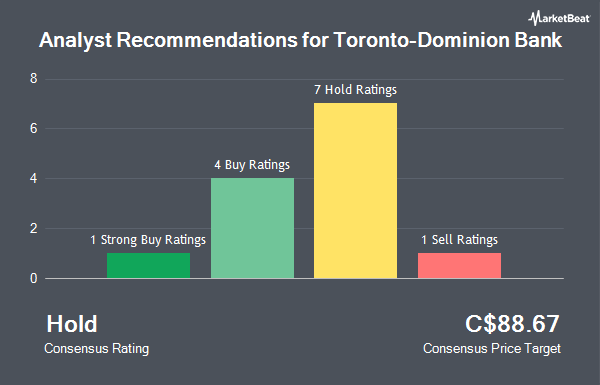

The Toronto-Dominion Bank (TSE:TD - Get Free Report) NYSE: TD has been assigned a consensus recommendation of "Hold" from the eleven research firms that are covering the stock, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, six have given a hold rating and four have assigned a buy rating to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is C$90.85.

TD has been the topic of a number of recent research reports. National Bankshares set a C$80.00 price objective on Toronto-Dominion Bank and gave the stock a "sector perform" rating in a research note on Thursday, May 22nd. Scotiabank raised Toronto-Dominion Bank to a "hold" rating in a research note on Wednesday, May 14th. Canaccord Genuity Group set a C$101.00 price target on Toronto-Dominion Bank and gave the company a "buy" rating in a research note on Tuesday, June 24th. Barclays upped their price target on Toronto-Dominion Bank from C$83.00 to C$91.00 in a research note on Monday, June 9th. Finally, CIBC upped their price target on Toronto-Dominion Bank from C$96.00 to C$99.00 and gave the company an "outperform" rating in a research note on Thursday, June 5th.

View Our Latest Report on TD

Insider Transactions at Toronto-Dominion Bank

In related news, Director Theresa Lynn Currie sold 48,792 shares of the business's stock in a transaction on Wednesday, May 28th. The stock was sold at an average price of C$94.64, for a total value of C$4,617,674.88. Following the sale, the director owned 163 shares in the company, valued at approximately C$15,426.32. The trade was a 99.67% decrease in their position. Also, Senior Officer Kelvin Vi Luan Tran sold 9,612 shares of the business's stock in a transaction on Monday, June 2nd. The shares were sold at an average price of C$94.98, for a total value of C$912,947.76. In the last three months, insiders have sold 81,612 shares of company stock worth $7,748,610. 0.08% of the stock is owned by corporate insiders.

Toronto-Dominion Bank Trading Up 0.4%

TSE TD traded up C$0.38 on Monday, reaching C$101.67. 3,936,732 shares of the company were exchanged, compared to its average volume of 8,040,107. The business's fifty day moving average price is C$96.37 and its 200 day moving average price is C$88.01. The stock has a market capitalization of C$178.37 billion, a P/E ratio of 20.14, a price-to-earnings-growth ratio of 1.22 and a beta of 0.82. Toronto-Dominion Bank has a fifty-two week low of C$73.22 and a fifty-two week high of C$102.45.

Toronto-Dominion Bank Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, July 31st. Investors of record on Thursday, July 31st will be issued a $1.05 dividend. The ex-dividend date of this dividend is Thursday, July 10th. This represents a $4.20 annualized dividend and a dividend yield of 4.13%. Toronto-Dominion Bank's dividend payout ratio is presently 80.84%.

About Toronto-Dominion Bank

(

Get Free ReportToronto-Dominion is one of Canada's two largest banks and operates three business segments: Canadian retail banking, U.S. retail banking, and wholesale banking. The bank's U.S. operations span from Maine to Florida, with a strong presence in the Northeast. It also has a 13% ownership stake in Charles Schwab.

Further Reading

Before you consider Toronto-Dominion Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Toronto-Dominion Bank wasn't on the list.

While Toronto-Dominion Bank currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.