Tvardi Therapeutics (NASDAQ:TVRD - Get Free Report) was downgraded by stock analysts at Piper Sandler from an "overweight" rating to a "neutral" rating in a report issued on Monday, MarketBeat.com reports.

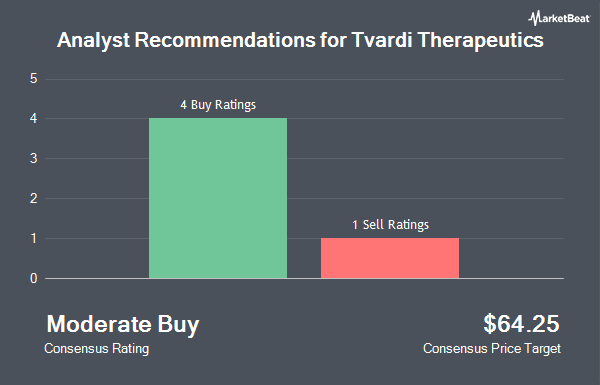

Several other equities research analysts have also commented on the stock. Barclays began coverage on shares of Tvardi Therapeutics in a research note on Monday. They set an "overweight" rating and a $61.00 price target on the stock. Weiss Ratings reaffirmed a "sell (e)" rating on shares of Tvardi Therapeutics in a report on Saturday, September 27th. Raymond James Financial started coverage on shares of Tvardi Therapeutics in a research report on Monday, July 14th. They issued an "outperform" rating and a $62.00 price objective for the company. Finally, Cantor Fitzgerald initiated coverage on shares of Tvardi Therapeutics in a research report on Friday, July 11th. They set an "overweight" rating and a $52.00 price target for the company. Four investment analysts have rated the stock with a Buy rating, two have given a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, Tvardi Therapeutics currently has a consensus rating of "Hold" and an average price target of $55.50.

Check Out Our Latest Research Report on TVRD

Tvardi Therapeutics Stock Performance

Shares of NASDAQ:TVRD traded down $35.04 during mid-day trading on Monday, reaching $6.56. 4,494,120 shares of the company were exchanged, compared to its average volume of 58,488. Tvardi Therapeutics has a 1 year low of $5.65 and a 1 year high of $43.65. The company has a 50-day moving average price of $32.02.

Tvardi Therapeutics (NASDAQ:TVRD - Get Free Report) last issued its quarterly earnings results on Thursday, August 14th. The company reported ($1.00) EPS for the quarter, missing the consensus estimate of ($0.51) by ($0.49). Tvardi Therapeutics had a negative net margin of 678.79% and a negative return on equity of 565.83%.

Institutional Investors Weigh In On Tvardi Therapeutics

Hedge funds have recently added to or reduced their stakes in the business. Geode Capital Management LLC bought a new stake in Tvardi Therapeutics in the second quarter worth approximately $2,617,000. Marshall Wace LLP purchased a new stake in Tvardi Therapeutics during the second quarter valued at about $583,000. Bank of America Corp DE bought a new stake in shares of Tvardi Therapeutics during the 2nd quarter valued at $399,000. New York State Common Retirement Fund bought a new stake in shares of Tvardi Therapeutics during the 2nd quarter valued at $92,000. Finally, Headlands Technologies LLC bought a new position in Tvardi Therapeutics in the 2nd quarter worth about $80,000. 44.66% of the stock is currently owned by institutional investors.

About Tvardi Therapeutics

(

Get Free Report)

Cara Therapeutics, Inc, an early commercial-stage biopharmaceutical company, focuses on developing and commercializing chemical entities with a primary focus on pruritus and pain by selectively targeting kappa opioid receptors in the United States. The company is developing product candidates that target the body's peripheral nervous system and immune cells.

Featured Stories

Before you consider Tvardi Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tvardi Therapeutics wasn't on the list.

While Tvardi Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.