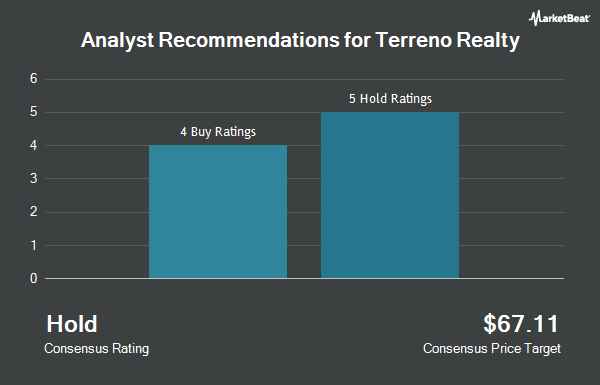

Shares of Terreno Realty Corporation (NYSE:TRNO - Get Free Report) have earned a consensus recommendation of "Hold" from the eleven analysts that are presently covering the stock, Marketbeat Ratings reports. One analyst has rated the stock with a sell rating, seven have given a hold rating and three have assigned a buy rating to the company. The average 1-year price target among brokers that have updated their coverage on the stock in the last year is $64.00.

A number of brokerages have recently issued reports on TRNO. Wall Street Zen raised shares of Terreno Realty from a "sell" rating to a "hold" rating in a report on Tuesday, May 20th. Barclays lowered their price target on shares of Terreno Realty from $57.00 to $56.00 and set an "equal weight" rating on the stock in a report on Tuesday, May 27th. Wells Fargo & Company set a $72.00 price target on shares of Terreno Realty in a report on Sunday, July 13th. KeyCorp lowered their price target on shares of Terreno Realty from $70.00 to $64.00 and set an "overweight" rating on the stock in a report on Thursday. Finally, The Goldman Sachs Group set a $64.00 price target on shares of Terreno Realty and gave the company a "buy" rating in a report on Tuesday, August 12th.

Get Our Latest Analysis on Terreno Realty

Terreno Realty Stock Down 0.7%

NYSE:TRNO traded down $0.39 on Friday, hitting $55.25. 798,537 shares of the company's stock were exchanged, compared to its average volume of 783,121. The company has a debt-to-equity ratio of 0.20, a current ratio of 1.75 and a quick ratio of 1.75. The firm has a 50-day moving average price of $56.33 and a 200-day moving average price of $59.35. The company has a market cap of $5.71 billion, a P/E ratio of 21.92, a price-to-earnings-growth ratio of 2.37 and a beta of 1.02. Terreno Realty has a 52 week low of $48.18 and a 52 week high of $71.63.

Terreno Realty Increases Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 10th. Stockholders of record on Monday, September 29th will be issued a dividend of $0.52 per share. This is a boost from Terreno Realty's previous quarterly dividend of $0.49. This represents a $2.08 annualized dividend and a dividend yield of 3.8%. The ex-dividend date of this dividend is Monday, September 29th. Terreno Realty's payout ratio is 77.78%.

Insider Activity at Terreno Realty

In other news, President Michael A. Coke sold 10,000 shares of the firm's stock in a transaction that occurred on Thursday, August 14th. The shares were sold at an average price of $53.96, for a total transaction of $539,600.00. Following the transaction, the president directly owned 412,415 shares of the company's stock, valued at approximately $22,253,913.40. This trade represents a 2.37% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 2.40% of the company's stock.

Institutional Inflows and Outflows

A number of hedge funds have recently added to or reduced their stakes in TRNO. EverSource Wealth Advisors LLC boosted its position in Terreno Realty by 73.3% in the second quarter. EverSource Wealth Advisors LLC now owns 447 shares of the real estate investment trust's stock valued at $25,000 after buying an additional 189 shares in the last quarter. Geneos Wealth Management Inc. lifted its holdings in shares of Terreno Realty by 304.3% during the first quarter. Geneos Wealth Management Inc. now owns 465 shares of the real estate investment trust's stock worth $29,000 after purchasing an additional 350 shares during the period. Quarry LP lifted its holdings in shares of Terreno Realty by 613.7% during the fourth quarter. Quarry LP now owns 728 shares of the real estate investment trust's stock worth $43,000 after purchasing an additional 626 shares during the period. Jones Financial Companies Lllp lifted its holdings in shares of Terreno Realty by 90.2% during the first quarter. Jones Financial Companies Lllp now owns 797 shares of the real estate investment trust's stock worth $50,000 after purchasing an additional 378 shares during the period. Finally, CWM LLC lifted its holdings in shares of Terreno Realty by 26.5% during the second quarter. CWM LLC now owns 1,171 shares of the real estate investment trust's stock worth $66,000 after purchasing an additional 245 shares during the period.

Terreno Realty Company Profile

(

Get Free Report)

Terreno Realty Corporation (Terreno, and together with its subsidiaries, the Company) acquires, owns and operates industrial real estate in six major coastal U.S. markets: Los Angeles, Northern New Jersey/New York City, San Francisco Bay Area, Seattle, Miami, and Washington, DC All square feet, acres, occupancy and number of properties disclosed in these notes to the consolidated financial statements are unaudited.

Further Reading

Before you consider Terreno Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Terreno Realty wasn't on the list.

While Terreno Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.