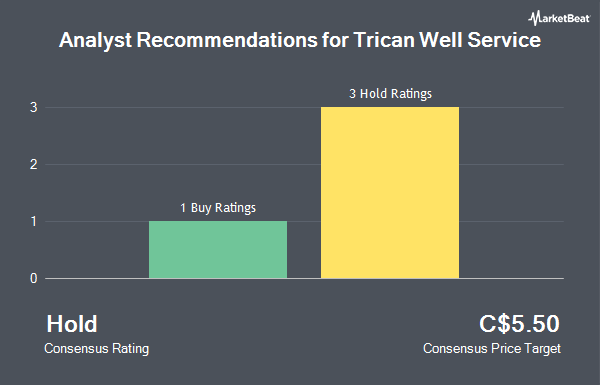

Trican Well Service Ltd. (TSE:TCW - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the five analysts that are currently covering the firm, MarketBeat reports. Two equities research analysts have rated the stock with a hold rating and three have issued a buy rating on the company. The average 1-year price target among brokerages that have issued a report on the stock in the last year is C$6.17.

A number of research firms have recently weighed in on TCW. BMO Capital Markets upped their target price on Trican Well Service from C$5.00 to C$6.00 and gave the company an "outperform" rating in a research report on Friday, July 4th. TD Securities upped their target price on Trican Well Service from C$4.75 to C$5.50 and gave the company a "hold" rating in a research report on Friday, July 4th. Raymond James Financial upgraded Trican Well Service from a "hold" rating to a "moderate buy" rating and upped their target price for the company from C$5.00 to C$6.50 in a research report on Friday, July 4th. National Bankshares upped their price objective on Trican Well Service from C$5.75 to C$6.50 and gave the stock a "sector perform" rating in a research report on Friday, July 4th. Finally, ATB Capital upped their price objective on Trican Well Service from C$5.50 to C$6.50 and gave the stock an "outperform" rating in a research report on Friday, July 4th.

Read Our Latest Report on TCW

Trican Well Service Price Performance

Shares of TSE:TCW traded down C$0.14 during trading on Wednesday, reaching C$5.71. 335,979 shares of the company traded hands, compared to its average volume of 539,749. The company's 50 day moving average is C$5.77 and its two-hundred day moving average is C$4.92. The firm has a market capitalization of C$1.02 billion, a PE ratio of 10.57, a PEG ratio of 0.22 and a beta of 0.62. The company has a quick ratio of 1.75, a current ratio of 2.62 and a debt-to-equity ratio of 5.89. Trican Well Service has a 52 week low of C$3.69 and a 52 week high of C$6.02.

Trican Well Service Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Tuesday, September 30th. Investors of record on Tuesday, September 30th will be given a dividend of $0.055 per share. The ex-dividend date is Friday, September 12th. This represents a $0.22 annualized dividend and a dividend yield of 3.9%. This is an increase from Trican Well Service's previous quarterly dividend of $0.05. Trican Well Service's dividend payout ratio is currently 35.19%.

Trican Well Service Company Profile

(

Get Free Report)

Trican Well Service Ltd is an equipment services company. It provides products, equipment, services, and technology for use in the drilling, completion, stimulation, and reworking of oil and gas wells primarily through its continuing pressure pumping operations in Canada. The company offers services related to coiled tubing, pipeline service, cementing, fracturing and reservoir solutions.

Read More

Before you consider Trican Well Service, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Trican Well Service wasn't on the list.

While Trican Well Service currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.