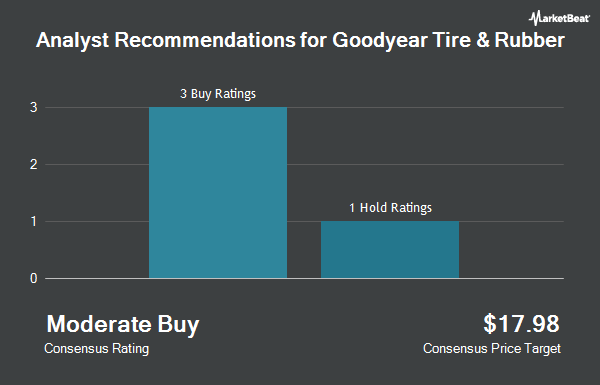

Shares of The Goodyear Tire & Rubber Company (NASDAQ:GT - Get Free Report) have been assigned a consensus recommendation of "Buy" from the seven analysts that are presently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a hold rating, four have assigned a buy rating and two have assigned a strong buy rating to the company. The average 12 month target price among brokerages that have covered the stock in the last year is $14.20.

Several research firms have recently issued reports on GT. BNP Paribas upgraded shares of Goodyear Tire & Rubber from a "hold" rating to a "strong-buy" rating in a report on Monday, June 9th. Wall Street Zen cut shares of Goodyear Tire & Rubber from a "buy" rating to a "hold" rating in a report on Saturday, May 10th. Deutsche Bank Aktiengesellschaft raised shares of Goodyear Tire & Rubber from a "hold" rating to a "buy" rating and set a $13.00 price objective on the stock in a research report on Monday, March 31st. JPMorgan Chase & Co. reissued an "overweight" rating and issued a $17.00 target price (down from $18.00) on shares of Goodyear Tire & Rubber in a report on Thursday, May 22nd. Finally, BNP Paribas Exane upgraded shares of Goodyear Tire & Rubber from a "neutral" rating to an "outperform" rating and set a $15.00 price target on the stock in a research note on Monday, June 9th.

Check Out Our Latest Analysis on GT

Goodyear Tire & Rubber Price Performance

Shares of Goodyear Tire & Rubber stock traded up $0.34 during mid-day trading on Friday, reaching $11.01. 7,145,920 shares of the stock traded hands, compared to its average volume of 5,872,393. The company has a quick ratio of 0.64, a current ratio of 1.22 and a debt-to-equity ratio of 1.44. The business has a 50-day moving average of $10.97 and a 200 day moving average of $9.99. The stock has a market capitalization of $3.15 billion, a PE ratio of 13.11, a PEG ratio of 0.34 and a beta of 1.35. Goodyear Tire & Rubber has a fifty-two week low of $7.27 and a fifty-two week high of $12.31.

Goodyear Tire & Rubber (NASDAQ:GT - Get Free Report) last announced its quarterly earnings data on Wednesday, May 7th. The company reported ($0.04) earnings per share for the quarter, beating analysts' consensus estimates of ($0.06) by $0.02. The company had revenue of $4.25 billion for the quarter, compared to analyst estimates of $4.41 billion. Goodyear Tire & Rubber had a return on equity of 5.31% and a net margin of 1.30%. The firm's revenue for the quarter was down 6.3% compared to the same quarter last year. During the same quarter in the previous year, the company earned $0.10 EPS. On average, analysts predict that Goodyear Tire & Rubber will post 1.5 EPS for the current year.

Institutional Investors Weigh In On Goodyear Tire & Rubber

Large investors have recently bought and sold shares of the business. Platinum Investment Management Ltd. purchased a new position in Goodyear Tire & Rubber in the 2nd quarter worth approximately $260,000. Chelsea Counsel Co. bought a new position in shares of Goodyear Tire & Rubber during the 2nd quarter worth $1,225,000. SummerHaven Investment Management LLC lifted its stake in shares of Goodyear Tire & Rubber by 1.9% during the 2nd quarter. SummerHaven Investment Management LLC now owns 74,711 shares of the company's stock worth $775,000 after purchasing an additional 1,393 shares during the last quarter. Guardian Investment Management lifted its stake in shares of Goodyear Tire & Rubber by 5.1% during the 2nd quarter. Guardian Investment Management now owns 41,500 shares of the company's stock worth $430,000 after purchasing an additional 2,000 shares during the last quarter. Finally, Signaturefd LLC raised its stake in shares of Goodyear Tire & Rubber by 125.6% in the second quarter. Signaturefd LLC now owns 4,508 shares of the company's stock worth $47,000 after purchasing an additional 2,510 shares during the last quarter. 84.19% of the stock is currently owned by institutional investors.

About Goodyear Tire & Rubber

(

Get Free ReportGoodyear Tire & Rubber Co engages in the development, manufacture, distribution, and sale of tires. It operates through the following geographical segments: Americas, Europe, Middle East, and Africa, and Asia Pacific. The Americas segment is involved in the development, manufacture, distribution, and sale of tires and related products and services in North, Central, and South America.

Read More

Before you consider Goodyear Tire & Rubber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goodyear Tire & Rubber wasn't on the list.

While Goodyear Tire & Rubber currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.