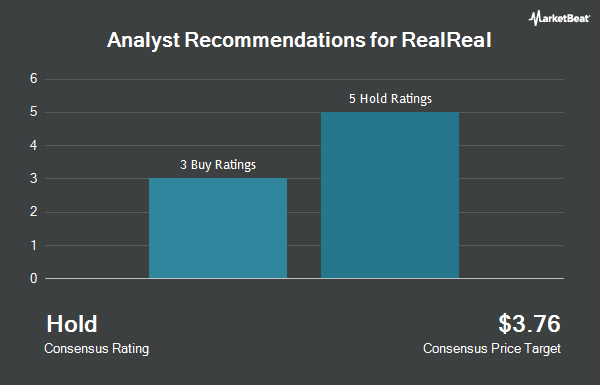

Shares of The RealReal, Inc. (NASDAQ:REAL - Get Free Report) have received an average recommendation of "Buy" from the seven research firms that are presently covering the company, Marketbeat reports. Two investment analysts have rated the stock with a hold recommendation, three have given a buy recommendation and two have assigned a strong buy recommendation to the company. The average 12 month price objective among brokers that have updated their coverage on the stock in the last year is $8.33.

A number of analysts have issued reports on the company. UBS Group lifted their price objective on RealReal from $6.00 to $7.00 and gave the stock a "neutral" rating in a research note on Friday, May 9th. B. Riley assumed coverage on RealReal in a report on Thursday, July 17th. They issued a "buy" rating and a $8.00 target price for the company.

Check Out Our Latest Report on REAL

Hedge Funds Weigh In On RealReal

A number of institutional investors and hedge funds have recently modified their holdings of REAL. Voloridge Investment Management LLC purchased a new position in RealReal during the 4th quarter valued at $17,138,000. Norges Bank purchased a new position in RealReal during the 4th quarter valued at $11,989,000. Kanen Wealth Management LLC boosted its holdings in RealReal by 26.2% during the 2nd quarter. Kanen Wealth Management LLC now owns 4,708,623 shares of the company's stock valued at $22,554,000 after acquiring an additional 978,660 shares during the period. Driehaus Capital Management LLC purchased a new position in RealReal during the 4th quarter valued at $10,370,000. Finally, Landscape Capital Management L.L.C. purchased a new position in RealReal during the 1st quarter valued at $4,958,000. Hedge funds and other institutional investors own 64.73% of the company's stock.

RealReal Stock Performance

NASDAQ:REAL traded down $0.02 during trading hours on Thursday, reaching $5.24. The stock had a trading volume of 3,232,448 shares, compared to its average volume of 2,323,648. RealReal has a 52 week low of $2.24 and a 52 week high of $11.38. The company has a 50 day moving average price of $5.40 and a two-hundred day moving average price of $6.18. The stock has a market capitalization of $592.59 million, a PE ratio of -4.64 and a beta of 2.48.

RealReal (NASDAQ:REAL - Get Free Report) last released its quarterly earnings data on Thursday, May 8th. The company reported ($0.14) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.13) by ($0.01). The business had revenue of $160.03 million during the quarter, compared to analyst estimates of $159.98 million. Equities research analysts predict that RealReal will post -0.4 EPS for the current year.

RealReal Company Profile

(

Get Free ReportThe RealReal, Inc operates an online marketplace for resale luxury goods in the United State. The company offers various product categories, including women's fashion, men's fashion, jewelry, and watches. It primarily sells products through online marketplace and retail stores. The company was incorporated in 2011 and is headquartered in San Francisco, California.

Read More

Before you consider RealReal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RealReal wasn't on the list.

While RealReal currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.