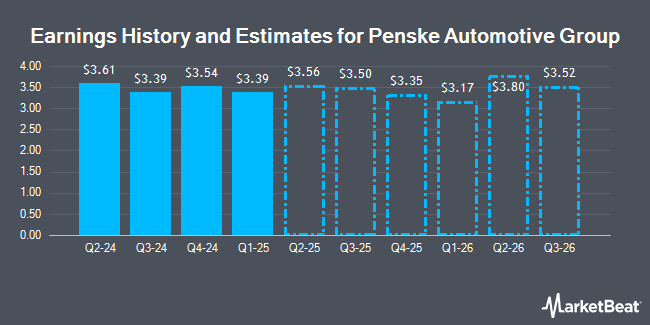

Penske Automotive Group, Inc. (NYSE:PAG - Free Report) - Equities research analysts at Seaport Res Ptn increased their Q4 2025 earnings estimates for Penske Automotive Group in a note issued to investors on Wednesday, July 30th. Seaport Res Ptn analyst G. Chin now anticipates that the company will post earnings per share of $3.42 for the quarter, up from their previous forecast of $3.41. The consensus estimate for Penske Automotive Group's current full-year earnings is $13.86 per share. Seaport Res Ptn also issued estimates for Penske Automotive Group's FY2026 earnings at $13.78 EPS.

Penske Automotive Group (NYSE:PAG - Get Free Report) last posted its earnings results on Wednesday, July 30th. The company reported $3.78 EPS for the quarter, beating analysts' consensus estimates of $3.56 by $0.22. The business had revenue of $7.66 billion for the quarter, compared to the consensus estimate of $7.98 billion. Penske Automotive Group had a net margin of 3.13% and a return on equity of 17.43%. The company's revenue for the quarter was down .4% on a year-over-year basis. During the same quarter last year, the firm posted $3.61 EPS.

A number of other brokerages also recently issued reports on PAG. JPMorgan Chase & Co. raised shares of Penske Automotive Group from an "underweight" rating to a "neutral" rating and lifted their price objective for the stock from $155.00 to $175.00 in a research report on Tuesday. Citigroup lifted their price objective on shares of Penske Automotive Group from $185.00 to $195.00 and gave the stock a "buy" rating in a research report on Monday, May 19th. Stephens reaffirmed an "equal weight" rating and issued a $140.00 price objective on shares of Penske Automotive Group in a research report on Wednesday, June 11th. Bank of America lifted their price objective on shares of Penske Automotive Group from $190.00 to $205.00 and gave the stock a "buy" rating in a research report on Monday, June 16th. Finally, Wall Street Zen raised shares of Penske Automotive Group from a "hold" rating to a "buy" rating in a research report on Wednesday, April 23rd. Two investment analysts have rated the stock with a hold rating and five have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $179.00.

View Our Latest Stock Analysis on PAG

Penske Automotive Group Stock Up 5.4%

NYSE PAG traded up $9.11 during trading on Friday, reaching $177.51. 211,469 shares of the company's stock traded hands, compared to its average volume of 243,595. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.90 and a quick ratio of 0.21. The firm has a market cap of $11.75 billion, a price-to-earnings ratio of 12.35 and a beta of 0.87. The company's 50 day simple moving average is $171.47 and its two-hundred day simple moving average is $163.22. Penske Automotive Group has a 12-month low of $134.05 and a 12-month high of $186.33.

Institutional Trading of Penske Automotive Group

Several hedge funds have recently made changes to their positions in PAG. Sound Income Strategies LLC purchased a new stake in shares of Penske Automotive Group during the second quarter worth approximately $34,000. Acadian Asset Management LLC purchased a new stake in shares of Penske Automotive Group during the first quarter worth approximately $42,000. UMB Bank n.a. increased its stake in shares of Penske Automotive Group by 421.5% during the first quarter. UMB Bank n.a. now owns 339 shares of the company's stock worth $49,000 after buying an additional 274 shares during the period. GAMMA Investing LLC increased its stake in shares of Penske Automotive Group by 51.9% during the first quarter. GAMMA Investing LLC now owns 398 shares of the company's stock worth $57,000 after buying an additional 136 shares during the period. Finally, Brooklyn Investment Group increased its stake in Penske Automotive Group by 353.0% in the first quarter. Brooklyn Investment Group now owns 453 shares of the company's stock valued at $65,000 after purchasing an additional 353 shares during the last quarter. Institutional investors and hedge funds own 77.08% of the company's stock.

Insider Buying and Selling at Penske Automotive Group

In other news, CEO Roger S. Penske sold 77,357 shares of the stock in a transaction dated Tuesday, June 3rd. The shares were sold at an average price of $161.37, for a total transaction of $12,483,099.09. Following the sale, the chief executive officer owned 140,042 shares of the company's stock, valued at approximately $22,598,577.54. This represents a 35.58% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director Greg C. Smith sold 1,529 shares of the stock in a transaction dated Tuesday, June 3rd. The stock was sold at an average price of $161.64, for a total transaction of $247,147.56. The disclosure for this sale can be found here. Insiders have sold 82,044 shares of company stock valued at $13,257,948 over the last 90 days. 52.40% of the stock is owned by insiders.

Penske Automotive Group Increases Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, September 3rd. Shareholders of record on Friday, August 15th will be given a $1.32 dividend. The ex-dividend date of this dividend is Friday, August 15th. This is an increase from Penske Automotive Group's previous quarterly dividend of $1.26. This represents a $5.28 dividend on an annualized basis and a yield of 3.0%. Penske Automotive Group's dividend payout ratio is currently 36.74%.

Penske Automotive Group declared that its Board of Directors has approved a stock buyback plan on Wednesday, May 14th that authorizes the company to repurchase $250.00 million in outstanding shares. This repurchase authorization authorizes the company to repurchase up to 2.3% of its stock through open market purchases. Stock repurchase plans are usually a sign that the company's leadership believes its stock is undervalued.

About Penske Automotive Group

(

Get Free Report)

Penske Automotive Group, Inc, a diversified transportation services company, operates automotive and commercial truck dealerships worldwide. The company operates through four segments: Retail Automotive, Retail Commercial Truck, Other, and Non-Automotive Investments. It operates dealerships under franchise agreements with various automotive manufacturers and distributors.

Featured Stories

Before you consider Penske Automotive Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Penske Automotive Group wasn't on the list.

While Penske Automotive Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.