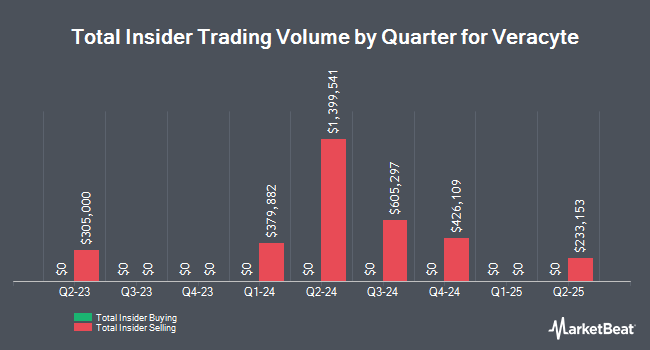

Veracyte, Inc. (NASDAQ:VCYT - Get Free Report) CEO Marc Stapley sold 7,667 shares of Veracyte stock in a transaction on Thursday, September 4th. The stock was sold at an average price of $30.41, for a total transaction of $233,153.47. Following the completion of the transaction, the chief executive officer directly owned 334,185 shares in the company, valued at approximately $10,162,565.85. The trade was a 2.24% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website.

Veracyte Stock Performance

Shares of NASDAQ VCYT traded down $0.98 during mid-day trading on Friday, hitting $30.88. The stock had a trading volume of 615,136 shares, compared to its average volume of 948,481. The business has a 50 day moving average price of $27.71 and a two-hundred day moving average price of $29.02. The firm has a market cap of $2.43 billion, a P/E ratio of 93.58 and a beta of 2.07. Veracyte, Inc. has a 1 year low of $22.61 and a 1 year high of $47.32.

Analysts Set New Price Targets

A number of brokerages have issued reports on VCYT. Morgan Stanley set a $28.00 price objective on shares of Veracyte and gave the company an "underweight" rating in a research report on Friday, August 8th. Wall Street Zen raised shares of Veracyte from a "hold" rating to a "buy" rating in a research report on Saturday, July 26th. Eight analysts have rated the stock with a Buy rating, one has issued a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat, Veracyte presently has a consensus rating of "Moderate Buy" and a consensus price target of $40.90.

Read Our Latest Stock Analysis on VCYT

Institutional Trading of Veracyte

A number of hedge funds have recently modified their holdings of VCYT. Captrust Financial Advisors bought a new stake in shares of Veracyte during the 4th quarter valued at $206,000. Deutsche Bank AG boosted its stake in Veracyte by 42.4% in the 4th quarter. Deutsche Bank AG now owns 81,266 shares of the biotechnology company's stock worth $3,218,000 after purchasing an additional 24,197 shares in the last quarter. Fred Alger Management LLC boosted its stake in Veracyte by 254.1% in the 4th quarter. Fred Alger Management LLC now owns 33,892 shares of the biotechnology company's stock worth $1,342,000 after purchasing an additional 24,321 shares in the last quarter. Graham Capital Management L.P. boosted its stake in Veracyte by 24.0% in the 4th quarter. Graham Capital Management L.P. now owns 21,787 shares of the biotechnology company's stock worth $863,000 after purchasing an additional 4,216 shares in the last quarter. Finally, Gotham Asset Management LLC boosted its stake in Veracyte by 21.5% in the 4th quarter. Gotham Asset Management LLC now owns 20,057 shares of the biotechnology company's stock worth $794,000 after purchasing an additional 3,549 shares in the last quarter.

Veracyte Company Profile

(

Get Free Report)

Veracyte, Inc engages in the research, development and commercialization of diagnostic products. The firm's portfolio includes Afirma, Percepta, and Envisia. It intends to treat thyroid cancer, improve lung cancer screening, and clarify the diagnosis of idiopathic pulmonary fibrosis. The company was founded by Bonnie H.

Read More

Before you consider Veracyte, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veracyte wasn't on the list.

While Veracyte currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.