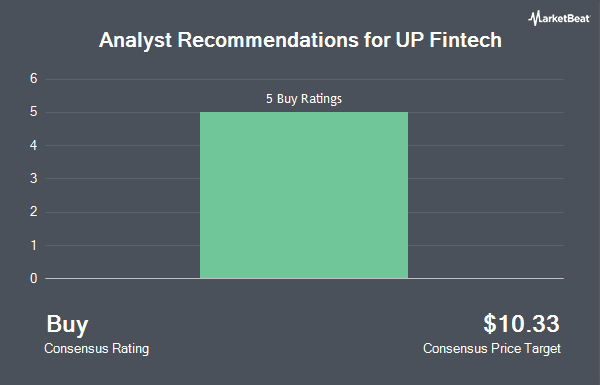

UP Fintech Holding Limited (NASDAQ:TIGR - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the six analysts that are presently covering the firm, MarketBeat reports. One analyst has rated the stock with a hold rating and five have given a buy rating to the company. The average 12 month target price among brokers that have covered the stock in the last year is $12.1250.

A number of equities research analysts recently issued reports on the stock. Citigroup raised shares of UP Fintech from a "neutral" rating to a "buy" rating and lifted their price target for the company from $9.50 to $14.00 in a research note on Tuesday, July 22nd. Weiss Ratings reissued a "hold (c)" rating on shares of UP Fintech in a research note on Wednesday, October 8th. Wall Street Zen raised shares of UP Fintech from a "hold" rating to a "buy" rating in a research note on Saturday, August 30th. UBS Group assumed coverage on shares of UP Fintech in a research note on Thursday. They issued a "buy" rating and a $13.10 price target on the stock. Finally, Jefferies Financial Group assumed coverage on shares of UP Fintech in a research note on Monday, September 29th. They issued a "buy" rating and a $12.00 price target on the stock.

View Our Latest Report on UP Fintech

Institutional Investors Weigh In On UP Fintech

Institutional investors and hedge funds have recently added to or reduced their stakes in the business. Raymond James Financial Inc. acquired a new stake in UP Fintech during the 2nd quarter worth $33,000. Caitong International Asset Management Co. Ltd boosted its stake in UP Fintech by 205.6% during the 2nd quarter. Caitong International Asset Management Co. Ltd now owns 5,094 shares of the company's stock worth $49,000 after purchasing an additional 3,427 shares during the last quarter. First Horizon Advisors Inc. acquired a new stake in UP Fintech during the 2nd quarter worth $52,000. SBI Securities Co. Ltd. boosted its stake in UP Fintech by 22.7% during the 2nd quarter. SBI Securities Co. Ltd. now owns 6,382 shares of the company's stock worth $62,000 after purchasing an additional 1,179 shares during the last quarter. Finally, Bingham Private Wealth LLC acquired a new stake in UP Fintech during the 1st quarter worth $90,000. Institutional investors and hedge funds own 9.03% of the company's stock.

UP Fintech Stock Performance

UP Fintech stock opened at $10.15 on Friday. The company's fifty day moving average price is $10.90 and its 200 day moving average price is $9.60. UP Fintech has a 1 year low of $5.36 and a 1 year high of $13.55. The stock has a market capitalization of $1.87 billion, a P/E ratio of 15.62, a P/E/G ratio of 0.63 and a beta of 0.55.

About UP Fintech

(

Get Free Report)

UP Fintech Holding Limited provides online brokerage services focusing on Chinese investors. The company has developed a brokerage platform, which allows investor to trade stocks, options, warrants, and other financial instruments that can be accessed through its APP and website. It offers brokerage and value-added services, including investor education, community engagement, and IR platform services.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider UP Fintech, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and UP Fintech wasn't on the list.

While UP Fintech currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.