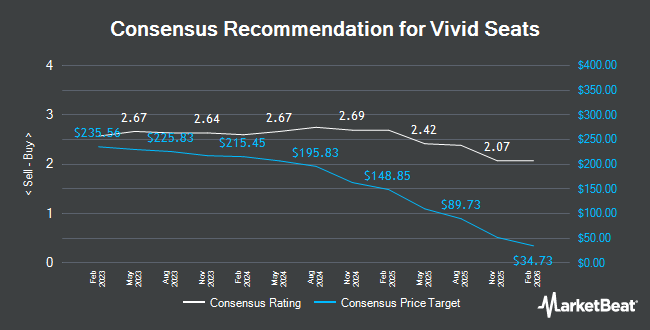

Vivid Seats (NASDAQ:SEAT - Get Free Report)'s stock had its "sell (d-)" rating reiterated by stock analysts at Weiss Ratings in a report issued on Friday,Weiss Ratings reports.

A number of other equities research analysts also recently weighed in on the company. Canaccord Genuity Group reaffirmed a "hold" rating and set a $23.00 price objective (down from $80.00) on shares of Vivid Seats in a report on Wednesday, August 6th. Citigroup downgraded Vivid Seats from a "buy" rating to a "neutral" rating and cut their target price for the stock from $32.00 to $13.00 in a research report on Thursday. Benchmark upped their price target on Vivid Seats to $26.00 and gave the company a "buy" rating in a research report on Wednesday, August 6th. Finally, Craig Hallum set a $2.00 price objective on Vivid Seats in a research note on Tuesday, August 5th. Two analysts have rated the stock with a Buy rating, nine have given a Hold rating and two have given a Sell rating to the company. Based on data from MarketBeat, Vivid Seats has a consensus rating of "Hold" and an average target price of $45.10.

Get Our Latest Stock Report on SEAT

Vivid Seats Stock Up 4.5%

NASDAQ SEAT traded up $0.58 on Friday, reaching $13.33. The company's stock had a trading volume of 79,268 shares, compared to its average volume of 152,388. The business has a 50-day moving average price of $15.25 and a 200 day moving average price of $30.03. Vivid Seats has a 52 week low of $10.55 and a 52 week high of $100.00. The company has a debt-to-equity ratio of 1.77, a quick ratio of 0.63 and a current ratio of 0.72.

Institutional Investors Weigh In On Vivid Seats

Hedge funds and other institutional investors have recently bought and sold shares of the business. Rangeley Capital LLC acquired a new position in Vivid Seats in the second quarter worth $42,000. Ameriprise Financial Inc. grew its holdings in shares of Vivid Seats by 10.7% during the second quarter. Ameriprise Financial Inc. now owns 2,222,751 shares of the company's stock worth $3,756,000 after purchasing an additional 215,057 shares during the last quarter. Raymond James Financial Inc. acquired a new stake in shares of Vivid Seats in the second quarter valued at $35,000. Caption Management LLC raised its holdings in shares of Vivid Seats by 1,470.9% in the second quarter. Caption Management LLC now owns 250,472 shares of the company's stock valued at $423,000 after buying an additional 234,528 shares during the last quarter. Finally, Jump Financial LLC acquired a new position in Vivid Seats during the 2nd quarter worth about $32,000. 39.92% of the stock is owned by institutional investors and hedge funds.

Vivid Seats Company Profile

(

Get Free Report)

Vivid Seats Inc operates an online ticket marketplace in the United States, Canada, and Japan. The company operates in two segments, Marketplace and Resale. The Marketplace segment acts as an intermediary between event ticket buyers and sellers; processes ticket sales on its website and mobile applications through its distribution partners; and sells tickets for sports, concerts, theater events, and other live events.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vivid Seats, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vivid Seats wasn't on the list.

While Vivid Seats currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.