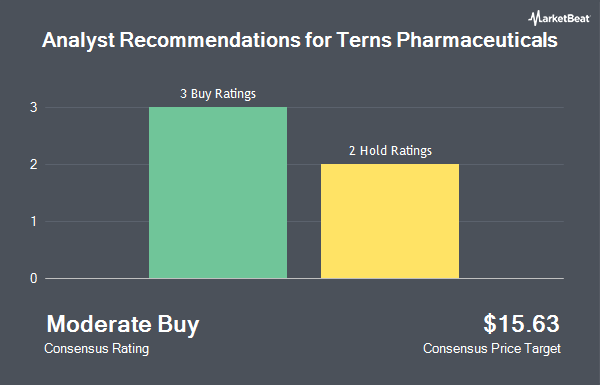

Terns Pharmaceuticals, Inc. (NASDAQ:TERN - Get Free Report) has earned an average recommendation of "Moderate Buy" from the five analysts that are currently covering the stock, MarketBeat Ratings reports. Two research analysts have rated the stock with a hold recommendation and three have given a buy recommendation to the company. The average twelve-month price target among brokers that have updated their coverage on the stock in the last year is $15.6250.

A number of brokerages recently commented on TERN. JMP Securities restated a "market outperform" rating and set a $20.00 price target on shares of Terns Pharmaceuticals in a research note on Monday, April 21st. BMO Capital Markets decreased their target price on shares of Terns Pharmaceuticals from $26.00 to $15.00 and set an "outperform" rating on the stock in a research report on Tuesday, May 13th.

View Our Latest Stock Analysis on Terns Pharmaceuticals

Insider Activity

In other news, CFO Andrew Gengos bought 10,000 shares of the company's stock in a transaction dated Friday, June 27th. The shares were purchased at an average price of $3.93 per share, for a total transaction of $39,300.00. Following the completion of the purchase, the chief financial officer owned 25,000 shares in the company, valued at approximately $98,250. This represents a 66.67% increase in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Amy L. Burroughs acquired 23,314 shares of the stock in a transaction that occurred on Wednesday, June 25th. The shares were bought at an average price of $3.87 per share, for a total transaction of $90,225.18. Following the transaction, the chief executive officer owned 47,083 shares of the company's stock, valued at $182,211.21. This trade represents a 98.09% increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders have purchased 48,314 shares of company stock worth $186,575 in the last three months. 1.50% of the stock is currently owned by insiders.

Institutional Investors Weigh In On Terns Pharmaceuticals

Institutional investors and hedge funds have recently added to or reduced their stakes in the stock. Vontobel Holding Ltd. acquired a new stake in shares of Terns Pharmaceuticals during the first quarter worth about $39,000. LPL Financial LLC grew its position in shares of Terns Pharmaceuticals by 397.2% during the fourth quarter. LPL Financial LLC now owns 252,325 shares of the company's stock worth $1,398,000 after acquiring an additional 201,575 shares during the last quarter. Norges Bank acquired a new stake in shares of Terns Pharmaceuticals during the fourth quarter worth $4,706,000. Parkman Healthcare Partners LLC lifted its holdings in Terns Pharmaceuticals by 51.9% in the fourth quarter. Parkman Healthcare Partners LLC now owns 829,105 shares of the company's stock valued at $4,593,000 after acquiring an additional 283,354 shares during the period. Finally, Nuveen Asset Management LLC lifted its holdings in Terns Pharmaceuticals by 30.6% in the fourth quarter. Nuveen Asset Management LLC now owns 2,633,918 shares of the company's stock valued at $14,592,000 after acquiring an additional 617,009 shares during the period. Hedge funds and other institutional investors own 98.26% of the company's stock.

Terns Pharmaceuticals Stock Down 6.8%

TERN stock traded down $0.42 during trading on Friday, reaching $5.67. The stock had a trading volume of 900,450 shares, compared to its average volume of 1,158,598. Terns Pharmaceuticals has a one year low of $1.87 and a one year high of $11.40. The company's 50 day moving average is $4.53 and its two-hundred day moving average is $3.76. The company has a market capitalization of $494.78 million, a price-to-earnings ratio of -5.21 and a beta of -0.05.

Terns Pharmaceuticals (NASDAQ:TERN - Get Free Report) last released its earnings results on Thursday, May 8th. The company reported ($0.26) earnings per share for the quarter, beating analysts' consensus estimates of ($0.29) by $0.03. As a group, research analysts predict that Terns Pharmaceuticals will post -1.19 earnings per share for the current fiscal year.

Terns Pharmaceuticals Company Profile

(

Get Free Report)

Terns Pharmaceuticals, Inc, a clinical-stage biopharmaceutical company, develops small-molecule product candidates for the treatment of oncology, metabolic dysfunction-associated steatohepatitis (MASH), and obesity. The company develops TERN-701, an allosteric BCR-ABL tyrosine kinase inhibitor (TKI) that is in phase 1 clinical trial for chronic myeloid leukemia (CML), a form of cancer that starts in bone marrow.

Featured Articles

Before you consider Terns Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terns Pharmaceuticals wasn't on the list.

While Terns Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.