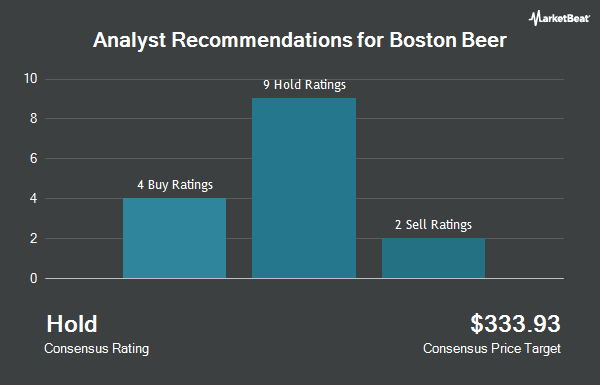

The Boston Beer Company, Inc. (NYSE:SAM - Get Free Report) has been assigned a consensus recommendation of "Hold" from the twelve brokerages that are currently covering the company, MarketBeat.com reports. One research analyst has rated the stock with a sell rating, nine have given a hold rating and two have issued a buy rating on the company. The average 12 month price objective among brokers that have covered the stock in the last year is $261.10.

A number of research analysts have commented on SAM shares. Berenberg Bank started coverage on Boston Beer in a report on Wednesday, April 2nd. They issued a "hold" rating and a $281.10 price objective on the stock. Citigroup decreased their price target on shares of Boston Beer from $285.00 to $230.00 and set a "buy" rating on the stock in a research note on Tuesday, July 15th. Sanford C. Bernstein lowered their price target on shares of Boston Beer from $270.00 to $230.00 and set a "market perform" rating on the stock in a research report on Wednesday, July 9th. Wall Street Zen cut shares of Boston Beer from a "buy" rating to a "hold" rating in a research note on Friday, June 27th. Finally, UBS Group decreased their target price on shares of Boston Beer from $275.00 to $214.00 and set a "neutral" rating on the stock in a research report on Thursday, July 17th.

View Our Latest Report on Boston Beer

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the business. Norges Bank bought a new position in Boston Beer in the fourth quarter valued at about $30,741,000. Millennium Management LLC increased its stake in shares of Boston Beer by 97.3% in the first quarter. Millennium Management LLC now owns 185,898 shares of the company's stock valued at $44,400,000 after buying an additional 91,667 shares during the period. Armistice Capital LLC raised its holdings in Boston Beer by 72.7% in the 1st quarter. Armistice Capital LLC now owns 210,553 shares of the company's stock valued at $50,288,000 after buying an additional 88,624 shares during the last quarter. J. Goldman & Co LP boosted its position in Boston Beer by 251.8% during the 4th quarter. J. Goldman & Co LP now owns 119,687 shares of the company's stock worth $35,904,000 after buying an additional 85,669 shares during the period. Finally, Cooper Creek Partners Management LLC bought a new stake in Boston Beer during the 4th quarter worth approximately $25,054,000. Institutional investors own 81.13% of the company's stock.

Boston Beer Stock Performance

Shares of NYSE:SAM opened at $193.82 on Tuesday. Boston Beer has a 52-week low of $185.34 and a 52-week high of $329.55. The company has a market capitalization of $2.16 billion, a P/E ratio of 32.14, a price-to-earnings-growth ratio of 1.42 and a beta of 0.99. The company has a 50-day simple moving average of $213.45 and a 200 day simple moving average of $232.40.

Boston Beer (NYSE:SAM - Get Free Report) last released its quarterly earnings data on Thursday, April 24th. The company reported $2.16 EPS for the quarter, beating the consensus estimate of $0.78 by $1.38. The firm had revenue of $481.36 million for the quarter, compared to the consensus estimate of $436.27 million. Boston Beer had a net margin of 3.30% and a return on equity of 13.81%. The company's quarterly revenue was up 6.5% on a year-over-year basis. During the same period in the previous year, the company earned $1.04 earnings per share. As a group, equities analysts forecast that Boston Beer will post 9.29 earnings per share for the current year.

Boston Beer Company Profile

(

Get Free ReportThe Boston Beer Company, Inc produces and sells alcohol beverages primarily in the United States. The company's flagship beer is Samuel Adams Boston Lager. It offers various beers, hard ciders, flavored malt beverages, and hard seltzers under the Samuel Adams, Twisted Tea, Truly, Angry Orchard, Dogfish Head, Angel City, and Coney Island brand names.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Boston Beer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boston Beer wasn't on the list.

While Boston Beer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.