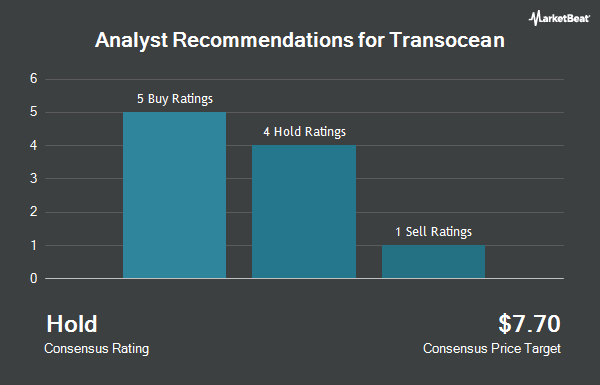

Shares of Transocean Ltd. (NYSE:RIG - Get Free Report) have received a consensus recommendation of "Hold" from the ten analysts that are presently covering the stock, Marketbeat.com reports. Six analysts have rated the stock with a hold recommendation and four have given a buy recommendation to the company. The average 12-month price objective among analysts that have updated their coverage on the stock in the last year is $4.2556.

A number of research analysts have weighed in on RIG shares. Morgan Stanley lowered their target price on Transocean from $4.00 to $3.50 and set an "equal weight" rating on the stock in a report on Friday, May 16th. Wall Street Zen raised Transocean from a "sell" rating to a "hold" rating in a research note on Sunday, August 10th. BTIG Research set a $5.00 price objective on Transocean and gave the stock a "buy" rating in a research note on Monday, May 5th. Finally, Barclays raised their price objective on Transocean from $3.50 to $4.00 and gave the stock an "overweight" rating in a research note on Wednesday, August 13th.

Get Our Latest Stock Report on RIG

Transocean Stock Performance

RIG stock traded down $0.07 during trading on Thursday, reaching $3.04. The stock had a trading volume of 14,623,983 shares, compared to its average volume of 23,051,086. Transocean has a 52 week low of $1.97 and a 52 week high of $5.01. The stock's 50 day moving average is $2.86 and its two-hundred day moving average is $2.82. The company has a current ratio of 1.26, a quick ratio of 0.99 and a debt-to-equity ratio of 0.63. The firm has a market cap of $2.86 billion, a PE ratio of -1.63, a PEG ratio of 6.63 and a beta of 2.52.

Institutional Trading of Transocean

Several institutional investors have recently made changes to their positions in the business. First Trust Advisors LP grew its holdings in Transocean by 51.5% during the 4th quarter. First Trust Advisors LP now owns 930,851 shares of the offshore drilling services provider's stock valued at $3,491,000 after buying an additional 316,362 shares in the last quarter. Gotham Asset Management LLC bought a new stake in shares of Transocean in the 4th quarter valued at approximately $698,000. Ensign Peak Advisors Inc lifted its stake in shares of Transocean by 17.4% in the 4th quarter. Ensign Peak Advisors Inc now owns 7,152,461 shares of the offshore drilling services provider's stock valued at $26,822,000 after purchasing an additional 1,059,893 shares during the last quarter. SG Americas Securities LLC lifted its stake in shares of Transocean by 3,039.6% in the 1st quarter. SG Americas Securities LLC now owns 930,599 shares of the offshore drilling services provider's stock valued at $2,950,000 after purchasing an additional 900,958 shares during the last quarter. Finally, Keybank National Association OH lifted its stake in shares of Transocean by 14.2% in the 1st quarter. Keybank National Association OH now owns 13,480,351 shares of the offshore drilling services provider's stock valued at $42,733,000 after purchasing an additional 1,672,958 shares during the last quarter. Hedge funds and other institutional investors own 67.73% of the company's stock.

About Transocean

(

Get Free Report)

Transocean Ltd., together with its subsidiaries, provides offshore contract drilling services for oil and gas wells worldwide. It contracts mobile offshore drilling rigs, related equipment, and work crews to drill oil and gas wells. The company operates a fleet of mobile offshore drilling units, consisting of ultra-deepwater floaters and harsh environment floaters.

Read More

Before you consider Transocean, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Transocean wasn't on the list.

While Transocean currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.