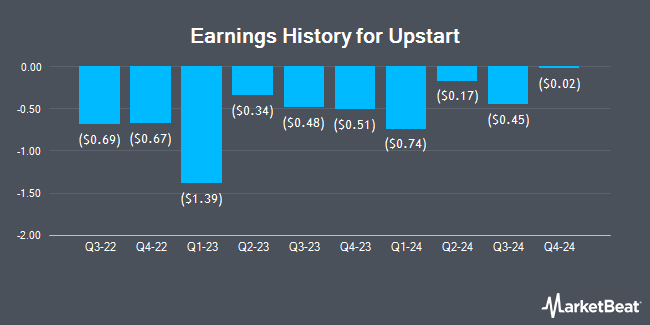

Upstart (NASDAQ:UPST - Get Free Report) posted its quarterly earnings results on Tuesday. The company reported $0.36 EPS for the quarter, topping the consensus estimate of $0.27 by $0.09, Briefing.com reports. The firm had revenue of $257.29 million for the quarter, compared to the consensus estimate of $225.35 million. Upstart had a negative net margin of 9.20% and a negative return on equity of 15.27%. The business's revenue was up 101.6% compared to the same quarter last year. During the same period last year, the firm posted ($0.17) earnings per share. Upstart updated its FY 2025 guidance to EPS and its Q3 2025 guidance to EPS.

Upstart Trading Down 0.3%

Shares of UPST stock opened at $82.62 on Wednesday. Upstart has a 12 month low of $23.20 and a 12 month high of $96.43. The stock has a market cap of $7.86 billion, a PE ratio of -110.16 and a beta of 2.39. The company's fifty day moving average price is $67.47 and its 200-day moving average price is $59.06.

Analyst Ratings Changes

Several research firms have commented on UPST. Morgan Stanley decreased their price target on shares of Upstart from $70.00 to $50.00 and set an "equal weight" rating on the stock in a research note on Wednesday, May 7th. The Goldman Sachs Group upgraded shares of Upstart to a "sell" rating and set a $71.00 target price on the stock in a report on Monday, July 14th. Piper Sandler upgraded shares of Upstart to an "overweight" rating and set a $75.00 target price on the stock in a report on Tuesday, June 24th. Needham & Company LLC restated a "buy" rating and issued a $70.00 target price on shares of Upstart in a report on Monday, May 19th. Finally, Bank of America upgraded shares of Upstart from an "underperform" rating to a "neutral" rating and set a $53.00 target price on the stock in a report on Tuesday, April 29th. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and five have issued a buy rating to the company's stock. According to data from MarketBeat.com, Upstart has a consensus rating of "Hold" and an average target price of $71.62.

Read Our Latest Stock Analysis on UPST

Insider Activity

In other news, CEO Dave Girouard sold 41,667 shares of the business's stock in a transaction on Tuesday, July 15th. The shares were sold at an average price of $75.07, for a total transaction of $3,127,941.69. Following the sale, the chief executive officer owned 52,614 shares in the company, valued at approximately $3,949,732.98. The trade was a 44.19% decrease in their position. The sale was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, insider Natalia Mirgorodskaya sold 4,000 shares of the business's stock in a transaction on Tuesday, July 8th. The shares were sold at an average price of $80.07, for a total transaction of $320,280.00. Following the sale, the insider owned 24,623 shares in the company, valued at approximately $1,971,563.61. This trade represents a 13.97% decrease in their position. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 151,650 shares of company stock worth $9,665,841. Corporate insiders own 16.67% of the company's stock.

Hedge Funds Weigh In On Upstart

Several large investors have recently modified their holdings of the stock. NewEdge Advisors LLC raised its position in shares of Upstart by 20.0% in the 1st quarter. NewEdge Advisors LLC now owns 1,997 shares of the company's stock worth $92,000 after purchasing an additional 333 shares during the last quarter. Integrated Wealth Concepts LLC raised its position in Upstart by 13.8% in the 1st quarter. Integrated Wealth Concepts LLC now owns 4,628 shares of the company's stock worth $213,000 after buying an additional 563 shares during the last quarter. Acadian Asset Management LLC purchased a new position in Upstart in the 1st quarter worth about $208,000. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its position in Upstart by 18.7% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 173,017 shares of the company's stock worth $7,964,000 after buying an additional 27,287 shares during the last quarter. Finally, AQR Capital Management LLC raised its position in Upstart by 89.5% in the 1st quarter. AQR Capital Management LLC now owns 96,706 shares of the company's stock worth $4,451,000 after buying an additional 45,664 shares during the last quarter. Hedge funds and other institutional investors own 63.01% of the company's stock.

About Upstart

(

Get Free Report)

Upstart Holdings, Inc, together with its subsidiaries, operates a cloud-based artificial intelligence (AI) lending platform in the United States. Its platform includes personal loans, automotive retail and refinance loans, home equity lines of credit, and small dollar loans that connects consumer demand for loans to its to bank and credit unions.

Featured Articles

Before you consider Upstart, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Upstart wasn't on the list.

While Upstart currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.