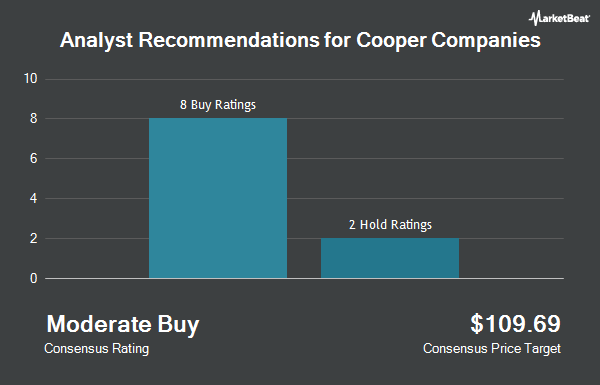

Shares of The Cooper Companies, Inc. (NASDAQ:COO - Get Free Report) have received an average recommendation of "Moderate Buy" from the fourteen research firms that are currently covering the company, Marketbeat.com reports. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $84.75.

A number of analysts recently weighed in on COO shares. Mizuho dropped their target price on Cooper Companies from $105.00 to $90.00 and set an "outperform" rating for the company in a research report on Wednesday, July 16th. Stifel Nicolaus dropped their target price on Cooper Companies from $90.00 to $85.00 and set a "buy" rating for the company in a research report on Thursday, August 28th. Needham & Company LLC reiterated a "buy" rating and issued a $94.00 price objective on shares of Cooper Companies in a research report on Thursday, August 28th. Wells Fargo & Company lowered their price objective on Cooper Companies from $93.00 to $72.00 and set an "overweight" rating for the company in a research report on Thursday, August 28th. Finally, JPMorgan Chase & Co. lowered their price objective on Cooper Companies from $76.00 to $66.00 and set a "neutral" rating for the company in a research report on Thursday, August 28th.

Read Our Latest Research Report on Cooper Companies

Cooper Companies Stock Performance

NASDAQ:COO opened at $68.37 on Friday. The business has a 50 day moving average of $69.43 and a 200 day moving average of $73.73. The company has a market capitalization of $13.59 billion, a price-to-earnings ratio of 33.68, a PEG ratio of 1.83 and a beta of 1.02. Cooper Companies has a 1-year low of $61.78 and a 1-year high of $109.37. The company has a debt-to-equity ratio of 0.29, a current ratio of 2.12 and a quick ratio of 1.24.

Cooper Companies (NASDAQ:COO - Get Free Report) last released its earnings results on Wednesday, August 27th. The medical device company reported $1.10 earnings per share for the quarter, topping analysts' consensus estimates of $1.07 by $0.03. The company had revenue of $1.06 billion during the quarter, compared to the consensus estimate of $1.06 billion. Cooper Companies had a return on equity of 9.82% and a net margin of 10.08%.Cooper Companies's quarterly revenue was up 5.7% compared to the same quarter last year. During the same quarter in the previous year, the company posted $0.96 EPS. Cooper Companies has set its Q4 2025 guidance at 1.100-1.140 EPS. FY 2025 guidance at 4.080-4.120 EPS. On average, sell-side analysts predict that Cooper Companies will post 3.98 earnings per share for the current fiscal year.

Cooper Companies announced that its Board of Directors has authorized a stock buyback plan on Wednesday, September 17th that authorizes the company to repurchase $2.00 billion in shares. This repurchase authorization authorizes the medical device company to reacquire up to 15.4% of its stock through open market purchases. Stock repurchase plans are typically a sign that the company's board believes its stock is undervalued.

Insider Transactions at Cooper Companies

In related news, CEO Albert G. White III acquired 10,000 shares of the stock in a transaction on Friday, September 5th. The stock was purchased at an average price of $68.39 per share, for a total transaction of $683,900.00. Following the completion of the transaction, the chief executive officer owned 226,151 shares of the company's stock, valued at $15,466,466.89. This trade represents a 4.63% increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, COO Daniel G. Mcbride acquired 3,000 shares of the stock in a transaction on Tuesday, September 2nd. The stock was bought at an average price of $65.04 per share, with a total value of $195,120.00. Following the transaction, the chief operating officer directly owned 63,120 shares of the company's stock, valued at approximately $4,105,324.80. The trade was a 4.99% increase in their position. The disclosure for this purchase can be found here. In the last ninety days, insiders have purchased 17,975 shares of company stock valued at $1,216,346. Insiders own 1.98% of the company's stock.

Hedge Funds Weigh In On Cooper Companies

Several hedge funds have recently made changes to their positions in the business. Mitchell & Pahl Private Wealth LLC increased its stake in shares of Cooper Companies by 3.8% during the third quarter. Mitchell & Pahl Private Wealth LLC now owns 10,082 shares of the medical device company's stock valued at $691,000 after buying an additional 366 shares during the period. Buckhead Capital Management LLC grew its stake in Cooper Companies by 14.3% in the third quarter. Buckhead Capital Management LLC now owns 58,930 shares of the medical device company's stock worth $4,040,000 after purchasing an additional 7,368 shares during the period. Czech National Bank grew its stake in Cooper Companies by 3.7% in the third quarter. Czech National Bank now owns 50,673 shares of the medical device company's stock worth $3,474,000 after purchasing an additional 1,791 shares during the period. Caldwell Trust Co purchased a new stake in Cooper Companies in the second quarter worth $274,000. Finally, Orion Porfolio Solutions LLC grew its stake in Cooper Companies by 840.5% in the second quarter. Orion Porfolio Solutions LLC now owns 96,592 shares of the medical device company's stock worth $6,873,000 after purchasing an additional 86,322 shares during the period. 24.39% of the stock is owned by hedge funds and other institutional investors.

Cooper Companies Company Profile

(

Get Free Report)

The Cooper Companies, Inc, together with its subsidiaries, develops, manufactures, and markets contact lens wearers. The company operates in two segments, CooperVision and CooperSurgical. The CooperVision segment provides spherical lense, including lenses that correct near and farsightedness; and toric and multifocal lenses comprising lenses correcting vision challenges, such as astigmatism, presbyopia, and myopia in the Americas, Europe, Middle East, Africa, and Asia Pacific.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cooper Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cooper Companies wasn't on the list.

While Cooper Companies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.