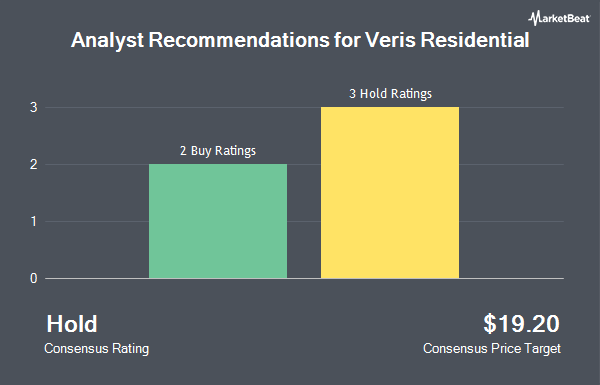

Veris Residential, Inc. (NYSE:VRE - Get Free Report) has been given an average recommendation of "Hold" by the five brokerages that are currently covering the company, Marketbeat Ratings reports. Three investment analysts have rated the stock with a hold rating and two have given a buy rating to the company. The average 12-month price target among brokers that have updated their coverage on the stock in the last year is $19.20.

Several research firms have recently issued reports on VRE. Wall Street Zen raised Veris Residential from a "sell" rating to a "hold" rating in a research note on Saturday, July 26th. Evercore ISI increased their price target on Veris Residential from $17.50 to $18.00 and gave the stock an "in-line" rating in a report on Friday, July 25th. Finally, BTIG Research reduced their price target on Veris Residential from $26.00 to $22.00 and set a "buy" rating on the stock in a report on Wednesday, July 23rd.

View Our Latest Research Report on VRE

Veris Residential Trading Down 3.3%

Shares of NYSE:VRE traded down $0.53 during trading on Thursday, hitting $15.38. The company had a trading volume of 472,661 shares, compared to its average volume of 671,426. The stock has a market cap of $1.44 billion, a price-to-earnings ratio of -66.85, a price-to-earnings-growth ratio of 2.72 and a beta of 1.34. Veris Residential has a one year low of $13.69 and a one year high of $18.85. The company has a fifty day simple moving average of $14.80 and a two-hundred day simple moving average of $15.31. The company has a debt-to-equity ratio of 1.47, a current ratio of 0.61 and a quick ratio of 0.61.

Veris Residential (NYSE:VRE - Get Free Report) last posted its quarterly earnings data on Wednesday, July 23rd. The company reported $0.17 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.14 by $0.03. The business had revenue of $75.93 million during the quarter, compared to analyst estimates of $69.06 million. Veris Residential had a negative return on equity of 1.89% and a negative net margin of 7.84%. Veris Residential has set its FY 2025 guidance at 0.630-0.640 EPS. As a group, equities analysts forecast that Veris Residential will post 0.61 earnings per share for the current year.

Veris Residential Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Friday, October 10th. Stockholders of record on Tuesday, September 30th will be issued a $0.08 dividend. This represents a $0.32 annualized dividend and a dividend yield of 2.1%. The ex-dividend date is Tuesday, September 30th. Veris Residential's dividend payout ratio is presently -139.13%.

Institutional Investors Weigh In On Veris Residential

Hedge funds and other institutional investors have recently modified their holdings of the business. Exchange Traded Concepts LLC purchased a new stake in shares of Veris Residential in the first quarter worth approximately $810,000. Cbre Investment Management Listed Real Assets LLC raised its position in Veris Residential by 17.1% during the 1st quarter. Cbre Investment Management Listed Real Assets LLC now owns 1,142,407 shares of the company's stock valued at $19,330,000 after purchasing an additional 167,145 shares in the last quarter. New York State Common Retirement Fund raised its position in Veris Residential by 13.8% during the 1st quarter. New York State Common Retirement Fund now owns 24,786 shares of the company's stock valued at $419,000 after purchasing an additional 3,000 shares in the last quarter. GAMMA Investing LLC raised its position in Veris Residential by 1,629.2% during the 1st quarter. GAMMA Investing LLC now owns 22,808 shares of the company's stock valued at $386,000 after purchasing an additional 21,489 shares in the last quarter. Finally, Man Group plc bought a new stake in Veris Residential during the 4th quarter valued at $851,000. 93.04% of the stock is currently owned by hedge funds and other institutional investors.

Veris Residential Company Profile

(

Get Free Report)

Veris Residential, Inc is a forward-thinking, environmentally and socially conscious real estate investment trust (REIT) that primarily owns, operates, acquires and develops holistically-inspired, Class A multifamily properties that meet the sustainability-conscious lifestyle needs of today's residents while seeking to positively impact the communities it serves and the planet at large.

See Also

Before you consider Veris Residential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veris Residential wasn't on the list.

While Veris Residential currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.