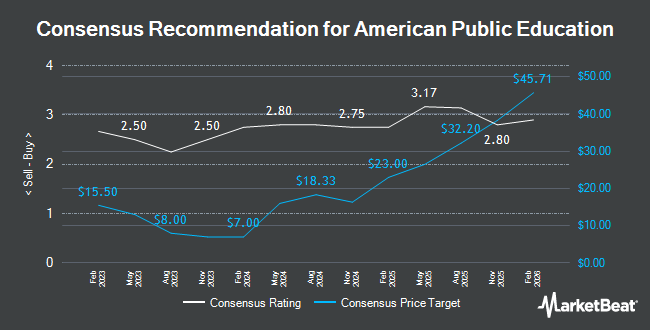

American Public Education (NASDAQ:APEI - Get Free Report)'s stock had its "hold (c)" rating reiterated by research analysts at Weiss Ratings in a research report issued to clients and investors on Wednesday,Weiss Ratings reports.

Several other brokerages have also issued reports on APEI. Griffin Securities set a $37.00 price target on American Public Education in a research note on Thursday, August 7th. B. Riley lifted their price target on American Public Education from $36.00 to $37.00 and gave the stock a "buy" rating in a research note on Thursday, August 7th. DA Davidson assumed coverage on American Public Education in a research note on Tuesday, September 9th. They set a "buy" rating and a $40.00 price target for the company. Barrington Research lifted their price target on American Public Education from $36.00 to $40.00 and gave the stock an "outperform" rating in a research note on Tuesday, September 23rd. Finally, Northland Capmk raised American Public Education to a "strong-buy" rating in a research note on Wednesday, June 18th. One equities research analyst has rated the stock with a Strong Buy rating, six have assigned a Buy rating and three have assigned a Hold rating to the stock. According to MarketBeat, American Public Education has a consensus rating of "Moderate Buy" and a consensus price target of $37.86.

Get Our Latest Stock Analysis on American Public Education

American Public Education Price Performance

NASDAQ:APEI traded up $0.19 during trading hours on Wednesday, hitting $37.20. 209,559 shares of the company's stock traded hands, compared to its average volume of 204,429. The firm has a market cap of $672.20 million, a P/E ratio of 35.09, a P/E/G ratio of 2.16 and a beta of 1.64. American Public Education has a 52 week low of $13.46 and a 52 week high of $39.83. The business's fifty day simple moving average is $32.97 and its two-hundred day simple moving average is $29.09. The company has a quick ratio of 2.83, a current ratio of 2.83 and a debt-to-equity ratio of 0.35.

American Public Education (NASDAQ:APEI - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported ($0.02) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.07) by $0.05. The company had revenue of $162.77 million during the quarter, compared to analyst estimates of $160.88 million. American Public Education had a return on equity of 10.82% and a net margin of 4.44%. On average, research analysts anticipate that American Public Education will post 0.47 earnings per share for the current fiscal year.

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently made changes to their positions in the company. Osaic Holdings Inc. lifted its position in American Public Education by 5,909.5% in the 2nd quarter. Osaic Holdings Inc. now owns 1,262 shares of the company's stock valued at $38,000 after acquiring an additional 1,241 shares in the last quarter. BNP Paribas Financial Markets lifted its position in American Public Education by 84.1% in the 2nd quarter. BNP Paribas Financial Markets now owns 1,616 shares of the company's stock valued at $49,000 after acquiring an additional 738 shares in the last quarter. USA Financial Formulas purchased a new stake in American Public Education during the 2nd quarter valued at $58,000. Legal & General Group Plc raised its stake in American Public Education by 40.5% during the 2nd quarter. Legal & General Group Plc now owns 1,914 shares of the company's stock valued at $58,000 after buying an additional 552 shares during the last quarter. Finally, GAMMA Investing LLC raised its stake in American Public Education by 19,594.1% during the 1st quarter. GAMMA Investing LLC now owns 3,348 shares of the company's stock valued at $75,000 after buying an additional 3,331 shares during the last quarter. Hedge funds and other institutional investors own 79.62% of the company's stock.

About American Public Education

(

Get Free Report)

American Public Education, Inc, together with its subsidiaries, provides online and campus-based postsecondary education and career learning in the United States. It operates through three segments: American Public University System, Rasmussen University, and Hondros College of Nursing. The company offers 184 degree programs and 134 certificate programs in various fields of study, including nursing, national security, military studies, intelligence, homeland security, business, health science, information technology, justice studies, education, and liberal arts; and career learning opportunities in leadership, finance, human resources, and other fields of study critical to the federal government workforce.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider American Public Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and American Public Education wasn't on the list.

While American Public Education currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.