Ross Stores (NASDAQ:ROST - Get Free Report)'s stock had its "market perform" rating reiterated by equities researchers at Telsey Advisory Group in a report released on Monday,Benzinga reports. They currently have a $150.00 price objective on the apparel retailer's stock. Telsey Advisory Group's target price points to a potential upside of 2.08% from the company's current price.

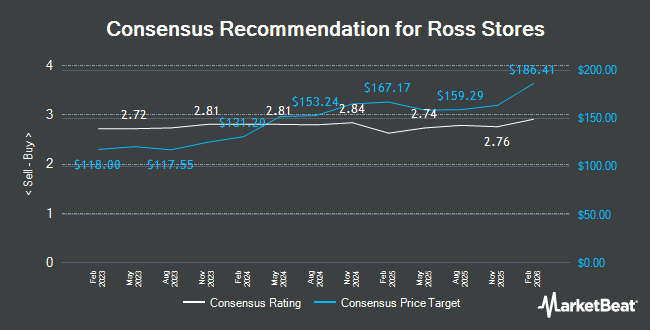

Several other analysts have also recently issued reports on the stock. Wells Fargo & Company lowered their price objective on shares of Ross Stores from $155.00 to $150.00 and set an "overweight" rating for the company in a research note on Friday, May 23rd. Morgan Stanley lowered their price objective on shares of Ross Stores from $128.00 to $126.00 and set an "equal weight" rating for the company in a research note on Friday, May 23rd. Loop Capital lowered their price objective on shares of Ross Stores from $175.00 to $170.00 and set a "buy" rating for the company in a research note on Friday, May 23rd. Jefferies Financial Group raised shares of Ross Stores from a "hold" rating to a "buy" rating and upped their price target for the stock from $135.00 to $150.00 in a research report on Wednesday, July 2nd. Finally, Wall Street Zen cut shares of Ross Stores from a "buy" rating to a "hold" rating in a research report on Wednesday, May 21st. Five research analysts have rated the stock with a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, Ross Stores presently has a consensus rating of "Moderate Buy" and an average price target of $159.06.

Get Our Latest Stock Analysis on ROST

Ross Stores Stock Down 0.3%

Shares of NASDAQ ROST opened at $146.94 on Monday. The stock has a market cap of $48.06 billion, a P/E ratio of 23.21, a PEG ratio of 2.82 and a beta of 1.11. The company has a current ratio of 1.55, a quick ratio of 0.95 and a debt-to-equity ratio of 0.18. Ross Stores has a 12-month low of $122.36 and a 12-month high of $163.60. The business's fifty day simple moving average is $135.11 and its 200-day simple moving average is $137.14.

Ross Stores (NASDAQ:ROST - Get Free Report) last issued its quarterly earnings data on Thursday, May 22nd. The apparel retailer reported $1.47 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.44 by $0.03. Ross Stores had a return on equity of 38.77% and a net margin of 9.79%. The company had revenue of $4.98 billion for the quarter, compared to analyst estimates of $4.94 billion. During the same quarter last year, the company posted $1.46 earnings per share. The business's quarterly revenue was up 2.6% compared to the same quarter last year. As a group, equities analysts predict that Ross Stores will post 6.17 EPS for the current fiscal year.

Institutional Inflows and Outflows

Several institutional investors have recently bought and sold shares of ROST. Forum Financial Management LP increased its holdings in shares of Ross Stores by 5.3% during the 4th quarter. Forum Financial Management LP now owns 1,474 shares of the apparel retailer's stock worth $223,000 after purchasing an additional 74 shares during the period. Ossiam increased its holdings in shares of Ross Stores by 10.3% during the 4th quarter. Ossiam now owns 12,069 shares of the apparel retailer's stock worth $1,826,000 after purchasing an additional 1,131 shares during the period. MetLife Investment Management LLC increased its holdings in shares of Ross Stores by 1.0% during the 4th quarter. MetLife Investment Management LLC now owns 91,012 shares of the apparel retailer's stock worth $13,767,000 after purchasing an additional 897 shares during the period. MML Investors Services LLC increased its holdings in shares of Ross Stores by 0.3% during the 4th quarter. MML Investors Services LLC now owns 29,684 shares of the apparel retailer's stock worth $4,490,000 after purchasing an additional 102 shares during the period. Finally, Tower Research Capital LLC TRC increased its holdings in shares of Ross Stores by 113.5% during the 4th quarter. Tower Research Capital LLC TRC now owns 30,107 shares of the apparel retailer's stock worth $4,554,000 after purchasing an additional 16,006 shares during the period. Institutional investors own 86.86% of the company's stock.

Ross Stores Company Profile

(

Get Free Report)

Ross Stores, Inc, together with its subsidiaries, operates off-price retail apparel and home fashion stores under the Ross Dress for Less and dd's DISCOUNTS brand names in the United States. Its stores primarily offer apparel, accessories, footwear, and home fashions. The company's Ross Dress for Less stores sell its products at department and specialty stores to middle income households; and dd's DISCOUNTS stores sell its products at department and discount stores for households with moderate income.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ross Stores, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ross Stores wasn't on the list.

While Ross Stores currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.