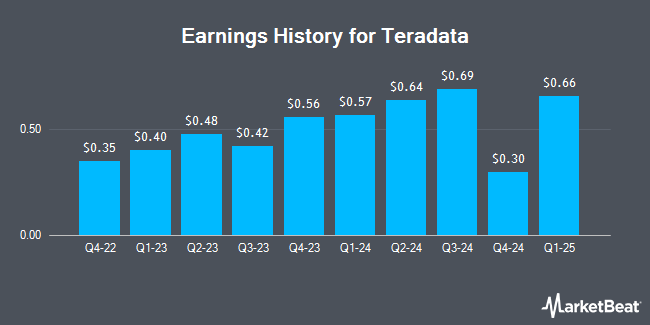

Teradata (NYSE:TDC - Get Free Report) is anticipated to post its Q1 2025 quarterly earnings results after the market closes on Tuesday, May 6th. Analysts expect Teradata to post earnings of $0.57 per share and revenue of $423.85 million for the quarter. Teradata has set its FY 2025 guidance at 2.150-2.250 EPS and its Q1 2025 guidance at 0.550-0.590 EPS.

Teradata (NYSE:TDC - Get Free Report) last released its quarterly earnings results on Tuesday, February 11th. The technology company reported $0.30 earnings per share for the quarter, missing the consensus estimate of $0.44 by ($0.14). Teradata had a return on equity of 149.16% and a net margin of 6.51%. On average, analysts expect Teradata to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Teradata Price Performance

Shares of NYSE TDC opened at $21.60 on Tuesday. The stock has a market capitalization of $2.07 billion, a PE ratio of 18.46, a P/E/G ratio of 6.23 and a beta of 0.87. The company has a debt-to-equity ratio of 3.65, a current ratio of 0.81 and a quick ratio of 0.79. The business has a fifty day moving average price of $22.16 and a two-hundred day moving average price of $27.89. Teradata has a fifty-two week low of $18.43 and a fifty-two week high of $38.45.

Analysts Set New Price Targets

Several equities analysts have weighed in on TDC shares. Guggenheim dropped their price objective on Teradata from $42.00 to $37.00 and set a "buy" rating for the company in a report on Wednesday, February 12th. Evercore ISI dropped their price objective on Teradata from $37.00 to $32.00 and set an "outperform" rating for the company in a report on Wednesday, February 12th. Barclays dropped their price objective on Teradata from $25.00 to $22.00 and set an "underweight" rating for the company in a report on Monday, April 21st. JMP Securities reiterated a "market perform" rating on shares of Teradata in a research note on Thursday, February 13th. Finally, StockNews.com lowered Teradata from a "strong-buy" rating to a "buy" rating in a research note on Tuesday, April 8th. Three investment analysts have rated the stock with a sell rating, three have assigned a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, Teradata currently has a consensus rating of "Hold" and a consensus target price of $33.70.

View Our Latest Research Report on Teradata

About Teradata

(

Get Free Report)

Teradata Corporation, together with its subsidiaries, provides a connected multi-cloud data platform for enterprise analytics. The company offers Teradata Vantage, an open and connected platform designed to leverage data across an enterprise. Its business consulting services include support services for organizations to establish a data and analytic vision, enable a multi-cloud ecosystem architecture, and identify and operationalize analytical opportunities, as well as to ensure the analytical infrastructure delivers value.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Teradata, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradata wasn't on the list.

While Teradata currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.