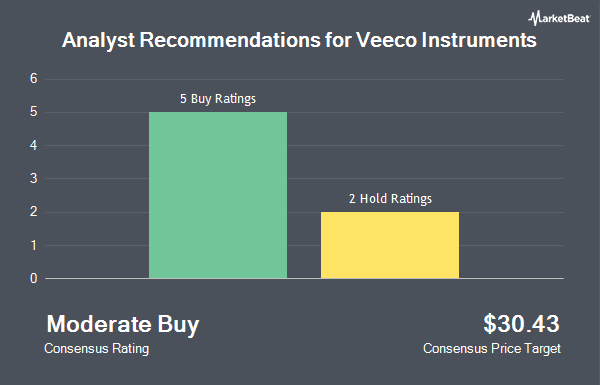

Shares of Veeco Instruments Inc. (NASDAQ:VECO - Get Free Report) have earned a consensus recommendation of "Hold" from the nine analysts that are currently covering the stock, Marketbeat Ratings reports. Six research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $27.7143.

A number of research firms recently issued reports on VECO. Northland Securities lowered Veeco Instruments from an "outperform" rating to a "market perform" rating and set a $30.00 price objective on the stock. in a research note on Tuesday. Weiss Ratings reaffirmed a "hold (c)" rating on shares of Veeco Instruments in a report on Wednesday. Northland Capmk lowered shares of Veeco Instruments from a "strong-buy" rating to a "hold" rating in a report on Tuesday. Benchmark decreased their target price on shares of Veeco Instruments from $31.00 to $28.00 and set a "buy" rating on the stock in a report on Thursday, August 7th. Finally, Needham & Company LLC cut shares of Veeco Instruments from a "buy" rating to a "hold" rating in a report on Friday, October 3rd.

Check Out Our Latest Stock Report on Veeco Instruments

Veeco Instruments Stock Performance

NASDAQ VECO opened at $29.74 on Thursday. The company's 50 day moving average is $25.87 and its 200-day moving average is $22.08. Veeco Instruments has a 12-month low of $16.92 and a 12-month high of $34.45. The company has a quick ratio of 3.43, a current ratio of 5.10 and a debt-to-equity ratio of 0.26. The firm has a market cap of $1.79 billion, a P/E ratio of 29.16 and a beta of 1.27.

Veeco Instruments (NASDAQ:VECO - Get Free Report) last issued its earnings results on Wednesday, August 6th. The semiconductor company reported $0.36 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.22 by $0.14. Veeco Instruments had a net margin of 8.65% and a return on equity of 7.38%. The business had revenue of $166.10 million for the quarter, compared to analysts' expectations of $151.31 million. During the same quarter in the previous year, the firm posted $0.42 EPS. The business's revenue for the quarter was down 5.6% compared to the same quarter last year. Sell-side analysts predict that Veeco Instruments will post 0.76 earnings per share for the current year.

Insider Transactions at Veeco Instruments

In other Veeco Instruments news, CEO William John Miller sold 25,000 shares of Veeco Instruments stock in a transaction that occurred on Wednesday, October 1st. The shares were sold at an average price of $32.00, for a total transaction of $800,000.00. Following the completion of the sale, the chief executive officer directly owned 514,543 shares in the company, valued at $16,465,376. The trade was a 4.63% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, SVP Adrian Devasahayam sold 4,046 shares of the stock in a transaction on Monday, September 15th. The stock was sold at an average price of $26.00, for a total transaction of $105,196.00. Following the completion of the transaction, the senior vice president directly owned 86,134 shares in the company, valued at $2,239,484. The trade was a 4.49% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 61,911 shares of company stock worth $1,781,550 over the last 90 days. Corporate insiders own 2.40% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors have recently added to or reduced their stakes in the company. Amalgamated Bank increased its stake in Veeco Instruments by 3.2% in the second quarter. Amalgamated Bank now owns 16,926 shares of the semiconductor company's stock valued at $344,000 after acquiring an additional 531 shares during the last quarter. Maryland State Retirement & Pension System increased its position in shares of Veeco Instruments by 3.3% during the 2nd quarter. Maryland State Retirement & Pension System now owns 17,614 shares of the semiconductor company's stock valued at $358,000 after purchasing an additional 569 shares during the last quarter. Russell Investments Group Ltd. increased its position in shares of Veeco Instruments by 9.9% during the 2nd quarter. Russell Investments Group Ltd. now owns 6,421 shares of the semiconductor company's stock valued at $130,000 after purchasing an additional 580 shares during the last quarter. Andra AP fonden increased its position in shares of Veeco Instruments by 1.4% during the 2nd quarter. Andra AP fonden now owns 55,039 shares of the semiconductor company's stock valued at $1,118,000 after purchasing an additional 744 shares during the last quarter. Finally, Legal & General Group Plc increased its position in shares of Veeco Instruments by 0.5% during the 2nd quarter. Legal & General Group Plc now owns 152,518 shares of the semiconductor company's stock valued at $3,099,000 after purchasing an additional 791 shares during the last quarter. Institutional investors own 98.46% of the company's stock.

About Veeco Instruments

(

Get Free Report)

Veeco Instruments Inc, together with its subsidiaries, develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices in the United States, Europe, the Middle East, and Africa, China, Rest of the Asia-Pacific, and internationally. The company offers laser annealing, ion beam deposition and etch, metal organic chemical vapor deposition, single wafer wet processing and surface preparation, molecular beam epitaxy, advanced packaging lithography, atomic layer deposition, and other deposition systems.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Veeco Instruments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veeco Instruments wasn't on the list.

While Veeco Instruments currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.