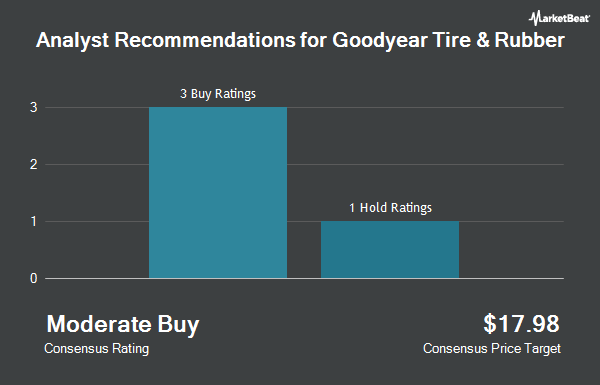

The Goodyear Tire & Rubber Company (NASDAQ:GT - Get Free Report) has been given an average rating of "Hold" by the ten research firms that are covering the company, MarketBeat.com reports. One analyst has rated the stock with a sell recommendation, five have given a hold recommendation, three have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 12 month price target among analysts that have issued ratings on the stock in the last year is $11.50.

A number of research firms have issued reports on GT. Hsbc Global Res cut Goodyear Tire & Rubber from a "strong-buy" rating to a "hold" rating in a report on Wednesday, August 20th. BNP Paribas Exane reiterated a "neutral" rating and set a $9.00 target price on shares of Goodyear Tire & Rubber in a report on Friday, August 8th. BNP Paribas cut Goodyear Tire & Rubber from a "strong-buy" rating to a "hold" rating in a report on Friday, August 8th. Citigroup began coverage on Goodyear Tire & Rubber in a report on Monday, September 8th. They set a "neutral" rating and a $10.00 target price for the company. Finally, Deutsche Bank Aktiengesellschaft lowered their target price on Goodyear Tire & Rubber from $15.00 to $12.00 and set a "buy" rating for the company in a report on Monday, August 11th.

Check Out Our Latest Analysis on Goodyear Tire & Rubber

Hedge Funds Weigh In On Goodyear Tire & Rubber

A number of large investors have recently modified their holdings of the business. American Century Companies Inc. boosted its stake in shares of Goodyear Tire & Rubber by 7.9% during the 2nd quarter. American Century Companies Inc. now owns 11,640,517 shares of the company's stock worth $120,712,000 after buying an additional 854,130 shares during the last quarter. Greenvale Capital LLP acquired a new position in shares of Goodyear Tire & Rubber during the 2nd quarter worth about $106,292,000. Marshall Wace LLP boosted its stake in shares of Goodyear Tire & Rubber by 1,107.5% during the 2nd quarter. Marshall Wace LLP now owns 7,825,605 shares of the company's stock worth $81,152,000 after buying an additional 7,177,542 shares during the last quarter. Maple Rock Capital Partners Inc. boosted its stake in shares of Goodyear Tire & Rubber by 215.6% during the 2nd quarter. Maple Rock Capital Partners Inc. now owns 5,561,846 shares of the company's stock worth $57,676,000 after buying an additional 3,799,383 shares during the last quarter. Finally, Victory Capital Management Inc. boosted its stake in shares of Goodyear Tire & Rubber by 1.9% during the 1st quarter. Victory Capital Management Inc. now owns 5,247,677 shares of the company's stock worth $48,489,000 after buying an additional 99,933 shares during the last quarter. 84.19% of the stock is currently owned by institutional investors and hedge funds.

Goodyear Tire & Rubber Trading Up 1.5%

Shares of GT opened at $7.24 on Friday. The company has a quick ratio of 0.63, a current ratio of 1.15 and a debt-to-equity ratio of 1.24. Goodyear Tire & Rubber has a 12-month low of $6.51 and a 12-month high of $12.03. The stock's 50-day moving average price is $7.92 and its 200 day moving average price is $9.67. The firm has a market capitalization of $2.07 billion, a price-to-earnings ratio of 5.10, a P/E/G ratio of 2.43 and a beta of 1.28.

Goodyear Tire & Rubber (NASDAQ:GT - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The company reported ($0.17) EPS for the quarter, missing analysts' consensus estimates of $0.14 by ($0.31). Goodyear Tire & Rubber had a net margin of 2.22% and a return on equity of 3.17%. The firm had revenue of $4.47 billion during the quarter, compared to the consensus estimate of $4.50 billion. During the same quarter in the prior year, the company earned $0.19 EPS. Goodyear Tire & Rubber's quarterly revenue was down 2.3% on a year-over-year basis. As a group, research analysts predict that Goodyear Tire & Rubber will post 1.5 earnings per share for the current year.

Goodyear Tire & Rubber Company Profile

(

Get Free Report)

Goodyear Tire & Rubber Co engages in the development, manufacture, distribution, and sale of tires. It operates through the following geographical segments: Americas, Europe, Middle East, and Africa, and Asia Pacific. The Americas segment is involved in the development, manufacture, distribution, and sale of tires and related products and services in North, Central, and South America.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Goodyear Tire & Rubber, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Goodyear Tire & Rubber wasn't on the list.

While Goodyear Tire & Rubber currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.