Telsey Advisory Group restated their market perform rating on shares of Wolverine World Wide (NYSE:WWW - Free Report) in a research note released on Wednesday morning,Benzinga reports. The brokerage currently has a $17.00 target price on the textile maker's stock. Telsey Advisory Group also issued estimates for Wolverine World Wide's Q1 2026 earnings at $0.16 EPS, Q2 2026 earnings at $0.24 EPS and Q4 2026 earnings at $0.52 EPS.

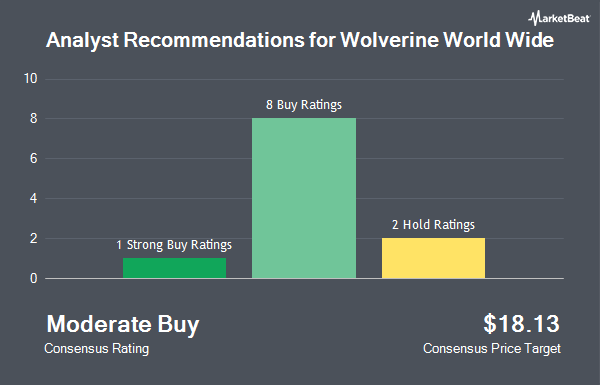

Several other equities research analysts also recently commented on the stock. Piper Sandler reduced their target price on shares of Wolverine World Wide from $27.00 to $18.00 and set an "overweight" rating on the stock in a research note on Friday, April 11th. UBS Group set a $30.00 price target on shares of Wolverine World Wide and gave the company a "buy" rating in a research report on Monday. Stifel Nicolaus cut their target price on shares of Wolverine World Wide from $27.00 to $19.00 and set a "buy" rating for the company in a research note on Thursday, April 10th. Baird R W upgraded Wolverine World Wide from a "hold" rating to a "strong-buy" rating in a research report on Monday, April 21st. Finally, Argus raised Wolverine World Wide from a "hold" rating to a "buy" rating and set a $20.00 price objective on the stock in a research note on Friday, May 16th. Two equities research analysts have rated the stock with a hold rating, seven have assigned a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $20.75.

Read Our Latest Stock Report on Wolverine World Wide

Wolverine World Wide Price Performance

NYSE WWW traded down $0.48 during trading on Wednesday, reaching $22.10. 227,249 shares of the company traded hands, compared to its average volume of 1,445,137. Wolverine World Wide has a 1-year low of $9.58 and a 1-year high of $24.64. The company has a market cap of $1.79 billion, a price-to-earnings ratio of 25.45 and a beta of 1.70. The stock's 50 day moving average price is $19.08 and its two-hundred day moving average price is $17.03. The company has a debt-to-equity ratio of 1.76, a quick ratio of 0.77 and a current ratio of 1.26.

Wolverine World Wide (NYSE:WWW - Get Free Report) last announced its quarterly earnings results on Thursday, May 8th. The textile maker reported $0.18 EPS for the quarter, beating the consensus estimate of $0.11 by $0.07. Wolverine World Wide had a return on equity of 28.74% and a net margin of 4.15%. The business had revenue of $412.30 million for the quarter, compared to analyst estimates of $395.94 million. During the same quarter in the previous year, the firm earned $0.11 EPS. Wolverine World Wide's quarterly revenue was up 4.4% on a year-over-year basis. As a group, analysts anticipate that Wolverine World Wide will post 1.23 EPS for the current year.

Wolverine World Wide Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, November 3rd. Investors of record on Wednesday, October 1st will be given a $0.10 dividend. This represents a $0.40 dividend on an annualized basis and a dividend yield of 1.8%. The ex-dividend date is Wednesday, October 1st. Wolverine World Wide's dividend payout ratio (DPR) is currently 45.98%.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Natixis bought a new stake in shares of Wolverine World Wide during the fourth quarter worth $41,000. Point72 Asia Singapore Pte. Ltd. bought a new stake in shares of Wolverine World Wide in the fourth quarter valued at about $64,000. Hilltop National Bank bought a new position in shares of Wolverine World Wide during the second quarter worth about $85,000. PNC Financial Services Group Inc. raised its position in Wolverine World Wide by 10.4% in the 1st quarter. PNC Financial Services Group Inc. now owns 9,132 shares of the textile maker's stock valued at $127,000 after buying an additional 863 shares during the last quarter. Finally, GAMMA Investing LLC lifted its stake in Wolverine World Wide by 48.7% in the 2nd quarter. GAMMA Investing LLC now owns 8,000 shares of the textile maker's stock valued at $145,000 after acquiring an additional 2,619 shares in the last quarter. 90.25% of the stock is owned by institutional investors and hedge funds.

Wolverine World Wide Company Profile

(

Get Free Report)

Wolverine World Wide, Inc designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America. It operates through Active Group and Work Group segments. The company offers casual footwear and apparel; performance outdoor and athletic footwear and apparel; kids' footwear; industrial work boots and apparel; and uniform shoes and boots.

Further Reading

Before you consider Wolverine World Wide, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wolverine World Wide wasn't on the list.

While Wolverine World Wide currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Summer 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.