "outperform" rating and issued a $47.00 price target (down previously from $51.00) on shares of Telephone and Data Systems in a research report on Monday.

Get Our Latest Stock Analysis on Telephone and Data Systems

About Telephone and Data Systems

(

Get Free Report)

Telephone and Data Systems, Inc, a telecommunications company, provides communications services in the United States. It operates through two segments: UScellular and TDS Telecom. The company offers wireless solutions to consumers, and business and government customers, including a suite of connected Internet of things (IoT) solutions, and software applications for monitor and control, business automation/operations, communication, fleet and asset management, smart water solutions, private cellular networks and custom, and end-to-end IoT solutions; wireless priority services and quality priority and preemption options; smartphones and other handsets, tablets, wearables, mobile hotspots, fixed wireless home internet, and IoT devices; and accessories, such as cases, screen protectors, chargers, and memory cards, as well as consumer electronics, including audio, home automation and networking products.

Read More

Before you consider Telephone and Data Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Telephone and Data Systems wasn't on the list.

While Telephone and Data Systems currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.