Sixth Street Specialty Lending (NYSE:TSLX - Get Free Report) had its target price decreased by research analysts at Wells Fargo & Company from $23.00 to $22.00 in a report issued on Monday,Benzinga reports. The firm presently has an "overweight" rating on the financial services provider's stock. Wells Fargo & Company's target price would indicate a potential upside of 5.31% from the stock's previous close.

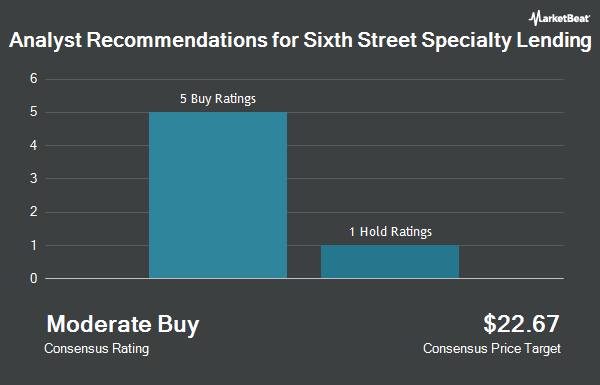

Several other analysts have also commented on the stock. Truist Financial increased their price target on shares of Sixth Street Specialty Lending from $23.00 to $24.00 and gave the company a "buy" rating in a research report on Tuesday, February 18th. Royal Bank of Canada raised their price target on Sixth Street Specialty Lending from $23.00 to $25.00 and gave the stock an "outperform" rating in a research report on Wednesday, February 26th. LADENBURG THALM/SH SH downgraded Sixth Street Specialty Lending from a "buy" rating to a "neutral" rating in a research report on Friday, February 14th. Keefe, Bruyette & Woods increased their price objective on Sixth Street Specialty Lending from $21.50 to $23.00 and gave the company an "outperform" rating in a research note on Tuesday, February 18th. Finally, JPMorgan Chase & Co. cut their target price on shares of Sixth Street Specialty Lending from $23.00 to $21.50 and set an "overweight" rating for the company in a research note on Thursday, April 24th. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. According to MarketBeat, Sixth Street Specialty Lending has a consensus rating of "Moderate Buy" and an average price target of $22.79.

Read Our Latest Stock Report on Sixth Street Specialty Lending

Sixth Street Specialty Lending Price Performance

Shares of NYSE:TSLX traded up $0.33 on Monday, reaching $20.89. 468,157 shares of the company were exchanged, compared to its average volume of 360,627. The company has a current ratio of 1.90, a quick ratio of 1.90 and a debt-to-equity ratio of 1.18. Sixth Street Specialty Lending has a 1-year low of $18.58 and a 1-year high of $23.67. The company has a 50-day moving average of $21.47 and a 200-day moving average of $21.38. The firm has a market cap of $1.96 billion, a price-to-earnings ratio of 10.29 and a beta of 0.82.

Sixth Street Specialty Lending (NYSE:TSLX - Get Free Report) last posted its earnings results on Wednesday, April 30th. The financial services provider reported $0.58 EPS for the quarter, topping analysts' consensus estimates of $0.56 by $0.02. The company had revenue of $113.92 billion for the quarter, compared to the consensus estimate of $116.70 million. Sixth Street Specialty Lending had a return on equity of 13.47% and a net margin of 38.67%. During the same period in the previous year, the business earned $0.52 earnings per share. Equities analysts forecast that Sixth Street Specialty Lending will post 2.19 earnings per share for the current fiscal year.

Institutional Trading of Sixth Street Specialty Lending

Large investors have recently modified their holdings of the company. Jane Street Group LLC boosted its holdings in shares of Sixth Street Specialty Lending by 29.1% in the third quarter. Jane Street Group LLC now owns 49,373 shares of the financial services provider's stock valued at $1,014,000 after acquiring an additional 11,117 shares in the last quarter. Tidal Investments LLC increased its position in shares of Sixth Street Specialty Lending by 7.4% during the 3rd quarter. Tidal Investments LLC now owns 50,883 shares of the financial services provider's stock valued at $1,045,000 after purchasing an additional 3,504 shares during the period. Franklin Resources Inc. boosted its stake in Sixth Street Specialty Lending by 28.3% during the third quarter. Franklin Resources Inc. now owns 327,083 shares of the financial services provider's stock valued at $6,751,000 after buying an additional 72,133 shares in the last quarter. JPMorgan Chase & Co. grew its holdings in Sixth Street Specialty Lending by 16.1% during the third quarter. JPMorgan Chase & Co. now owns 1,175,388 shares of the financial services provider's stock worth $24,131,000 after acquiring an additional 162,810 shares during the period. Finally, Confluence Investment Management LLC raised its position in Sixth Street Specialty Lending by 0.5% in the fourth quarter. Confluence Investment Management LLC now owns 251,182 shares of the financial services provider's stock worth $5,350,000 after acquiring an additional 1,273 shares in the last quarter. Institutional investors and hedge funds own 70.25% of the company's stock.

Sixth Street Specialty Lending Company Profile

(

Get Free Report)

Sixth Street Specialty Lending, Inc NYSE: TSLX is a business development company. The fund provides senior secured loans (first-lien, second-lien, and unitranche), unsecured loans, mezzanine debt, and investments in corporate bonds and equity securities and structured products, non-control structured equity, and common equity with a focus on co-investments for organic growth, acquisitions, market or product expansion, restructuring initiatives, recapitalizations, and refinancing.

Further Reading

Before you consider Sixth Street Specialty Lending, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sixth Street Specialty Lending wasn't on the list.

While Sixth Street Specialty Lending currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.