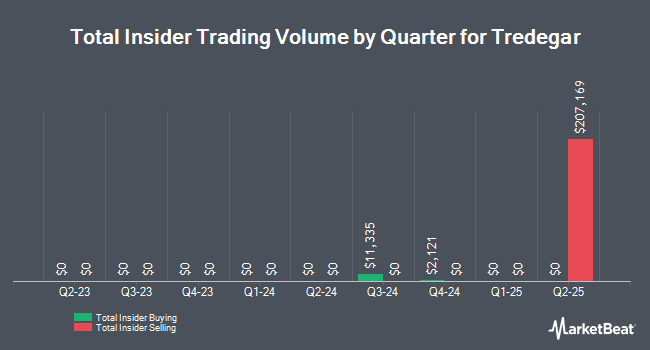

Tredegar Corporation (NYSE:TG - Get Free Report) major shareholder John D. Gottwald sold 7,168 shares of the business's stock in a transaction on Friday, August 1st. The stock was sold at an average price of $8.43, for a total value of $60,426.24. Following the completion of the transaction, the insider directly owned 781,507 shares of the company's stock, valued at approximately $6,588,104.01. The trade was a 0.91% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Large shareholders that own at least 10% of a company's shares are required to disclose their sales and purchases with the SEC.

Tredegar Stock Performance

Tredegar stock traded up $0.07 during mid-day trading on Friday, reaching $8.23. The company's stock had a trading volume of 13,524 shares, compared to its average volume of 81,995. The company has a market capitalization of $287.22 million, a P/E ratio of -4.90 and a beta of 0.83. The firm's fifty day moving average price is $8.77 and its two-hundred day moving average price is $8.08. Tredegar Corporation has a 12-month low of $5.30 and a 12-month high of $9.43.

Tredegar (NYSE:TG - Get Free Report) last announced its earnings results on Thursday, May 8th. The basic materials company reported $0.10 earnings per share (EPS) for the quarter. The firm had revenue of $164.73 million for the quarter. Tredegar had a positive return on equity of 9.28% and a negative net margin of 8.35%.

Wall Street Analysts Forecast Growth

Separately, Wall Street Zen cut Tredegar from a "buy" rating to a "hold" rating in a research note on Friday, May 9th.

Get Our Latest Report on Tredegar

Institutional Investors Weigh In On Tredegar

A number of large investors have recently made changes to their positions in TG. Central Pacific Bank Trust Division acquired a new stake in shares of Tredegar in the 1st quarter worth about $46,000. Occudo Quantitative Strategies LP bought a new stake in Tredegar during the 4th quarter valued at approximately $78,000. Price T Rowe Associates Inc. MD purchased a new position in Tredegar during the 4th quarter valued at $80,000. GAMMA Investing LLC increased its stake in Tredegar by 1,131.8% during the 1st quarter. GAMMA Investing LLC now owns 10,495 shares of the basic materials company's stock valued at $81,000 after purchasing an additional 9,643 shares in the last quarter. Finally, MetLife Investment Management LLC raised its stake in shares of Tredegar by 25.9% during the 1st quarter. MetLife Investment Management LLC now owns 15,268 shares of the basic materials company's stock valued at $118,000 after buying an additional 3,145 shares during the last quarter. Institutional investors and hedge funds own 79.24% of the company's stock.

Tredegar Company Profile

(

Get Free Report)

Tredegar Corporation manufactures and sells aluminum extrusions, polyethylene (PE) films, and plastic and polyester films in the United States and internationally. It operates through three segments: Aluminum Extrusions, PE Films, and Flexible Packaging Films. The Aluminum Extrusions segment produces soft and medium strength alloyed aluminum extrusions, custom fabricated and finished aluminum extrusions for the building and construction, automotive and transportation, consumer durables, machinery and equipment, electrical and renewable energy, and distribution markets; and manufactures mill, anodized, and painted and alloyed aluminum extrusions to fabricators and distributors.

Featured Articles

Before you consider Tredegar, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tredegar wasn't on the list.

While Tredegar currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.