Super Group (SGHC) (NYSE:SGHC - Get Free Report)'s stock had its "hold (c-)" rating reissued by Weiss Ratings in a note issued to investors on Wednesday,Weiss Ratings reports.

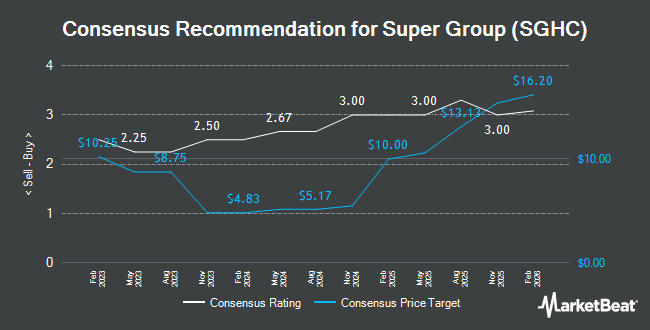

Other research analysts have also recently issued research reports about the company. Citigroup restated an "outperform" rating on shares of Super Group (SGHC) in a research report on Monday, September 22nd. JMP Securities raised their price target on Super Group (SGHC) from $15.00 to $16.00 and gave the stock a "market outperform" rating in a research report on Monday, September 22nd. Macquarie assumed coverage on Super Group (SGHC) in a research report on Monday, September 15th. They issued an "outperform" rating and a $17.00 price target on the stock. Citizens Jmp assumed coverage on Super Group (SGHC) in a research report on Monday, July 14th. They issued a "strong-buy" rating and a $15.00 price target on the stock. Finally, Benchmark raised their price target on Super Group (SGHC) from $16.00 to $18.00 and gave the stock a "buy" rating in a research report on Thursday, September 18th. Two analysts have rated the stock with a Strong Buy rating, eight have given a Buy rating and one has given a Hold rating to the company's stock. Based on data from MarketBeat, Super Group (SGHC) presently has a consensus rating of "Buy" and an average target price of $15.40.

Get Our Latest Research Report on Super Group (SGHC)

Super Group (SGHC) Price Performance

SGHC stock remained flat at $13.35 during trading hours on Wednesday. The company's stock had a trading volume of 2,267,568 shares, compared to its average volume of 3,773,636. The firm has a market cap of $6.72 billion, a price-to-earnings ratio of 51.35 and a beta of 1.11. The firm has a 50 day moving average price of $12.17 and a 200-day moving average price of $10.09. Super Group has a 1 year low of $3.85 and a 1 year high of $14.38.

Super Group (SGHC) (NYSE:SGHC - Get Free Report) last posted its quarterly earnings data on Thursday, September 4th. The company reported $0.11 earnings per share for the quarter, missing the consensus estimate of $0.13 by ($0.02). The firm had revenue of $579.00 million for the quarter, compared to the consensus estimate of $503.00 million. Super Group (SGHC) had a return on equity of 36.68% and a net margin of 6.42%. Equities research analysts anticipate that Super Group will post 0.29 EPS for the current year.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently bought and sold shares of the business. Nisa Investment Advisors LLC grew its position in Super Group (SGHC) by 132.1% in the second quarter. Nisa Investment Advisors LLC now owns 2,453 shares of the company's stock valued at $27,000 after acquiring an additional 1,396 shares during the last quarter. Pacer Advisors Inc. grew its position in Super Group (SGHC) by 56.6% in the first quarter. Pacer Advisors Inc. now owns 4,600 shares of the company's stock valued at $30,000 after acquiring an additional 1,662 shares during the last quarter. Tower Research Capital LLC TRC grew its position in Super Group (SGHC) by 19.5% in the second quarter. Tower Research Capital LLC TRC now owns 14,928 shares of the company's stock valued at $164,000 after acquiring an additional 2,432 shares during the last quarter. Signaturefd LLC grew its position in Super Group (SGHC) by 95.9% in the first quarter. Signaturefd LLC now owns 5,439 shares of the company's stock valued at $35,000 after acquiring an additional 2,662 shares during the last quarter. Finally, Police & Firemen s Retirement System of New Jersey grew its position in Super Group (SGHC) by 8.2% in the second quarter. Police & Firemen s Retirement System of New Jersey now owns 36,666 shares of the company's stock valued at $402,000 after acquiring an additional 2,776 shares during the last quarter. Institutional investors own 5.09% of the company's stock.

Super Group (SGHC) Company Profile

(

Get Free Report)

Super Group (SGHC) Limited operates as an online sports betting and gaming operator. It offers Betway, an online sports betting brand; and Spin, a multi-brand online casino offering. Super Group (SGHC) Limited is based in Saint Peter Port, Guernsey.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Super Group (SGHC), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Group (SGHC) wasn't on the list.

While Super Group (SGHC) currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.