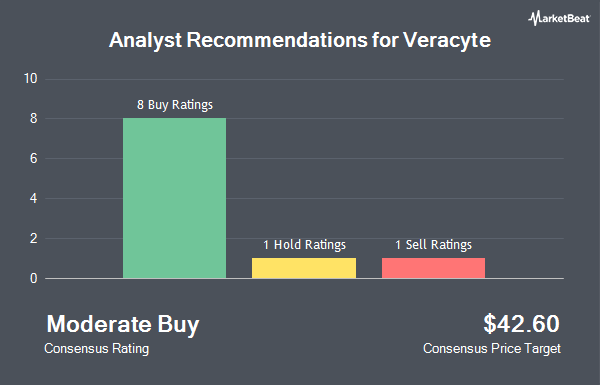

Veracyte, Inc. (NASDAQ:VCYT - Get Free Report) has been assigned an average rating of "Moderate Buy" from the ten analysts that are covering the company, Marketbeat.com reports. One equities research analyst has rated the stock with a sell rating, one has given a hold rating and eight have assigned a buy rating to the company. The average twelve-month price objective among brokers that have updated their coverage on the stock in the last year is $40.90.

Several brokerages have recently commented on VCYT. Morgan Stanley set a $28.00 price target on shares of Veracyte and gave the stock an "underweight" rating in a research report on Friday, August 8th. Wall Street Zen raised Veracyte from a "hold" rating to a "buy" rating in a research report on Saturday, July 26th.

Check Out Our Latest Stock Analysis on Veracyte

Veracyte Trading Up 3.4%

VCYT stock traded up $1.04 during mid-day trading on Friday, hitting $31.86. 907,724 shares of the company were exchanged, compared to its average volume of 972,672. The firm has a fifty day simple moving average of $27.65 and a 200 day simple moving average of $29.04. The company has a market capitalization of $2.51 billion, a PE ratio of 96.55 and a beta of 2.07. Veracyte has a twelve month low of $22.61 and a twelve month high of $47.32.

Insider Buying and Selling at Veracyte

In other Veracyte news, CEO Marc Stapley sold 7,667 shares of the stock in a transaction on Thursday, September 4th. The shares were sold at an average price of $30.41, for a total transaction of $233,153.47. Following the sale, the chief executive officer directly owned 334,185 shares of the company's stock, valued at approximately $10,162,565.85. This represents a 2.24% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Company insiders own 1.40% of the company's stock.

Institutional Investors Weigh In On Veracyte

Several institutional investors and hedge funds have recently bought and sold shares of VCYT. Nuveen LLC acquired a new position in Veracyte in the first quarter valued at approximately $33,003,000. Artisan Partners Limited Partnership lifted its holdings in shares of Veracyte by 20.7% in the 2nd quarter. Artisan Partners Limited Partnership now owns 6,321,775 shares of the biotechnology company's stock worth $170,878,000 after purchasing an additional 1,082,064 shares during the last quarter. Squarepoint Ops LLC lifted its holdings in shares of Veracyte by 770.6% in the 2nd quarter. Squarepoint Ops LLC now owns 897,387 shares of the biotechnology company's stock worth $24,256,000 after purchasing an additional 794,307 shares during the last quarter. Soleus Capital Management L.P. acquired a new position in Veracyte during the 2nd quarter valued at approximately $19,338,000. Finally, Point72 Asset Management L.P. bought a new position in Veracyte during the 4th quarter worth $20,717,000.

About Veracyte

(

Get Free Report)

Veracyte, Inc engages in the research, development and commercialization of diagnostic products. The firm's portfolio includes Afirma, Percepta, and Envisia. It intends to treat thyroid cancer, improve lung cancer screening, and clarify the diagnosis of idiopathic pulmonary fibrosis. The company was founded by Bonnie H.

Further Reading

Before you consider Veracyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veracyte wasn't on the list.

While Veracyte currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.