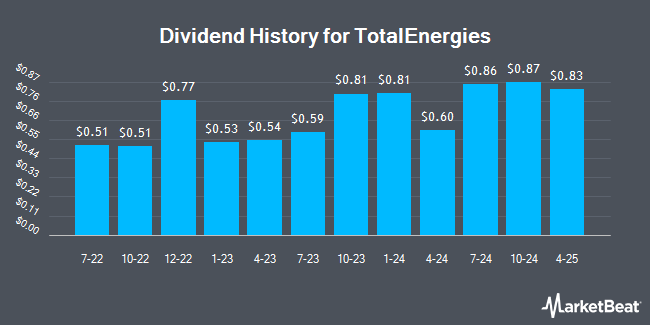

TotalEnergies SE Sponsored ADR (NYSE:TTE - Get Free Report) announced a quarterly dividend on Tuesday, April 29th. Investors of record on Tuesday, September 30th will be paid a dividend of 1.0068 per share on Wednesday, October 22nd. This represents a c) dividend on an annualized basis and a dividend yield of 6.4%. The ex-dividend date is Tuesday, September 30th.

TotalEnergies has a dividend payout ratio of 52.0% meaning its dividend is sufficiently covered by earnings. Equities research analysts expect TotalEnergies to earn $8.27 per share next year, which means the company should continue to be able to cover its $3.84 annual dividend with an expected future payout ratio of 46.4%.

TotalEnergies Stock Up 1.3%

TTE traded up $0.82 during trading on Friday, reaching $63.24. The company had a trading volume of 1,001,643 shares, compared to its average volume of 1,221,258. The company has a debt-to-equity ratio of 0.40, a current ratio of 1.00 and a quick ratio of 0.81. The business's fifty day moving average price is $61.57 and its 200 day moving average price is $60.74. TotalEnergies has a 12 month low of $52.78 and a 12 month high of $69.79. The company has a market cap of $151.63 billion, a P/E ratio of 11.48, a PEG ratio of 1.08 and a beta of 0.59.

TotalEnergies (NYSE:TTE - Get Free Report) last announced its quarterly earnings data on Thursday, July 24th. The company reported $1.57 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.62 by ($0.05). The firm had revenue of $44.68 billion for the quarter, compared to analyst estimates of $42.44 billion. TotalEnergies had a return on equity of 13.59% and a net margin of 6.20%. Equities analysts anticipate that TotalEnergies will post 8.02 EPS for the current year.

About TotalEnergies

(

Get Free Report)

TotalEnergies SE, a multi-energy company, produces and markets oil and biofuels, natural gas, green gases, renewables, and electricity in France, rest of Europe, North America, Africa, and internationally. It operates through five segments: Exploration & Production, Integrated LNG, Integrated Power, Refining & Chemicals, and Marketing & Services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TotalEnergies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TotalEnergies wasn't on the list.

While TotalEnergies currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.