Veris Residential (NYSE:VRE - Get Free Report) was upgraded by analysts at Wall Street Zen from a "sell" rating to a "hold" rating in a research note issued on Saturday.

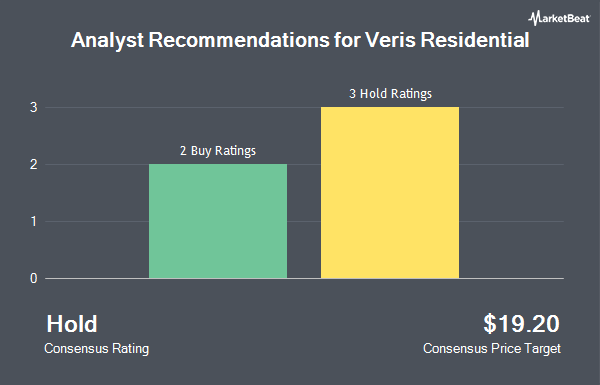

Other research analysts have also issued reports about the company. Evercore ISI raised their target price on Veris Residential from $17.50 to $18.00 and gave the stock an "in-line" rating in a research report on Friday. BTIG Research lowered their target price on Veris Residential from $26.00 to $22.00 and set a "buy" rating for the company in a research report on Wednesday, July 23rd. Finally, Truist Financial lowered their target price on Veris Residential from $17.00 to $16.00 and set a "hold" rating for the company in a research report on Monday, May 5th. Four analysts have rated the stock with a hold rating and two have assigned a buy rating to the company. According to data from MarketBeat, Veris Residential presently has an average rating of "Hold" and a consensus target price of $19.20.

Check Out Our Latest Stock Analysis on Veris Residential

Veris Residential Price Performance

Shares of VRE traded up $0.31 during trading hours on Friday, reaching $14.66. The stock had a trading volume of 467,121 shares, compared to its average volume of 477,177. Veris Residential has a 12 month low of $14.12 and a 12 month high of $18.85. The stock has a market capitalization of $1.37 billion, a PE ratio of -63.72, a PEG ratio of 2.23 and a beta of 1.21. The company has a debt-to-equity ratio of 1.47, a quick ratio of 0.61 and a current ratio of 0.61. The company's 50-day moving average is $14.83 and its two-hundred day moving average is $15.56.

Veris Residential (NYSE:VRE - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The company reported $0.17 EPS for the quarter, beating analysts' consensus estimates of $0.14 by $0.03. Veris Residential had a negative return on equity of 1.89% and a negative net margin of 7.84%. The company had revenue of $75.93 million during the quarter, compared to analysts' expectations of $69.06 million. Research analysts expect that Veris Residential will post 0.61 EPS for the current year.

Institutional Investors Weigh In On Veris Residential

Hedge funds have recently modified their holdings of the stock. GF Fund Management CO. LTD. bought a new stake in Veris Residential during the 4th quarter valued at $25,000. Covestor Ltd raised its holdings in Veris Residential by 11,246.7% during the 4th quarter. Covestor Ltd now owns 1,702 shares of the company's stock valued at $28,000 after acquiring an additional 1,687 shares during the period. Sterling Capital Management LLC raised its holdings in Veris Residential by 824.6% during the 4th quarter. Sterling Capital Management LLC now owns 2,515 shares of the company's stock valued at $42,000 after acquiring an additional 2,243 shares during the period. Point72 Hong Kong Ltd bought a new stake in Veris Residential during the 4th quarter valued at $45,000. Finally, State of Wyoming bought a new stake in Veris Residential during the 4th quarter valued at $52,000. Institutional investors own 93.04% of the company's stock.

Veris Residential Company Profile

(

Get Free Report)

Veris Residential, Inc is a forward-thinking, environmentally and socially conscious real estate investment trust (REIT) that primarily owns, operates, acquires and develops holistically-inspired, Class A multifamily properties that meet the sustainability-conscious lifestyle needs of today's residents while seeking to positively impact the communities it serves and the planet at large.

Further Reading

Before you consider Veris Residential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veris Residential wasn't on the list.

While Veris Residential currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.