Aptiv (NYSE:APTV - Get Free Report) was downgraded by Wall Street Zen from a "buy" rating to a "hold" rating in a report released on Sunday.

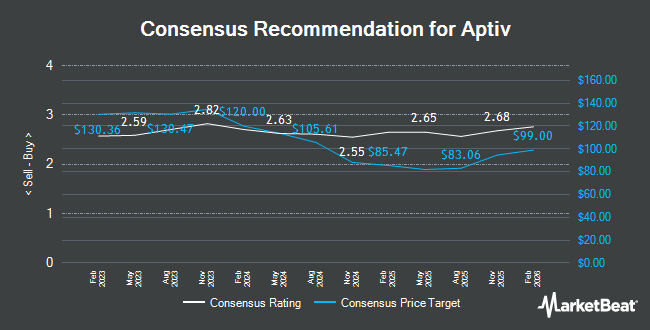

APTV has been the topic of several other reports. Wolfe Research lowered shares of Aptiv from an "outperform" rating to a "peer perform" rating in a research note on Wednesday, July 2nd. Wells Fargo & Company raised their price target on shares of Aptiv from $86.00 to $89.00 and gave the company an "overweight" rating in a research note on Friday, August 1st. Royal Bank Of Canada raised their price target on shares of Aptiv from $85.00 to $92.00 and gave the company an "outperform" rating in a research note on Tuesday, August 5th. Guggenheim lowered shares of Aptiv from a "buy" rating to a "neutral" rating in a research note on Wednesday, June 4th. Finally, UBS Group raised their price target on shares of Aptiv from $66.00 to $75.00 and gave the company a "neutral" rating in a research note on Monday, July 14th. Three analysts have rated the stock with a Strong Buy rating, ten have issued a Buy rating, seven have issued a Hold rating and one has assigned a Sell rating to the stock. According to data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $82.33.

Get Our Latest Stock Report on Aptiv

Aptiv Trading Up 0.0%

APTV stock opened at $80.47 on Friday. The company's 50-day simple moving average is $72.33 and its 200-day simple moving average is $65.78. The company has a quick ratio of 1.24, a current ratio of 1.76 and a debt-to-equity ratio of 0.79. Aptiv has a 52-week low of $47.19 and a 52-week high of $82.05. The firm has a market cap of $17.52 billion, a P/E ratio of 18.41, a PEG ratio of 0.90 and a beta of 1.48.

Aptiv (NYSE:APTV - Get Free Report) last posted its earnings results on Thursday, July 31st. The auto parts company reported $2.12 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.83 by $0.29. Aptiv had a net margin of 5.12% and a return on equity of 18.46%. The business had revenue of $5.21 billion for the quarter, compared to analyst estimates of $5.02 billion. During the same period in the prior year, the company posted $1.58 EPS. The company's revenue for the quarter was up 3.1% on a year-over-year basis. Aptiv has set its FY 2025 guidance at 7.300-7.600 EPS. Q3 2025 guidance at 1.600-1.800 EPS. As a group, equities analysts forecast that Aptiv will post 7.2 EPS for the current fiscal year.

Institutional Inflows and Outflows

A number of institutional investors have recently bought and sold shares of APTV. Goldman Sachs Group Inc. lifted its stake in Aptiv by 242.7% in the 1st quarter. Goldman Sachs Group Inc. now owns 8,560,781 shares of the auto parts company's stock worth $509,366,000 after purchasing an additional 6,062,438 shares in the last quarter. Boston Partners purchased a new position in Aptiv in the 2nd quarter worth approximately $220,911,000. Norges Bank purchased a new position in Aptiv in the 2nd quarter worth approximately $187,652,000. AustralianSuper Pty Ltd purchased a new position in Aptiv in the 1st quarter worth approximately $117,260,000. Finally, Pacer Advisors Inc. increased its holdings in shares of Aptiv by 5,379.7% during the 1st quarter. Pacer Advisors Inc. now owns 1,907,379 shares of the auto parts company's stock worth $113,489,000 after buying an additional 1,872,571 shares during the last quarter. 94.21% of the stock is owned by hedge funds and other institutional investors.

About Aptiv

(

Get Free Report)

Aptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.