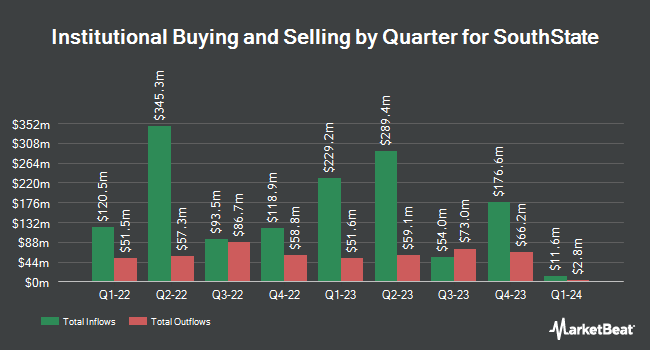

Westchester Capital Management LLC bought a new position in SouthState Co. (NASDAQ:SSB - Free Report) in the fourth quarter, according to its most recent disclosure with the SEC. The firm bought 58,200 shares of the bank's stock, valued at approximately $5,790,000. Westchester Capital Management LLC owned about 0.08% of SouthState as of its most recent SEC filing.

A number of other hedge funds and other institutional investors have also modified their holdings of SSB. Summit Securities Group LLC acquired a new position in shares of SouthState in the fourth quarter valued at approximately $38,000. Quadrant Capital Group LLC increased its stake in SouthState by 24.2% during the 4th quarter. Quadrant Capital Group LLC now owns 508 shares of the bank's stock worth $51,000 after buying an additional 99 shares during the period. Headlands Technologies LLC purchased a new stake in SouthState during the 4th quarter worth approximately $102,000. Blue Trust Inc. increased its stake in SouthState by 16.8% during the 4th quarter. Blue Trust Inc. now owns 1,161 shares of the bank's stock worth $113,000 after buying an additional 167 shares during the period. Finally, Stonebridge Financial Group LLC purchased a new stake in SouthState during the 4th quarter worth approximately $137,000. 89.76% of the stock is owned by institutional investors and hedge funds.

Insider Activity

In other SouthState news, CAO Sara Arana sold 1,991 shares of the business's stock in a transaction on Monday, March 3rd. The stock was sold at an average price of $100.78, for a total value of $200,652.98. Following the completion of the transaction, the chief accounting officer now directly owns 4,787 shares in the company, valued at approximately $482,433.86. The trade was a 29.37 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Also, Director Janet P. Froetscher acquired 2,717 shares of the company's stock in a transaction dated Monday, March 10th. The shares were purchased at an average price of $92.02 per share, with a total value of $250,018.34. Following the completion of the acquisition, the director now owns 4,689 shares in the company, valued at approximately $431,481.78. The trade was a 137.78 % increase in their ownership of the stock. The disclosure for this purchase can be found here. Insiders own 1.70% of the company's stock.

Analyst Upgrades and Downgrades

Several brokerages recently weighed in on SSB. Barclays cut their target price on shares of SouthState from $120.00 to $115.00 and set an "overweight" rating on the stock in a research note on Tuesday, April 8th. DA Davidson lowered their target price on shares of SouthState from $125.00 to $115.00 and set a "buy" rating for the company in a report on Monday. Stephens restated an "overweight" rating and issued a $119.00 target price on shares of SouthState in a report on Monday. Raymond James set a $110.00 price target on shares of SouthState in a research note on Monday. Finally, Citigroup upgraded shares of SouthState from a "neutral" rating to a "buy" rating and increased their price target for the stock from $106.00 to $128.00 in a research note on Monday, January 27th. Two research analysts have rated the stock with a hold rating, seven have issued a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average price target of $116.60.

Check Out Our Latest Analysis on SouthState

SouthState Price Performance

Shares of SSB traded down $1.49 during trading hours on Wednesday, reaching $86.17. The company had a trading volume of 147,562 shares, compared to its average volume of 628,191. The firm has a 50 day simple moving average of $90.35 and a 200-day simple moving average of $98.74. The company has a current ratio of 0.91, a quick ratio of 0.91 and a debt-to-equity ratio of 0.07. The company has a market capitalization of $8.73 billion, a price-to-earnings ratio of 12.38 and a beta of 0.65. SouthState Co. has a 12-month low of $70.68 and a 12-month high of $114.27.

SouthState Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, May 16th. Stockholders of record on Friday, May 9th will be issued a $0.54 dividend. The ex-dividend date of this dividend is Friday, May 9th. This represents a $2.16 dividend on an annualized basis and a dividend yield of 2.51%. SouthState's dividend payout ratio is presently 34.12%.

SouthState Company Profile

(

Free Report)

SouthState Corporation operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies. It offers checking accounts, savings deposits, interest-bearing transaction accounts, certificates of deposits, money market accounts, and other time deposits, as well as bond accounting, asset/liability consulting related activities, and other clearing and corporate checking account services.

See Also

Before you consider SouthState, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SouthState wasn't on the list.

While SouthState currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.