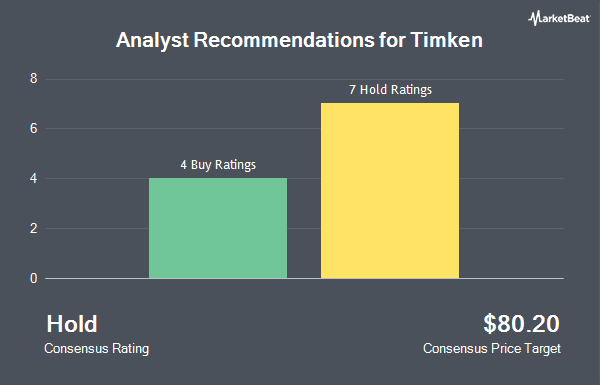

The Timken Company (NYSE:TKR - Get Free Report) has earned an average recommendation of "Hold" from the eleven analysts that are presently covering the company, MarketBeat Ratings reports. Seven analysts have rated the stock with a hold recommendation and four have issued a buy recommendation on the company. The average 1-year target price among brokers that have issued ratings on the stock in the last year is $78.50.

TKR has been the topic of a number of recent analyst reports. Citigroup upped their target price on shares of Timken from $70.00 to $75.00 and gave the company a "buy" rating in a research note on Thursday, May 8th. The Goldman Sachs Group cut their target price on shares of Timken from $85.00 to $75.00 and set a "neutral" rating on the stock in a research note on Wednesday, April 2nd. Bank of America upgraded shares of Timken from an "underperform" rating to a "neutral" rating and upped their target price for the company from $73.00 to $78.00 in a research note on Tuesday, February 4th. DA Davidson upped their target price on shares of Timken from $66.00 to $71.00 and gave the company a "neutral" rating in a research note on Monday, May 5th. Finally, Evercore ISI dropped their price objective on shares of Timken from $102.00 to $85.00 and set an "outperform" rating on the stock in a research note on Monday, May 19th.

Get Our Latest Report on Timken

Timken Stock Up 0.0%

TKR stock traded up $0.01 during trading on Friday, reaching $69.60. The stock had a trading volume of 365,937 shares, compared to its average volume of 569,298. Timken has a 1-year low of $56.20 and a 1-year high of $90.49. The company has a current ratio of 3.07, a quick ratio of 1.61 and a debt-to-equity ratio of 0.69. The company has a market capitalization of $4.87 billion, a P/E ratio of 13.95, a PEG ratio of 1.51 and a beta of 1.30. The firm has a fifty day moving average price of $66.70 and a 200 day moving average price of $73.08.

Timken (NYSE:TKR - Get Free Report) last issued its quarterly earnings data on Wednesday, April 30th. The industrial products company reported $1.40 EPS for the quarter, missing analysts' consensus estimates of $1.43 by ($0.03). The firm had revenue of $1.14 billion during the quarter, compared to analyst estimates of $1.13 billion. Timken had a return on equity of 13.93% and a net margin of 7.71%. The business's quarterly revenue was down 4.2% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $1.77 EPS. On average, equities analysts anticipate that Timken will post 5.62 earnings per share for the current year.

Timken Increases Dividend

The company also recently announced a quarterly dividend, which was paid on Friday, May 23rd. Shareholders of record on Tuesday, May 13th were given a $0.35 dividend. This is a boost from Timken's previous quarterly dividend of $0.34. The ex-dividend date was Tuesday, May 13th. This represents a $1.40 annualized dividend and a yield of 2.01%. Timken's dividend payout ratio is 30.17%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently bought and sold shares of the company. Pinnacle Associates Ltd. grew its position in Timken by 0.6% in the 1st quarter. Pinnacle Associates Ltd. now owns 25,605 shares of the industrial products company's stock worth $1,840,000 after purchasing an additional 155 shares during the last quarter. First Horizon Advisors Inc. grew its position in Timken by 8.7% in the 4th quarter. First Horizon Advisors Inc. now owns 1,981 shares of the industrial products company's stock worth $141,000 after purchasing an additional 158 shares during the last quarter. Blue Trust Inc. grew its position in Timken by 9.2% in the 1st quarter. Blue Trust Inc. now owns 2,050 shares of the industrial products company's stock worth $147,000 after purchasing an additional 173 shares during the last quarter. Amundi grew its position in Timken by 25.8% in the 4th quarter. Amundi now owns 848 shares of the industrial products company's stock worth $61,000 after purchasing an additional 174 shares during the last quarter. Finally, Ethic Inc. grew its position in Timken by 2.5% in the 1st quarter. Ethic Inc. now owns 7,056 shares of the industrial products company's stock worth $485,000 after purchasing an additional 174 shares during the last quarter. Institutional investors own 89.08% of the company's stock.

Timken Company Profile

(

Get Free ReportThe Timken Company designs, manufactures, and sells engineered bearings and industrial motion products, and related services in the United States and internationally. The company's Engineered Bearings segment provides various bearing products, including tapered, spherical, and cylindrical roller bearings; plain bearings, metal-polymer bearings, and rod end bearings; radial, angular, and precision ball bearings; thrust and specialty ball bearings; journal bearings; and housed or mounted bearings.

Featured Stories

Before you consider Timken, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Timken wasn't on the list.

While Timken currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.