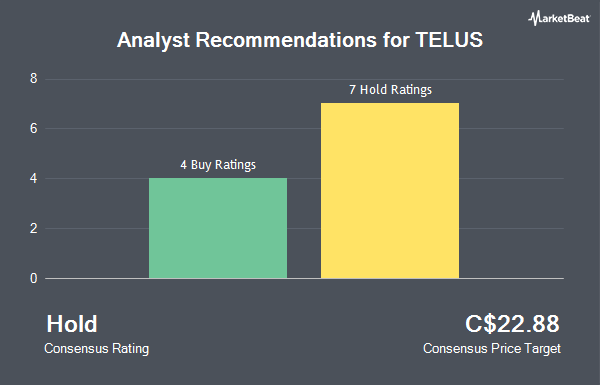

TELUS Co. (TSE:T - Get Free Report) NYSE: TU has been assigned a consensus recommendation of "Hold" from the eleven ratings firms that are covering the firm, MarketBeat.com reports. Six analysts have rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average 12 month price target among brokers that have covered the stock in the last year is C$23.18.

A number of equities research analysts recently commented on the stock. Scotiabank set a C$24.50 price target on shares of TELUS and gave the stock an "outperform" rating in a report on Friday, June 13th. Canaccord Genuity Group upped their price target on TELUS from C$20.25 to C$21.50 in a research report on Monday, May 12th. National Bankshares lifted their price objective on TELUS from C$22.00 to C$23.00 and gave the stock a "sector perform" rating in a report on Friday, June 6th. BMO Capital Markets upped their price objective on shares of TELUS from C$23.00 to C$24.00 and gave the company an "outperform" rating in a report on Wednesday, July 2nd. Finally, Royal Bank Of Canada reduced their target price on shares of TELUS from C$25.00 to C$24.00 and set an "outperform" rating for the company in a research note on Wednesday, April 9th.

Get Our Latest Stock Analysis on T

TELUS Stock Up 0.7%

TSE:T traded up C$0.16 on Friday, hitting C$21.92. The stock had a trading volume of 1,085,806 shares, compared to its average volume of 3,965,990. TELUS has a 1 year low of C$19.10 and a 1 year high of C$23.43. The firm's fifty day simple moving average is C$22.21 and its two-hundred day simple moving average is C$21.54. The stock has a market cap of C$33.00 billion, a P/E ratio of 35.56, a price-to-earnings-growth ratio of 1.65 and a beta of 0.72. The company has a debt-to-equity ratio of 183.41, a quick ratio of 0.52 and a current ratio of 0.69.

TELUS Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Wednesday, October 1st. Investors of record on Wednesday, September 10th will be given a dividend of $0.4163 per share. This represents a $1.67 annualized dividend and a yield of 7.6%. This is a boost from TELUS's previous quarterly dividend of $0.40. TELUS's payout ratio is presently 253.11%.

About TELUS

(

Get Free Report)

Telus is one of the Big Three wireless service providers in Canada, with its 9 million mobile phone subscribers nationwide constituting about 30% of the total market. It is the incumbent local exchange carrier in the western Canadian provinces of British Columbia and Alberta, where it provides internet, television, and landline phone services.

Featured Articles

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.