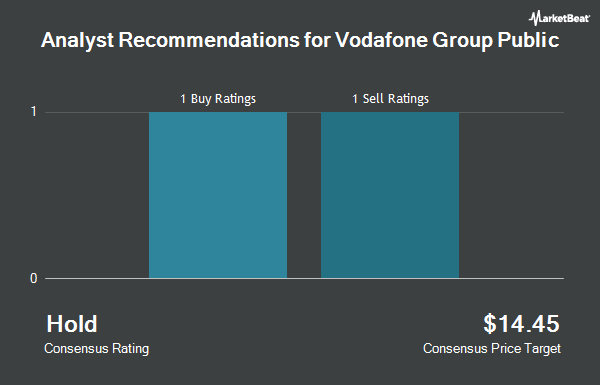

Shares of Vodafone Group PLC (NASDAQ:VOD - Get Free Report) have been assigned an average rating of "Hold" from the seven brokerages that are currently covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a sell recommendation, five have issued a hold recommendation and one has assigned a buy recommendation to the company.

Several brokerages recently issued reports on VOD. Berenberg Bank raised Vodafone Group to a "hold" rating in a research note on Thursday, June 26th. Bank of America cut Vodafone Group from a "buy" rating to a "neutral" rating in a research note on Monday, March 24th. Morgan Stanley began coverage on Vodafone Group in a research note on Wednesday, July 2nd. They issued an "equal weight" rating on the stock. JPMorgan Chase & Co. reissued an "underweight" rating on shares of Vodafone Group in a research note on Wednesday, April 23rd. Finally, Wall Street Zen cut Vodafone Group from a "buy" rating to a "hold" rating in a research note on Tuesday, May 27th.

Read Our Latest Research Report on Vodafone Group

Vodafone Group Trading Down 0.6%

NASDAQ:VOD traded down $0.07 during midday trading on Thursday, hitting $10.84. The stock had a trading volume of 6,050,844 shares, compared to its average volume of 9,296,696. Vodafone Group has a one year low of $8.00 and a one year high of $11.03. The company has a market capitalization of $26.87 billion, a price-to-earnings ratio of 9.51, a PEG ratio of 0.95 and a beta of 0.59. The stock has a 50-day moving average of $10.16 and a 200 day moving average of $9.30. The company has a quick ratio of 1.23, a current ratio of 1.26 and a debt-to-equity ratio of 0.85.

Vodafone Group Cuts Dividend

The business also recently announced a semi-annual dividend, which will be paid on Friday, August 1st. Shareholders of record on Friday, June 6th will be given a dividend of $0.2355 per share. The ex-dividend date is Friday, June 6th. This represents a yield of 6.6%. Vodafone Group's dividend payout ratio (DPR) is presently 41.23%.

Institutional Trading of Vodafone Group

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. ACR Alpine Capital Research LLC boosted its position in shares of Vodafone Group by 16.8% in the 1st quarter. ACR Alpine Capital Research LLC now owns 25,696,928 shares of the cell phone carrier's stock worth $240,780,000 after purchasing an additional 3,690,617 shares in the last quarter. Grantham Mayo Van Otterloo & Co. LLC boosted its position in shares of Vodafone Group by 18.1% in the 4th quarter. Grantham Mayo Van Otterloo & Co. LLC now owns 14,598,375 shares of the cell phone carrier's stock worth $123,940,000 after purchasing an additional 2,238,935 shares in the last quarter. Renaissance Technologies LLC boosted its position in shares of Vodafone Group by 2.9% in the 4th quarter. Renaissance Technologies LLC now owns 9,027,376 shares of the cell phone carrier's stock worth $76,642,000 after purchasing an additional 255,623 shares in the last quarter. Oppenheimer Asset Management Inc. boosted its position in shares of Vodafone Group by 18.7% in the 1st quarter. Oppenheimer Asset Management Inc. now owns 5,998,450 shares of the cell phone carrier's stock worth $56,205,000 after purchasing an additional 944,189 shares in the last quarter. Finally, Envestnet Asset Management Inc. boosted its position in shares of Vodafone Group by 1.3% in the 1st quarter. Envestnet Asset Management Inc. now owns 5,499,770 shares of the cell phone carrier's stock worth $51,533,000 after purchasing an additional 69,986 shares in the last quarter. Institutional investors own 7.84% of the company's stock.

About Vodafone Group

(

Get Free ReportVodafone Group Public Limited Company provides telecommunication services in Europe and internationally. It offers mobile connectivity services comprising end-to-end services for mobile voice and data, messaging, device management, BYOx, and telecoms management, as well as professional and consulting services; and fixed line connectivity, such as fixed voice and data, broadband, software-defined networks, managed WAN, LAN, ethernet, and satellite; and financial services, as well as business and merchant services.

Read More

Before you consider Vodafone Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vodafone Group wasn't on the list.

While Vodafone Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.