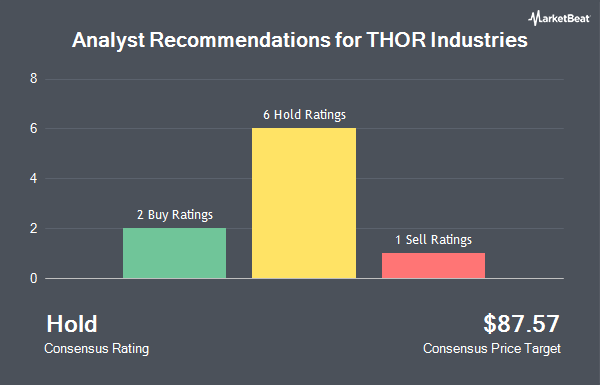

Shares of Thor Industries, Inc. (NYSE:THO - Get Free Report) have earned a consensus recommendation of "Hold" from the twelve ratings firms that are currently covering the company, MarketBeat.com reports. Ten analysts have rated the stock with a hold recommendation and two have assigned a buy recommendation to the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $104.00.

A number of research firms have weighed in on THO. KeyCorp upgraded Thor Industries from an "underweight" rating to a "sector weight" rating in a research note on Friday, August 1st. BMO Capital Markets raised their price target on Thor Industries from $105.00 to $115.00 and gave the company an "outperform" rating in a research note on Friday, September 26th. DA Davidson raised their price target on Thor Industries from $78.00 to $102.00 and gave the company a "neutral" rating in a research note on Tuesday, September 30th. Truist Financial decreased their price target on Thor Industries from $115.00 to $110.00 and set a "hold" rating for the company in a research note on Thursday, October 9th. Finally, Bank of America raised their price target on Thor Industries from $100.00 to $120.00 and gave the company a "buy" rating in a research note on Wednesday, September 10th.

Get Our Latest Stock Analysis on Thor Industries

Institutional Trading of Thor Industries

A number of hedge funds have recently made changes to their positions in THO. Hantz Financial Services Inc. lifted its position in shares of Thor Industries by 2,463.6% in the second quarter. Hantz Financial Services Inc. now owns 282 shares of the RV manufacturer's stock valued at $25,000 after buying an additional 271 shares during the last quarter. Country Trust Bank lifted its position in shares of Thor Industries by 50.0% in the second quarter. Country Trust Bank now owns 300 shares of the RV manufacturer's stock valued at $27,000 after buying an additional 100 shares during the last quarter. Curio Wealth LLC lifted its position in shares of Thor Industries by 33,300.0% in the second quarter. Curio Wealth LLC now owns 334 shares of the RV manufacturer's stock valued at $30,000 after buying an additional 333 shares during the last quarter. MAI Capital Management lifted its position in shares of Thor Industries by 174.8% in the second quarter. MAI Capital Management now owns 371 shares of the RV manufacturer's stock valued at $33,000 after buying an additional 236 shares during the last quarter. Finally, Signaturefd LLC lifted its position in shares of Thor Industries by 86.6% in the second quarter. Signaturefd LLC now owns 446 shares of the RV manufacturer's stock valued at $40,000 after buying an additional 207 shares during the last quarter. 96.71% of the stock is owned by institutional investors and hedge funds.

Thor Industries Stock Up 4.1%

NYSE:THO opened at $105.21 on Wednesday. The company has a debt-to-equity ratio of 0.21, a quick ratio of 0.90 and a current ratio of 1.75. The company has a market cap of $5.54 billion, a PE ratio of 25.23, a PEG ratio of 1.75 and a beta of 1.35. Thor Industries has a 52-week low of $63.15 and a 52-week high of $118.85. The stock has a 50-day simple moving average of $105.69 and a 200 day simple moving average of $90.53.

Thor Industries Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Thursday, November 6th. Shareholders of record on Thursday, October 23rd will be paid a $0.52 dividend. This is a positive change from Thor Industries's previous quarterly dividend of $0.50. This represents a $2.08 dividend on an annualized basis and a yield of 2.0%. The ex-dividend date is Thursday, October 23rd. Thor Industries's dividend payout ratio is 47.96%.

Thor Industries declared that its board has authorized a share buyback plan on Monday, June 23rd that authorizes the company to repurchase $400.00 million in shares. This repurchase authorization authorizes the RV manufacturer to purchase up to 8.8% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

About Thor Industries

(

Get Free Report)

THOR Industries, Inc designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Canada, and Europe. The company offers travel trailers; gasoline and diesel Class A, Class B, and Class C motorhomes; conventional travel trailers and fifth wheels; luxury fifth wheels; and motorcaravans, caravans, campervans, and urban vehicles.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Thor Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thor Industries wasn't on the list.

While Thor Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.